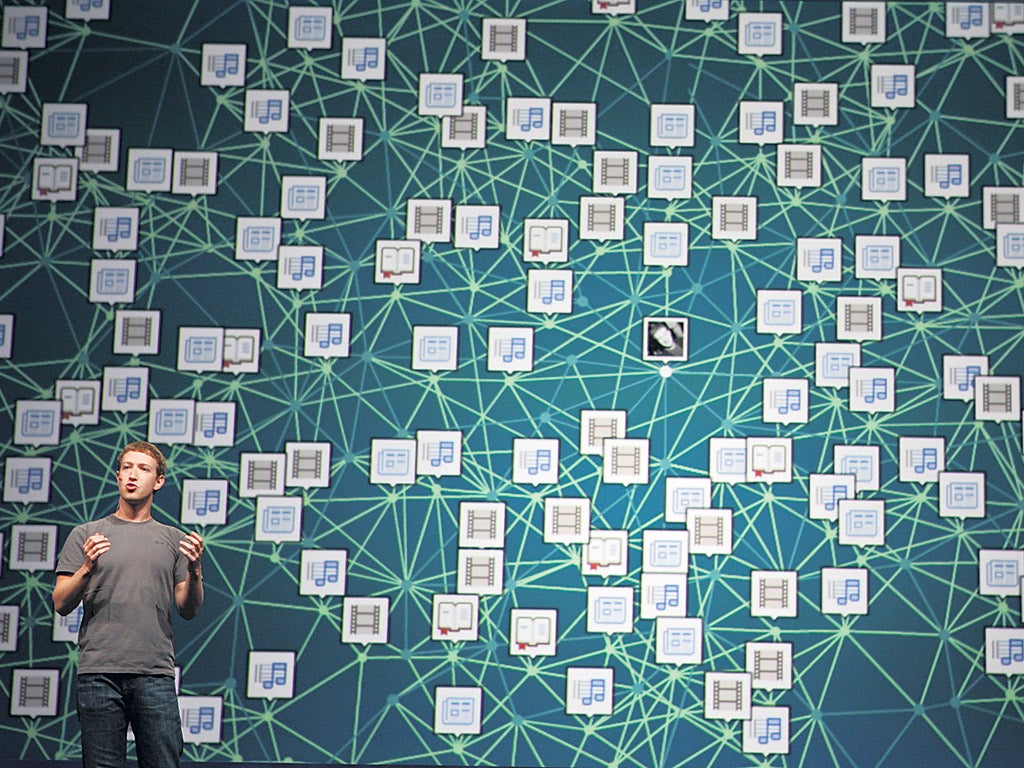

Is Facebook floating on a tech bubble?

The social network site's expected $100bn market launch raises fears of another dotcom fiasco for investors

Older investors could be forgiven for having a sense of de ja vu on hearing the news that Facebook is expected to float at an estimated value of $100bn (£64bn), roughly 30 times its annual revenues. The valuation of this most high-profile of social networks sends thoughts back to the late 1990s when investors worldwide stampeded into dotcom shares only for prices to go pop almost overnight.

But, is what we are seeing with Facebook – and other recent technology flotations – a case of history repeating itself; a prelude to another crash or merely a reflection of reforming of the investment world, tech truly coming of age?

"There is a huge amount of hype about Facebook and its float and it looks very expensive from a price to earnings equation," says Stephen Barber, a markets commentator at stockbroker Selftrade. "But, I don't think we're in a bubble scenario. There isn't the herd mentality where everything is getting bought because it has dot.com address as happened in the late 1990s; if you want to see a bubble in action look at gold."

Darius McDermott, the managing director Chelsea Financial Services, says things are different this time around: "Facebook looks overvalued. If it's worth $100bn what is the fair price for Apple which produces things people really want? But we are not in a dot.com bubble, because back then companies were merely burning through their cash. Now we have firms producing revenue, with huge players with massive cash piles such as Microsoft, Apple and Google."

But there are those that think that even at 30 times revenue, Facebook represents good value: "To an advertiser, the price you pay 'per eyeball' on Facebook is roughly one-10th the price you pay on TV," says Philip Pearson, the co-manager of the GLG Technology Equity fund. "This appears to be way too low when you consider how much more you know about the Facebook user than you know about those watching a TV show. When you model that through, even at $100bn Facebook looks significantly under-valued."

But it's difficult for even sophisticated private investors to correctly assess the potential in a technology company and it's possible to get a call badly wrong. For instance, the founder of once-mighty internet giant Yahoo recently resigned following sustained and dramatic falls in its value. Basically, Yahoo was squeezed out of markets by Google and the world of technology seems by nature to move fast, creating, but also potentially, destroying value in double-quick time.

"This for me places technology at the high-risk end of investment. Although we don't have firms that are creating no profit or revenue coming to market, as in the 1990s, you do see instances of expensive and seemingly high-value brands being swamped by competition," Martin Bamford, the director of independent financial advice firm Informed Choices, says.

But the idea of a separate tech sector can be called into question: "There are lots of types of technology. There are your Apples, for instance, which are really manufacturing, then your biotech and green technology, which has been quite a successful area. Then you have your start-ups, some of which could be the Facebook of the future and add real value. You could take a different risk approach to each of these," Selftrade's Mr Barber says.

This is echoed by Mr McDermott who says that some firms in the sector have so much cash that they could be considered "defensive" – a moniker usually preserved for the likes of utilities, tobacco and mining.

Nevertheless, the consensus among advisers is that investors ought to limit their exposure to technology. "I'd say no more than 5 to 10 per cent of your portfolio should be in tech shares. It needs to be balanced by safer investments," says Carl Melvin, managing director Affluent Financial Planning.

"I'd always tread a little carefully. Just because something that is a world changing concept – like Facebook – doesn't make it a world class investment," Mr Bamford adds.

There is also currency risk to take account of when investing in US tech companies. "Those investors wanting to take the plunge should do so cautiously. Beware of investing in the unknown and the exchange rate risks when investing overseas," Mr Pearson, of the GLG fund, says. "But, investors may look to LinkedIn, as a comparison of a recently floated social network. It floated at $45 per share last May and at close of market on Friday, the share price was $72.37 – an increase of over 60 per cent," he adds.

Against a backdrop of such risk warnings, it may be wise to look for a capable fund manager to invest with. But according to Mr Melvin such managers are few and far between. "The managers in the sector seem to merely shadow the index. You'd be better off either investing in technology shares direct through a stockbroker, which is easy to do, or going for an exchange traded fund (ETF) or an index tracking fund. All these options are cheaper than a managed fund," he says.

Mr Bamford says investing in a US fund would give exposure to technology: "Something like 15 to 20 per cent will be invested in technology if you go with a US fund."

But Mr McDermott disagrees that technology managers are a dead loss. "I like Polar Capital Technology, managed by Ben Rogoff, which is an investment trust, or alternatively Jeremy Gleeson's Axa Framlington fund. The advantage of having a manager over an index fund or ETF is that if the manager doesn't want to buy, say, Facebook, because they think it's pricey they don't have too," he says.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies