The Big Question: Why are car tax rates going up on older vehicles, and is the move unfair?

Why are we asking this now?

There are signs of another tax rebellion in the Commons and increasing protests across the country over changes to car tax which will see millions hit with a higher rate. Around 35 Labour MPs are worried the proposed increase will hit larger, older cars typically owned by less well-off families especially hard. Austin Mitchell, among others, is preparing to stop the Government in its tracks.

"It is a bombshell that will explode when it comes into force," he said. "We are warning this will hit people and will hit the Government." The hike in the Vehicle Excise Duty (VED) comes as petrol and diesel prices have hit record levels and the fuel protesters are blockading the roads again.

Who is affected?

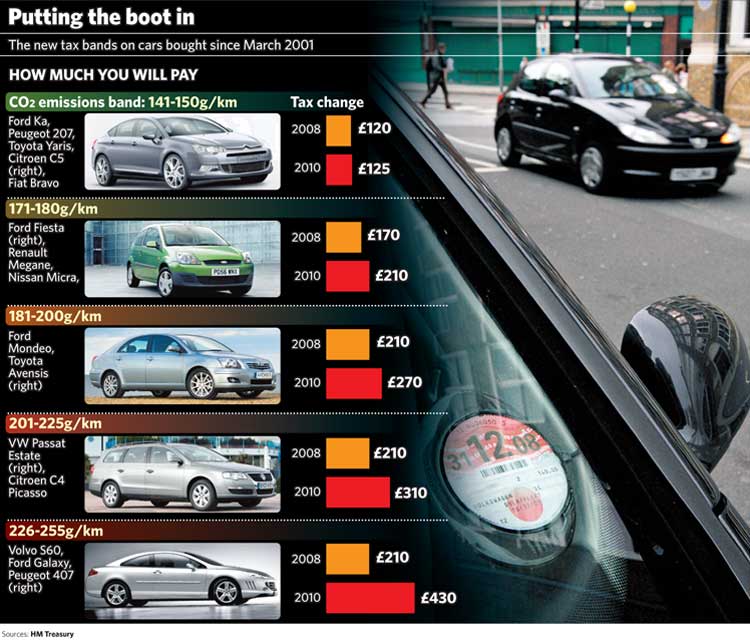

Mainly, anyone who drives a car registered between March 2001 and March 2006 and which officially emits more than 186g of carbon dioxide for every kilometre travelled. There used to be an exemption from the higher rate of VED,but that was dropped in the last Budget. Instead their tax will rise from £210 this year to £300 next year and to £430 in 2010.

The Renault Espace and Ford Mondeo are typical victims – a five-year-old people carrier or perhaps a saloon or estate car bought privately by a family which needs the space and, thus, the larger engine needed to push such a car along. Some, at least, of these will be driven by households already on a tight budget and hit hard by the resurgence in inflation of food and fuel costs (and the abolition of the 10p tax band, if that had been allowed to go through without compensation).

In many cases the increase in the cost of taxing it renders the vehicle effectively worthless, and in almost all cases the value of the car will soon be badly damaged. Thus, the owners of these cars suffer a loss of thousands of pounds that could not have been easily foreseen when they bought their cars. They claim that this is effectively a retrospective tax, traditionally avoided by governments on the grounds of equity. Even Friends of the Earth say it gives green taxes "a bad name".

Why did the Government do it?

It is an extension of the Government's greener approach to car taxation, focusing on how much pollution cars cause and setting variable tax demands accordingly. The fact that these cars are older and bought on certain assumptions about future taxation is irrelevant; they do damage to the environment and, under the principle that the polluter pays, the new taxes are an incentive to switch to cleaner alternatives.

For many, the motivation is less respectable, ranging from the simple need for the Treasury to raise cash to the Government's supposed "anti-motorist" agenda. The Prime Minister, Gordon Brown, doesn't drive, which tends to fuel the conspiracy theories that he is anti-motorist.

Could the new tax system be reversed?

The chances of that happening are increasing. The Business Secretary, John Hutton, hinted there might be a rethink yesterday when he told Today: "Obviously, the Chancellor is listening to what people are saying about Vehicle Excise Duty, as he has done on a number of occasions recently about tax rises. It's right that we listen to people's concerns".

"Listening" has become code for retreating in recent months, though the Chancellor, Alistair Darling, will need to find the cash lost from somewhere else.

Would the new measures make the public give up their cars anyway?

Most families with cars feel dpeendent on them and would surely be loath to give them up. The Conservatives say that although graduated VED revenues will total £4.4bn by 2010-11, carbon emissions from motoring are expected to come down by less than one per cent. Public transport has seen greater investment and popularity in recent times, but would struggle to cope with much greater demand.

What about the embarrassment?

Reversing this decision will mean the Government will have executed four handbrake turns while framing one finance bill, something of a record. After the changes of mind on the taxation of capital gains and on non-domiciled UK residents, and the £2.7bn compensation package for the abolition of the 10p rate, it might look as though the Treasury had lost its touch. If they abandon the fuel tax increase of 2p a litre scheduled for October, that will make a remarkable five U-turns and one mini-Budget in one year. At any rate, it doesn't chime well with a Prime Minister who continually stresses the need to take the "right long-term decisions for the economy".

Then again, ministers and the whips will be calculating their chance of an even more humiliating defeat in Parliament. For the Prime Minister and Chancellor, it's another "tough choice", though not quite of the kind they usually like to discuss.

What are the alternatives?

Critics argue it isn't so much the size of a car that matters as much as how far it is driven. A stationary Porsche or Range Rover emits no carbon dioxide; a Ford Fiesta driven 20,000 miles a year will dump plenty into the environment. Thus a fairer approach might be to concentrate on fuel duty; but attempts to increase that have also met spirited resistance.

Alternatively, the Government could transfer the lost tax on to the most polluting new cars. Another £2,000 on the price of a £100,000 Bentley, say, wouldn't cause much pain, or provoke much pity.

Is there anything that can be said in the policy's defence?

Well, it will lead to a lot of slightly dirtier older cars being scrapped and replaced with smaller and cleaner ones. It will raise much needed finance to pay for the Government's spending plans and will do so in a green way, that is it will be related to the damage a car does to the environment.

Most of the best-selling models are not effected by the change in the duty rates, and new buyers of the greenest cars are being given a car tax holiday of a year, so, overall, motorists are not being victimised – just encouraged to alter their behaviour in the long-term.

And although the cost of the tax is going up by £200 or more, that is actually only the cost of filling up that car a few times, so the tax aspect needs to be kept in proportion. Also, despite the claims by some, most of the energy a car uses is accounted for by the fuel it consumes in its lifetime rather than its manufacture; so scrapping and replacement isn't such an environmental cost. Maybe they could be exported to developing nations who need them (though that wouldn't satisfy the green lobby).

Is the car tax increase on some car models fair?

Yes...

* It hits the most polluting cars the hardest and will have a real impact on reducing emissions

* We have to save the planet. It might be painful for some, but hitting people in the pocket is the only way to change behaviour

* Though many may complain about a tax increase, no one has suggested a workable alternative

No...

* It isn't fair, as it will hit people who had no idea about a future higher tax when they bought their car

* Many families are already on a very tight budget at the moment and won't be able to afford it

* This change could result in thousands of perfectly good cars being scrapped prematurely

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies