8 out of 10 fat cats pay their way*

(*Well, more do than you might think) - Most people are honest about paying the Treasury. But 10 per cent will always fiddle, despite the risk of being caught

Eight out of 10 of the richest people in Britain pay more than 40 per cent in income tax, surprising new figures reveal after the spotlight fell on the extreme lengths some comedians, singers, sports stars and businessmen will go to minimise their dues.

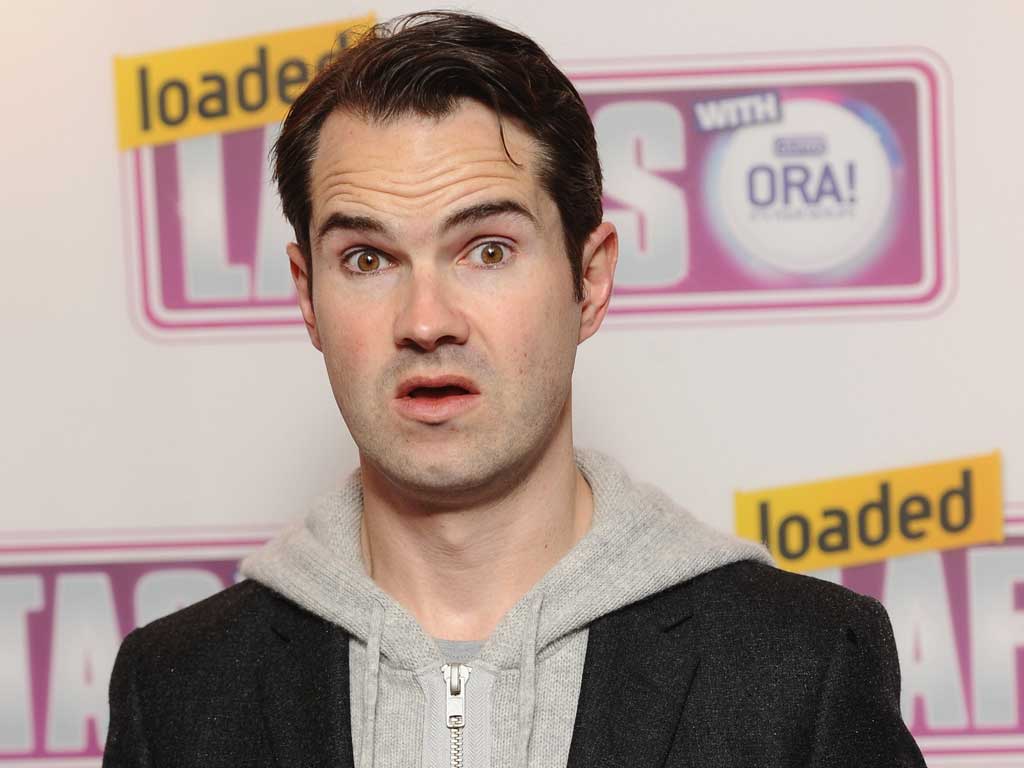

In a week when the big talking point was the tax affairs of Jimmy Carr, Gary Barlow, Gabby Logan and thousands of doctors and dentists, it was easy to think everyone was, to put it bluntly, at it. But the latest official figures from HM Revenue and Customs (HMRC) reveal that in 2010/11, 80 per cent of people with incomes between £500,000 and £10m had an average income tax rate of at least 40 per cent. Of course, the tax rate for earnings in excess of £150,000 was 50 per cent, so they are not all being virtuous. And 6 per cent of those earning more than £10m paid less than 10 per cent in tax.

Richard Murphy, from Tax Research UK, said human nature means most people will do the right thing: "Half of people will comply with what's demanded of them, and will do nothing untoward – they are highly risk averse. Forty per cent have to be persuaded to do what's required of them. And 10 per cent will always try to flout the rules, come hell or high water.

"What has been especially notable this week is how little there has been from the tax industry. They have no clue how to defend what they are doing. The big culprits here are the accountants and lawyers. They are like Macavity – they can't be seen anywhere."

The vanishing act by those who manipulate the system on behalf of others is deliberate; they hope the storm will pass. But with everyone from the Prime Minister down moralising about who is paying their fair share, it could take some time.

The storm broke on Tuesday, as The Times revealed that Carr, host of Channel 4's comedy panel show 8 Out Of 10 Cats, had sheltered £3.3m in a scheme known as K2. This worked by Carr paying his income to a firm in Jersey who returned it as a loan, on which tax was not liable. As a result, he paid as little as 1 per cent tax. The comedian, who performs up to 300 shows a year, faced a barrage of criticism from fellow comics on Friday's edition of the programme. Mr Carr said: "There should be absolutely no sympathy for me at all." Jon Richardson, a team captain on the show, said Carr had "lost the moral high ground to News International and David Cameron" and could "only make jokes about Hitler, Harold Shipman and Chico from X Factor".

On Wednesday, Take That stars Gary Barlow, Howard Donald and Mark Owen and the band's manager, Jonathan Wild, were accused of investing at least £26m in a music industry scheme that can act as a tax shelter. As the week progressed, the footballers Wayne Rooney and Steven Gerrard, broadcaster Gabby Logan and director Guy Ritchie were also revealed to have invested in the film industry for tax breaks.

The Olympic cyclist Sir Chris Hoy yesterday became the latest celebrity forced to defend his tax arrangements. Sir Chris insisted he takes his responsibilities as a taxpayer "as seriously as I do as an athlete".

David Cameron faced charges of hypocrisy after singling out Carr's "very dodgy tax-avoiding scheme" as morally wrong. The Prime Minister later refused to condemn the tax affairs of Mr Barlow, who supported the Tories before the 2010 election.

Mr Cameron's decision to criticise an individual's tax bill cleared the way for difficult questions about the financial dealings of his friends, family and party donors. His late father, Ian, reportedly used offshore tax havens in Panama and Switzerland to build the family's fortune. Viscount Astor, the PM's father-in-law, has a house in Scotland owned by a company registered in the Bahamas, while Sir Philip Green, the Topshop retail mogul who advised the Government on cutting waste, has put the bulk of his retail empire in the name of his wife, who is based in Monte Carlo. Sir Philip denies tax avoidance. Tory cabinet ministers Jeremy Hunt, Philip Hammond and Andrew Mitchell have all defended accusations that they avoided paying tax.

The figures for Britain's highest earners lay bare the extent of tax avoidance among the super-rich. One expert said an individual would have to work hard to pay less than 20 per cent on income of more than £10m.

Rachel Reeves, Labour's Shadow Chief Secretary to the Treasury, who obtained the figures, said: "These are shocking. David Cameron and George Osborne should be ensuring that everybody pays their fair share of tax. This is even more important at a time when families, pensioners and businesses who do pay their fair share are feeling the brunt of the recession."

Britain's 11,000-page tax code is fiendishly complicated, which creates the opportunities exploited by those highly rewarded tax talents at the biggest accountancy and legal firms. Last month, a report by the 2020 Tax Commission, backed by the Institute of Directors and the TaxPayers' Alliance, called for a new flat rate of 30 per cent. The move would benefit middle earners and make the UK a global trade hub, it claimed.

But the amount lost in personal income tax avoidance is dwarfed by the billions at risk through corporate legal – and illegal – arrangements. Vodaphone paid just £1.25bn of a £6bn tax bill after reaching a deal with HMRC in a nine-year dispute, while the campaign group UK Uncut is leading a legal challenge against a "sweetheart deal" between Goldman Sachs and HMRC, which meant the global bank was let off a £10m bill.

Before last week's revelations, some business groups attempted a fightback. In April, John Cridland, director general of the CBI, the business lobby, argued tax management is an important and legitimate aspect of business. "It's a dangerous – if sometimes convenient – myth some people peddle that all tax management is abusive and amounts to evasion – it doesn't. Tax evasion is illegal, immoral and damages the integrity of honest businesses the world over," he said.

However, a senior figure at one of the big four accountancy firms insists the appetite for aggressive tax avoidance will continue despite the furore. "The types of individuals who feel comfortable doing this won't have been deterred. I cannot see the publicity will deter those sorts at all."

Critics point out that HMRC was hit with a 15 per cent cut in its budget as part of the deficit reduction programme, although £917m has been reinvested in tackling evasion and fraud. A 2007 policy of taking legal action whenever the chance of winning was better than 50:50 has resulted in a vast backlog: there were 22,100 outstanding cases at the end of 2011, up from 15,600 in 2009.

The Treasury is pinning its hopes on a general anti-abuse rule, and launched a consultation just before the tax-avoidance storm began. A Treasury insider said the new rule will give HMRC more power to go after people. The source added: "If you are trying to save for your pension, that's one thing, but if what you are doing is just about reducing your tax, that's not on."

How Carr's '8 out of 10 cats' colleagues sank their claws in

Jimmy Carr

"I hate to sound like I'm passing the buck but I'll tell you who I blame for this whole mess: me. It's entirely my fault. It's quite a complicated arrangement, but I think from a legal standpoint now I'm actually a member of Take That. I could tell you about the work I did for charity, but I don't think lying is going to make this any better, is it? Julian Assange is seeking asylum at the Ecuadorian embassy. I wonder if the Ecuadorian embassy has got room for two."

Georgie Thompson

"On the plus side, at least you've been in a top five list of something."

Sean Lock

"The thing is to remember is: it's not illegal. But, then again, neither is farting in a lift, but I'll wait till I get to reception. You think about other people, and that's probably where you might have let yourself and others down."

Sarah Millican

"Your money was in Jersey. Did you just go on a holiday once and think, 'This is lovely – I'm just gonna leave some stuff here.' Like at my boyfriend's, I've got a hairbrush."

Louis Spence

"They're saying they're going to take Gary's OBE away. I mean, at least he gives us the pleasure of a song and you [Carr] make us laugh. What do they do when they rape us for our fucking taxes? Nothing – they make us cry."

Jon Richardson

"David Cameron got involved because he's in charge of the economy, and he gets shit in the papers every day for having to fire nurses and doctors, and one of the reasons he has to do that is because there's not enough money in the pot, and one of the reasons there's not enough money in the pot is because not everybody pays their taxes."

Micky Flanagan

"The one serious question I want to ask you is: did you not think there was a possibility you would get tumbled, as they say? Because that's what I would have thought, and I didn't go to Cambridge. Did you not think 'This might come out, you know'. Or did you just think: 'Fuck 'em. I'll ride it out."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies