Is now a good time to invest in retail?

As shops struggle, Sonia Speedy finds out whether there are any stock bargains to be had

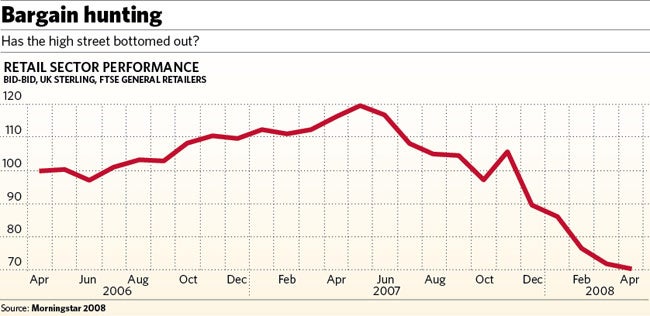

With the consumer under pressure and high- street retailers feeling the pinch, it may not just be in-store where the deals are to be found. But is now the right time to pick up a retail stock bargain? The views are mixed.

The credit crunch is leaving investors and consumers feeling shaky and with house prices under pressure, the effects of the current economic conditions have started spilling down into the high street.

The number of retailers issuing negative trading statements on the London Stock Exchange between January and March this year hit the highest level in two years, while eight retailers issued profit warnings, according to accountancy firm Grant Thornton.

Its latest Quoted Retail Companies Index shows that 23 per cent of retailers posted negative trading updates in the first quarter – the highest number since the same period in 2006. Among the retailers issuing profit warnings were Dixon's, Curry's and PC World, run by DSG International.

"The current mood in the high street is that of general nervousness," says David Bush, head of Grant Thornton's retail services team. "Consequently, this has led to a cut in consumer spending. This research shows that the first three months of 2008 have got off to a shaky start and that for the immediate future there is no short-term end to the consumer spending downturn," he says.

With retailers feeling the squeeze, it appears some investors are taking the chance to jump at attractively valued retail stocks, research from execution-only brokers TD Waterhouse reveals. Not usually a regular play for its investors, trader activity of late has shown TD Waterhouse investors are keen to pick up a retail bargain when they spot one. Recently, its investors have been snapping up British department store Debenhams, after Merrill Lynch unexpectedly sold its 6.2 per cent stake in the chain, seeing the share price drop 17 per cent to 59.25p.

The "lacklustre" performance from the Marks and Spencer Group in recent months has provided another buying opportunity for TD Waterhouse investors, the broker says. M&S stocks were its sixth most popular buy in the first quarter.

Brewin Dolphin retail analyst Tim Green describes the UK general retail sector as being "beaten to a fine pulp" by the credit crunch, but believes valuations have fallen too far. He says strong balance sheets and well controlled fixed costs mean that the better companies will be able to "weather" the weak demand until things improve. The UK consumer is resting, not resting in peace," he says. But he warns that investors should not just "fill their boots" and should make sure they select quality companies that are not in financial distress.

Richard Hunter, head of UK equities at stockbroker Hargreaves Lansdown, says that not only are retailers battling with the current economic conditions, but many are also under pricing pressure from the supermarkets continued move into non-food items and from the rising consumer demand to buy online

Despite a reasonably poor performance over the last three months, Tesco remains a market favourite, he says.

"They've got geographical diversification – they've got a foothold in China, they've got a strong presence in Europe, they've got non-food and they've got quite a strong online presence. So in terms of diversification, with regard to both products and geography, they do remain one of the favourites. The supermarkets are a good example of defensive, rather than cyclical stocks, on the basis that "whatever the state of the economy, we've all got to eat", Hunter says.

Grant Thornton's Quoted Retail Companies Index found that food and drink retailers, particularly the UK supermarkets, all reported positive trading statements in the first quarter.

Hunter warns that those searching out retail bargains need to be prepared to lock them away for the long term if they want to reap the good returns. "It is a good time to remind investors that investment is and should be taken on a medium to long term view. You've got to be talking about locking the stock away for three to five years, rather than expecting to just trade on day-to-day movements," he says. Investors should be looking out for blue-chip names that are stable, cash generative companies, which also have an eye on continued growth, he says. Investors also need to have a healthy appetite for risk if they want to go bargain hunting in this sector at the moment.

As Julian Chillingworth, chief investment officer at Rathbone Unit Trust Management says: "This is not a widows and orphans investment at all."

Chillingworth and Landsbanki analyst Paul Deacon believe investors keen to pick up a retail stock bargain, should wait for a while. "Despite the fact that the valuation is low, we are still pretty cautious," Deacon says. "The reason is we really have little or no visibility on the shape of this consumer downturn, which really has barely started.

"We're very early on in the downturn of the housing market; we're very early on in the slowdown in the rate of consumption growth and retail sales growth. It is likely that estimates around the markets for retailers are too high – it's very likely and that includes our own estimates," he says.

"We wouldn't be buying the sector yet. We would wait. We would wait until we see some further downgrades in estimates at lower levels."

But one retail area that is less likely to be affected by the current market conditions are "hyper-luxury" brands, Hunter suggests. "It's the middle market brands where people are going to start to rein in on more discretionary spending and look for cheaper items," he says.

Chillingworth agrees that luxury goods have held up better to date, but questions whether that will continue.

For those investors wanting to gain some exposure to potentially cheap retail stocks, but wanting to minimise their risk, Stephen Marriott, senior research analyst with independent financial advisers Bestinvest, suggests investing in a UK collective fund. "Then perhaps if you are wrong, you may at least have other areas that might make up for that," he says. While most funds are currently underweight UK retail stocks, it recommends the Jupiter UK Growth fund.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies