Julian Knight: Finally our banks must think the unthinkable

Mortgages of three times salary may not be set in stone. But lenders – get used to interference

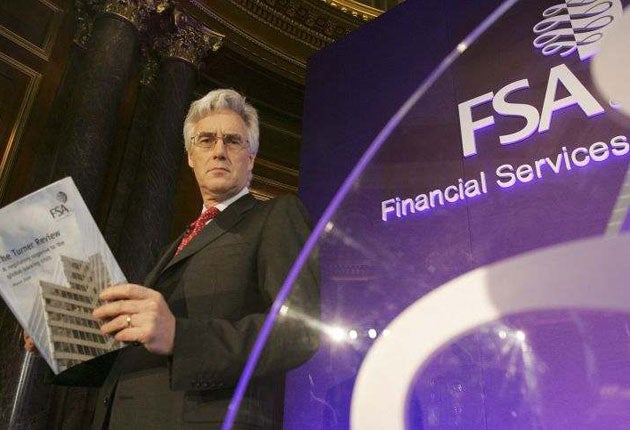

Mortgages limited to three times salary and minimum deposits of 10 per cent were the headline-grabbers in Lord Turner's report on banking. A great gnashing of teeth in the industry ensued and government officials quietly stepped away from these parts of the proposals. And I reckon Lord Turner, chairman of City regulator the Financial Services Authority (FSA), is not concerned one bit.

I can't believe there is a genuine appetite for laying down ultra-strict rules that lender A will be barred by a regulator from giving a mortgage because the homebuyer wants to borrow 3.0001 times salary. It may be good for Greece, Austria or Poland but not really for Britain. For example, a junior doctor or pupil barrister needing to borrow more than three times salary should be able to because of the strong likelihood that their income will rise dramatically over the next few years.

However, the industry's argument that we ought to leave it all to the market is laughable. And this is where the rest of Lord Turner's report comes in. The financial management of banks is going to be much more closely scrutinised than in the past, as happened to the insurance industry at the start of the century when there were fears some insurers could run out of money after a series of poor investments (sound familiar?). The regulator imposed stricter funding requirements on these firms and at the time some bleated about it. But the industry is now pretty grateful as an equilibrium of sorts was restored.

Along with tighter monitoring of balance sheets, we may end up with lenders having to offer the FSA pre-approval of new mortgage products that veer from the norm. The viability of these products should be set against the balance sheet and the wider context of the mortgage and housing market, and a decision made on whether they see the light of day.

In addition, one hopes the industry will respond to the proposed lending limits coming from Lord Turner with a ballpark figure for what is acceptable and what isn't. They know that if they routinely go above three times, they will have to justify it.

In the past such interference would have been anathema. But the world has changed utterly and by flying the kite of three times salary and a 10 per cent deposit limit (which is actually a higher loan to value than many lenders are countenancing at the moment), what Lord Turner has offered is a vision of what may come to pass, helping to make what was once unpalatable somehow palatable.

Who are the bad guys now?

Now here's a turn-up for the books. The latest research from Moneyfacts shows that it's those "evil incarnate" banks that offer the best rates on savings accounts and mortgages, rather than the good old building societies.

In fact, a bank mortgage borrower on the standard variable rate deal can expect to pay 0.72 per cent less interest than an equivalent borrower with a building society. That's a serious gulf, equivalent to around £50 a month extra in repayments on a £100,000 home loan.

As for savings, bank customers fare better on no-notice, notice and cash individual savings accounts – in other words, nearly the whole of the market.

Why is this happening? Aren't the building societies supposed to be there for their members, using money that would otherwise go to shareholders to offer better rates? There are two reasons. First, the banks have had to improve what they offer because of the need to get money in quickly to fund their operations. Second, building societies were every bit as guilty as the banks of idiotic lending and poor management – witness the fall from grace of Cheshire and Derbyshire.

There is a lot of talk about how the banking model is bust for good, but the building society model as executed over the past few years was also holed beneath the waterline.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies