The Big Question: What does working for no pay reveal about the plight of British Airways?

Why are we asking this now?

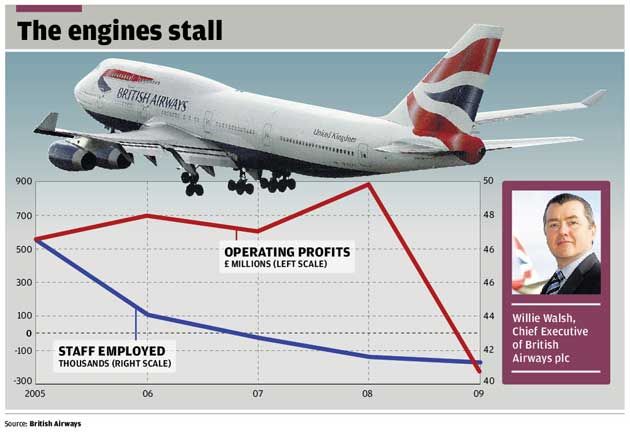

Willie Walsh, the pugnacious chief executive of the country's biggest airline, British Airways, has appealed to his 40,000 staff to work for free to help BA ride out what he calls "the toughest trading conditions in our history". This is not unprecedented in the travel industry; in the aftermath of 9/11, for example, senior managers at Lonely Planet worked for free for a short time. To set an example, Mr Walsh, along with the airline's chief financial officer, Keith Williams, will be working through July without pay.

Will many staff be taking up the offer?

BA says plenty of staff have enquired about the scheme. But some airline insiders are sceptical. Mr Walsh will give up his July earnings of £61,000, more than most staff earn in a year – but he will still pick up £674,000 in 2009. Given the depth of the aviation crisis, working for a few weeks without pay has an element of tokenism. In the financial year to 31 March, BA lost an average of £7 a second every day. Because the first half of the financial year was reasonably healthy, current losses are expected to be even worse. BA also has an ageing aircraft fleet, averaging 12 years, with no prospect of the more efficient and appealing Airbus A380s and Boeing 787s until 2012.

Is BA in an especially bad mess?

It faces tougher competition than any of its major rivals: its short-haul competitors, easyJet and Ryanair, are by far the largest low-cost airlines in Europe. In the long-haul market, Virgin Atlantic has been a thorn in BA's side for 25 years. Yet in current trading terms, BA is faring better than some airlines. Indeed it is pressing ahead with a multi-million makeover of its first-class cabins, and a new business-class only service from London City to New York. Every large "legacy" carrier has seen a dramatic decline in premium passengers, who previously bankrolled the business. BA, and others such as Singapore Airlines and Cathay Pacific, has been selling business-class seats at very low fares. The present strategy is to get "bums on seats" at almost any price. But BA has built-in advantages that many of its rivals lack.

What are its advantages?

It is the largest airline at the world's leading aviation hub, London; it holds the greatest number of slots at Heathrow, the world's most desirable airport; it owns rights to a large number of routes where competition is constricted; and it possesses a strong, premium brand. And despite the awful publicity surrounding the botched opening of Terminal 5 last year, the new £4.3bn facility has been widely praised. It has helped to transform BA's previously abysmal punctuality record into a premier-league performance. Yesterday, the airline announced its best-ever timekeeping for May. And the proportion of lost luggage has fallen from one in 33 bags to one in 100. While Virgin Atlantic has a gilt-edged brand, it lacks the network strength of British Airways – and has only 3 per cent of the most precious commodity in aviation slots at Heathrow, against BA's 41 per cent.

So why all the hand-wringing by the BA boss?

Partly because Mr Walsh has been playing a very shrewd game since the recession first appeared on the radar. Currently, the whole airline is unprofitable but the chief executive sees the downturn as the ideal opportunity finally to make BA fit for the future. Over the past couple of years, he has shed unprofitable parts of the airline, such as regional services; all BA routes now start or end in London. Now he is demanding more flexibility from cabin crew and pilots, whose generous working conditions were negotiated in the cushy old days when BA was shored up by the Government and competition was minimal. These working practices burden BA with a much higher cost base than its rivals, which is one reason why the airline has had to cede its supremacy at Gatwick to easyJet – now the dominant carrier at the Sussex airport. Mr Walsh never misses an chance to preach the need for permanent change, rather than short-term gestures such as working for free.

Will the unions play ball?

Unions representing many BA staff have already reached agreements – with Mr Walsh winning remarkable concessions from the pilots' union, BALPA. If members follow the union's recommendation to accept the deal, they will take a pay cut of 2.61 per cent in their basic wages and work longer hours. But cabin crew have yet to agree to concessions. In recent years they have proved the most combative part of the workforce, fully aware of their industrial muscle: even the hint of strike action hits an airline's finances, as travellers book with competing carriers in order to avoid possible disruption. Mr Walsh – a former negotiator for the pilots' union in his native Ireland – believes a threat of industrial action would, in the present trading conditions, be widely regarded as treachery. But even if he succeeds in getting all the staff onside by his stated deadline of 30 June, he still faces the profound problem of BA's pensions "black hole".

Hasn't the airline poured in cash to solve the pensions problem?

Yes and no: over the past three years BA has paid £1.8bn to meet its future pensions liabilities, representing an astonishing £18 per passenger per flight in that time; the corresponding figure for easyJet is 45p. Unfortunately, customers do not choose an airline on the basis of how good its company pension scheme is. Even though the deficit has swallowed nearly twice as much as BA made in profit in the same timeframe, it has not proved sufficient; as stock market values have fallen, the depths of the deficit have increased. Michael O'Leary, chief executive of Ryanair (which recently announced its first losses since flotation), describes BA as a "flying pension deficit". The uncertainty associated with pensions is a primary reason why merger talks with other airlines have foundered.

Could BA be vulnerable to a takeover?

The airline certainly looks cheap: at yesterday's closing share price, the market capitalisation of BA was barely £1.5bn – about £5bn less than it was in the heady days early in 2007, and considerably lower than the value of its slots at Heathrow. Some of the more tenacious of the constantly circling rumours in aviation suggest that a leading Middle Eastern airline will take advantage of BA's weakened state to launch a takeover and gain domination of Heathrow. But the excess baggage of the pensions deficit and other "legacy" constraints limit BA's appeal.

What does it all mean for passengers?

Things will get even better before they get worse. BA is likely to follow Singapore Airlines' lead in selling seats at historically low fares. But as rivals fall by the wayside or get swallowed up by bigger airlines, competition will dwindle, allowing BA and other carriers to increase fares to economic levels. In the meantime, some BA passengers will face disruption as it tactically cancels departures that are uneconomic to operate. I have just been told the Barcelona-Heathrow flight I booked six months ago has been axed; it is cheaper for the airline to keep the plane and crew on the ground than it is to operate the flight.

Is this the end of BA as we know it?

Yes...

* With such intense competition, BA has to strip away frills and axe routes to survive

* The airline could be bought up for an oligarch's or oil sheikh's small change, purely for the value of its slots

* BA is a 20th-century creation that is the wrong size and shape for the modern era

No...

* Despite its pension problems and operating losses, it remains far stronger than many rivals

* The airline has a large and loyal customer base who happily pay a premium for good service

* British Airways has come through many tough times and emerged leaner and stronger as a result

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies