Questions Of Cash: Overdrawn and unhappy</I>

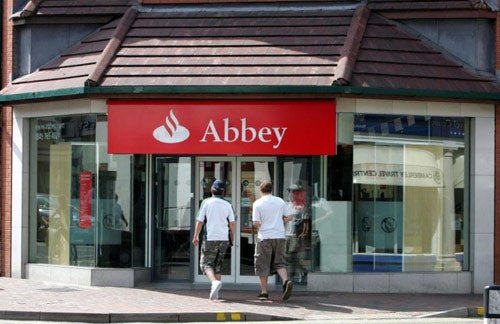

Q. Abbey has withdrawn my overdraft facility without notice or explanation. In August, I decided to move my account to Alliance & Leicester after Abbey mishandled a claim for a refund of overdraft charges. But the switchover caused me to be charged substantial overdraft charges by Abbey.

The switching of accounts was completed in October. My overdraft with Abbey was £5,450, but Alliance & Leicester offered only a £2,000 overdraft. I started to pay £1,000 per month into my Abbey account to pay off the outstanding overdraft and maintain the "preferred overdraft rate", in accordance with Abbey's policy. My July/August and September/October bank statements show the original overdraft of £5,450. But the overdraft limit did not appear on the October/November statement. My most recent statements show that I am now being charged for advanced overdraft interest, instant overdraft interest and an unauthorised overdraft/instant overdraft monthly fee.

A letter from Abbey in November thanked me for asking for an advance overdraft facility – which I didn't request – and gave me a £3,300 limit, which is now shown as my limit on my bank statements. I phoned Abbey to ask why my overdraft limit was now being shown incorrectly: I got no reply, but I did receive a letter saying that my reduced debit balance of £3,485.65 was over my limit. My only further correspondence has been so that fees were correctly charged, as I went over my limit. KB, Hertfordshire.

A. Abbey accepts that it made a mistake. It has reimbursed you £25 for charges and is offering £50 in compensation.

Q. You published a letter in Questions of Cash in July 2004, regarding the purchase of shares in Laserlock Technologies. Like your other reader, I bought shares in them through Intersecurities in Frankfurt, purchasing 7,000 shares. I was told they were a high-risk, high-return share. Laserlock Technology had sold at 40 US cents a share prior to my purchase: I bought at 12 cents a share when they were listed at 14 cents and now they sell at 0.007 cents a share. FSW Europe took over my file from Intersecurities and I have since received further calls asking if I would like shares in other firms. I have now received a letter from California Securities S.A. informing me that it is my nominee shareholder and to pay them $200 or forfeit my shares. DC, by email.

A. Back in 2004 we cautioned about these stocks and advised readers to avoid using overseas-based brokers for share purchases – although you had already bought yours by this time. Brokers in the UK can handle trades on other exchanges if you decide that you want to purchase overseas shares. There is a particular risk from cold callers in other countries – they may not be subject to stringent regulation and obtaining satisfaction in the event of a dispute is more difficult. Some overseas brokers are "boiler houses", which try to persuade people to buy shares of little or no value. You should ignore the latest letter, as you would probably just be sending good money after bad. We strongly advise readers against having anything to do with FSW Europe, Intersecurities in Frankfurt or California Securities – which appears to operate from Panama and uses only a correspondence address in the US.

Q. I moved home in August, but my Tiscali internet connection was not re-established within the promised 10 working days. After repeated calls, I gave up and cancelled my contract. I am still paying £15 monthly for a service that I cannot use and I cannot get a cancellation code to start a service with someone else. DG, by email.

A. Tiscali apologises. Your letter is typical of many we receive about the company.

Q. My wife was a shareholder in Eurotunnel and we submitted 1,440 units in last year's Exchange Tender Offer from GET. When the question of shareholder concessions was resolved, we sent a further 900 units to be added to the original tender. We heard nothing more form Computershare, which was handling the share exchange. We have written repeatedly, but had no reply. MT, Chester.

A. The full allocation of GET shares has now been provided to you following our intervention.

Questions of Cash cannot give individual advice. Please do not send original documents. Write to: Questions of Cash, The Independent, 191 Marsh Wall, London E14 9RS; cash@independent.co.uk.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies