Golden oldies – investment trusts back in demand

They can be a volatile ride, but this type of fund is again attracting interest.

Six bids, one day. It was like the 1980s and the fictional world of Gordon Gekko all over again. Last Monday’s multi-billion pound bids for some of the world’s biggest companies could potentially have marked the start of fresh bull run for stock markets in the developed world.

Investment trusts are back. The world’s oldest form of collective investment fund – the first date back to the 1860s – are attracting investor interest once again.

These are listed companies that can invest in stocks, bonds and areas that tend to be less liquid, like private equity. By investing in a fund that has a listed company structure you have two potential sources of return. You can make money if the value of the underlying assets the fund owns – its net asset value – appreciates over time. And if you buy in when a trust’s share price looks cheap, you can also profit if it rises.

Like anything in life, what goes up can also go down, so investors stand to lose on both fronts if the trust’s net asset value decreases alongside its share price. You can also face a more volatile ride in comparison to unit trusts, as the limited number of shares available means the share price is driven by the vagaries of supply and demand.

Another important aspect to monitor is if the trust trades at a discount or a premium. This tracks the relationship between the fund’s net asset value and its share price. If a trust trades at a discount – indicated by a negative percentage – it suggests you are buying assets cheaply, whereas a premium could mean that you are overpaying.

The problem investors face today is that investment trust bargains are becoming harder to find. After a bumper year which saw the average trust snap up a double-digit share-price return, discounts have been pushed down to 3.4 per cent – their lowest level for 40 years.

“Nothing looks screamingly cheap in this listed market today,” warns Stephen Peters, an analyst at wealth manager Charles Stanley. “There are things you can buy on a 90 per cent discount, but there are probably reasons for that.”

Mr Peters advises investors not to focus solely on discounts. He says the prospects for the underlying asset class, alongside the style and track record of the fund manager, should take priority. This is because the growth in the trust’s net asset value is likely to be the biggest driver of returns over the long term.

He suggests the optimum strategy for investment trusts is to hold them over time, but aim to buy in when markets are weaker to ensure you aren’t overpaying on entry.

Nick Sketch, a senior investment manager at Investec Wealth & Investment, argues there are outstanding opportunities for the next decade to be found among investment trusts. In his view, selectivity and research will prove critical to picking the winners.

“With so many lazy or ultra-short-term investors, those who do the most work should get the best results most of the time,” he says.

He cites the Witan Investment Trust as one of his top picks. It currently trades at 680p, which represents a 6.1 per cent discount to net asset value, and offers a dividend yield of 1.9 per cent.

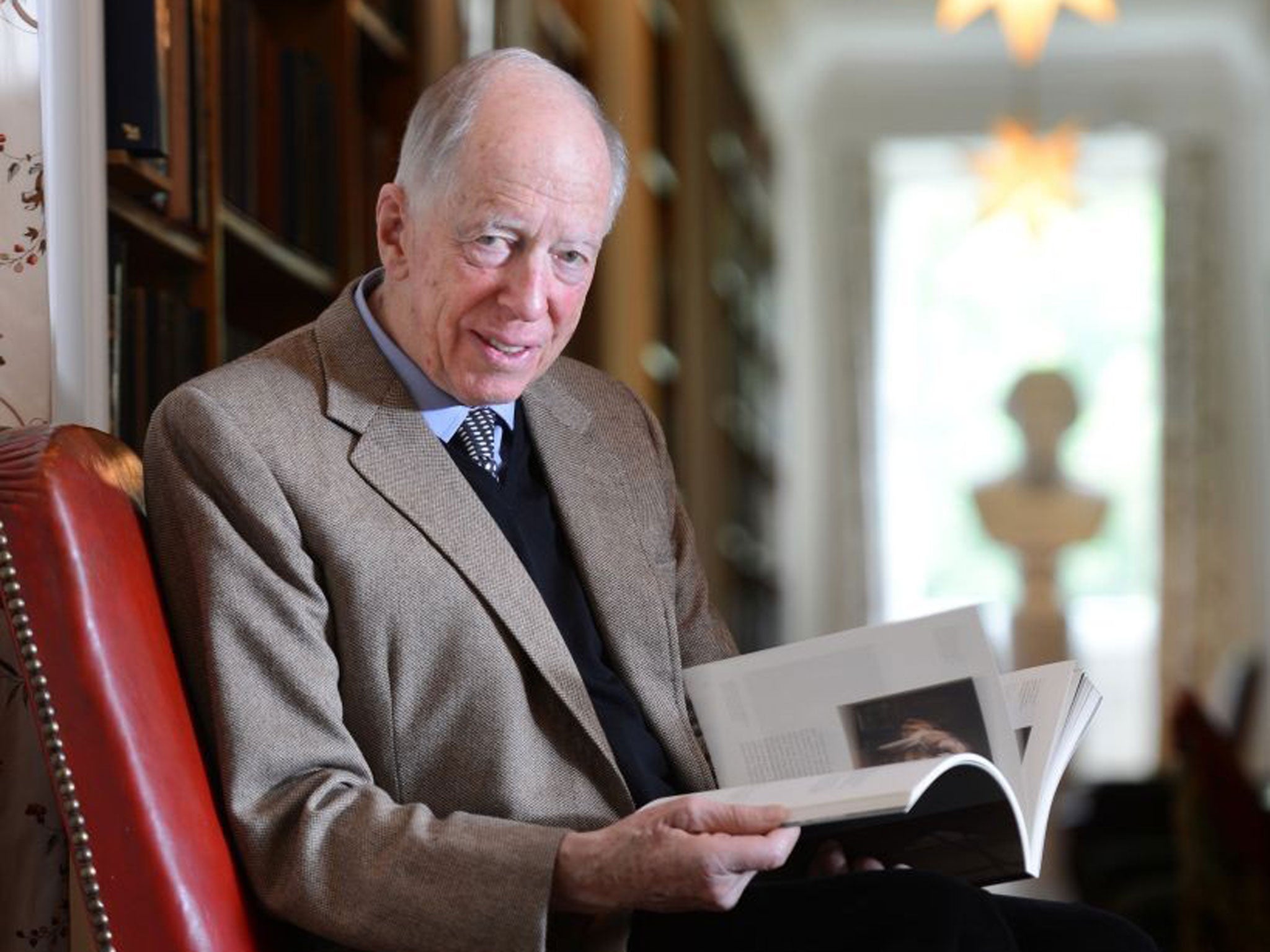

John Newlands of Brewin Dolphin highlights RIT Capital Partners, a trust that Lord Jacob Rothschild founded and chairs, as one to watch. It invests in equity funds, private investments and public equities. He says the 5.2 per cent discount on offer through its share price of 1,312p could represent an attractive entry point.

“You are getting access to some of the most skilled fund managers around and they have an unrivalled network of connections. Plus your money is sat alongside Lord Rothschild and his family,” he explains.

The British Empire Securities and General Trust could also attract the attention of those seeking a real bargain, in Mr Peters’s view. This trust seeks to invest in companies with share prices that are trading on a discount to their own net asset value.

“It is on a 13 per cent discount and you are getting a double-discount story as you are buying assets on a discount to their own asset value,” he says.

For those willing to take on more risk and the prospect of volatility, opportunities can be found among trusts that invest in small and medium-sized companies.

Here Mr Newlands highlights the Mercantile Investment Trust, which targets mid caps. It has has increased its dividend by 100 per cent over the past 10 years, currently trades on a 9.6 per cent discount to net asset value and offers a dividend yield of 2.5 per cent.

Among small-cap investment trusts, Mr Peters favours Aberforth Smaller Companies, which currently trades at an 8.7 per cent discount.

Emerging market equities have fallen out of favour with investors after a torrid year in which markets plummeted. But if investors buy into the longer-term investment story and are braced for potential volatility, Thomas Becket of Psigma Investment Management cites Templeton Emerging Markets as one to watch on a 10.4 per cent discount.

“There is a split between those areas that are in vogue, which still strike us as expensive. For example, infrastructure routinely trades on 10-15 per cent premiums, which reduces the yield on offer and makes it less attractive for new money. On the flip side, in areas that are out of favour – like emerging markets – you can still find good bargains for the long term. Templeton Emerging Markets is on a double-digit discount.”

The cost of investing in unit trusts is coming down as a result of new rules that ban financial advisers from taking commissions from products and force fund managers and brokers to be more transparent on pricing.

With this in mind, Mr Sketch anticipates the cost advantages of buying investment trusts over unit trusts will continue to narrow. However, these types of funds will still have a role to play, he says, given their ability to invest in less liquid assets, like infrastructure and private equity.

“I would expect the next five years to see more capital in investment trusts that do jobs others cannot, and to see less in investment trusts that do jobs that are just as well done by a unit trust,” he said.

Although the opportunities are harder to find, savers can still make money in investment trusts. Research and a willingness to hold a trust for the longer term will prove crucial if the last 10 years are anything to go by.

Danielle Levy is news editor at Citywire.co.uk

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies