Derek Pain: Spirit Pub Co lifts my spirits as Whitbread perks up with the help of Costa Coffee

No Pain, No Gain

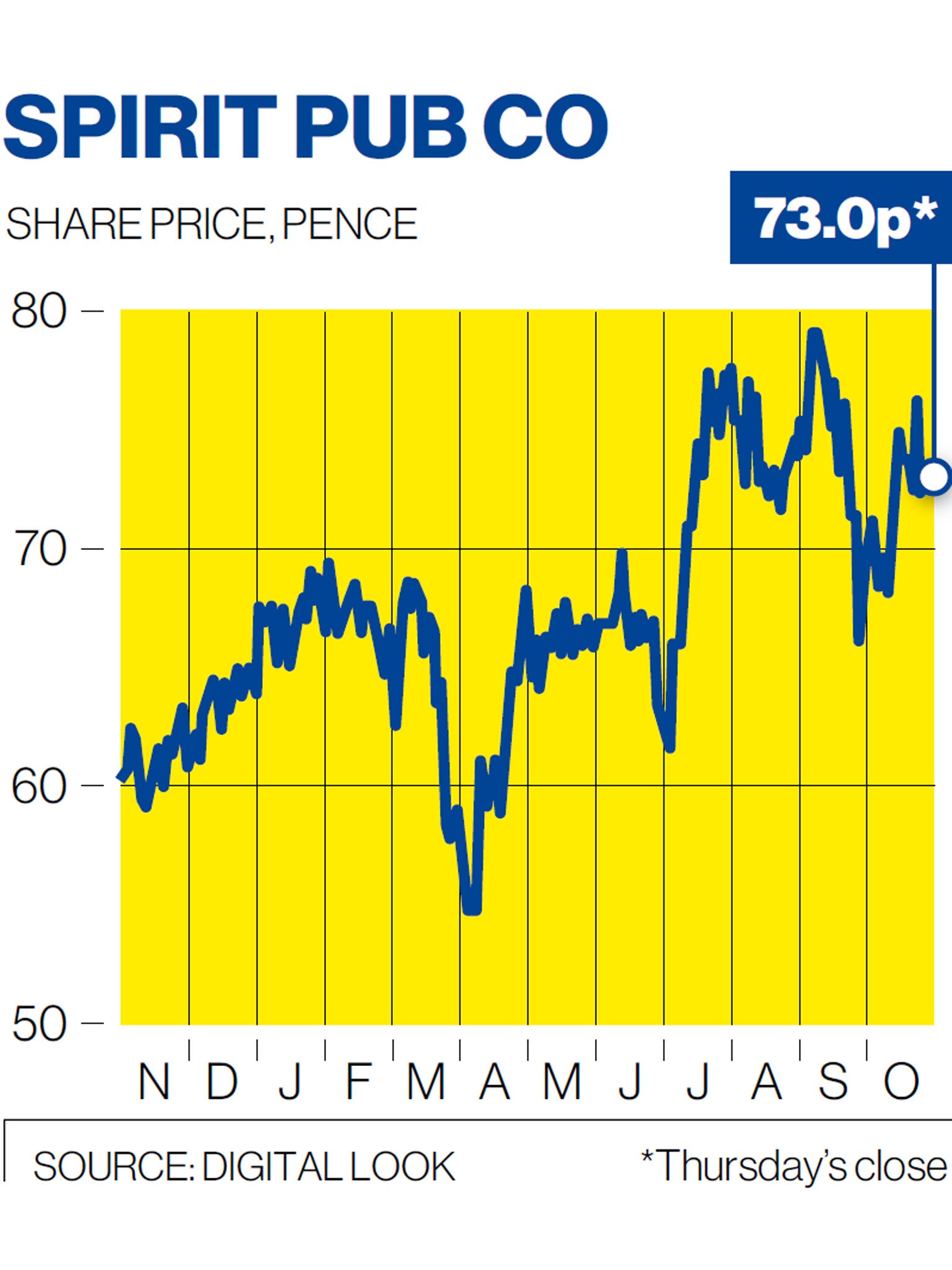

A few weeks ago I expressed concern about the performance of shares in the Spirit Pub Co. I am pleased to see that despite in-line profits and a scheme to reshape its debts, the price has rallied a little, although still well below its earlier level.

There is no doubt the group's plan to reorganise its debt pile should, if it is successful, benefit the lot of the pub chain. Through a tender process it wants to extend the date that £400m of bonds fall due. If most bondholders accept it should help the group continue to improve its pubs although interest costs would increase.

Spirit has already spent heavily on its estate but feels the need to continue its programme. It is benefiting from its expenditure with profits up 6 per cent to £54m although the quirks of modern accounting give a pre-tax profit, including exceptional contributions, of £71.7m against a £588.9m loss last time. The year's dividend is up 5 per cent to 2.05p a share.

The group, taking in such pub names as Chef & Brewer and Fayre & Square, says its 777 managed outlets improved sales last year by 1.6 per cent and the performance of the 452 pubs comprising the leased estate stabilised. In the first eight weeks of the current year managed pub sales were up by 4 per cent and leased income was down only 0.3 per cent.

Spirit shares have recovered from the 68p which attracted my earlier comments and now reside at around 73p, still below their 78p peak. There is little doubt the shares have attractions, although current indications suggest a fairly modest profits advance this year. They were recruited into the no pain, no gain portfolio at 42p.

Whitbread, with around 400 pub/restaurants, is one of the portfolio's star performers. The shares arrived at 1,105p and are 3,422p after topping 3,450p in intra-day trading following last week's interim figures.

But Whitbread's pubs are overshadowed by the success of its Premier Inn budget hotel chain and the impressive performance of Costa Coffee, which brewed a 20.5 per cent profits increase.

All told the three divisions increased sales by 12.4 per cent with underlying profits up 12.6 per cent at £216.1m, slightly ahead of most stock market estimates. The statutory pre-tax profit emerged at £200.7m against £185.2m. Interim dividend goes up by 11.8 per cent to 21.8p a share. Stockbroker Investec Securities expects around £405.2m for the year compared with £356.5m. But Deutsche Bank has downgraded its share recommendation from buy to hold although its target price is 3,485p.

Premier, closely linked with the group's Beefeater and other pub/restaurant brands, improved sales by 12.2 per cent; eating out managed a 2.9 per cent sales increase.

There have, as I have reported, been a series of bearish analytical recommendations on Whitbread shares. Despite the negativity evident at some of the City's stockbrokers, the shares have performed well, although I must admit I was worried about a recent, sudden relapse which occurred for no apparent reason.

The portfolio is a long-term investor and I can see no reason at the moment for any diminution in my admiration for the once Top Six brewer. Nowadays the pub/restaurants are the survivors of Whitbread's life as a leading member of the beerage when it rolled out such beers as Tankard, Mackeson and even Heineken. It sold its brewing interests at the turn of the century, and most of its pub chain not long afterwards.

Whitbread shares are on a relatively high rating and the dividend yield is nothing to get excited about. But the present coffee and hotels combination, with a little help from pub/restaurants, seems a likely beneficiary of the nation's improving economic outlook. I believe mouth-watering trading will continue and that can only help profits – and the shares.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies