Hamish McRae: Ah, the Callaghan years! PMs ranked by the market's rise

Economic View: By leaving office in June 2007, Tony Blair managed, in stock market terms, to sell at the top

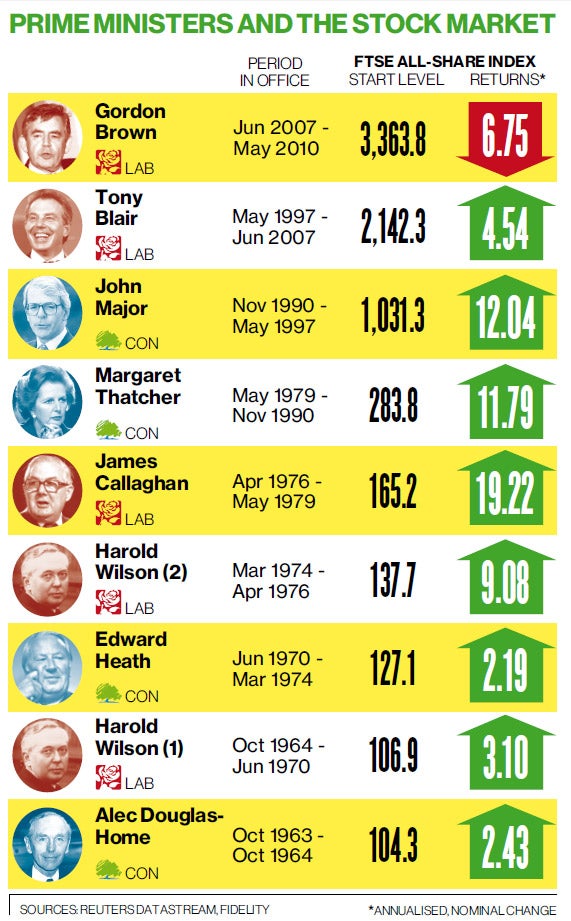

Would you ever have guessed that the best British prime minister of the past 50 years, as far as the stock market is concerned, was James Callaghan? Surely not. I think, on the other hand, that you might have guessed that the worst was Gordon Brown.

It is, of course, quite unfair to rank prime ministers by the movement of share prices on their watch, and for at least three reasons. One is that equity markets are driven as much by global factors as domestic ones. A second is that share indices are unduly affected by inflation, for high inflation eventually will be reflected in the value of shares. And a third is that the timing of market movements is pretty random, and when they do reflect changes in government policy, it is often only after a long time-lag.

And yet is it rather fun, isn't it? The graph, developed from figures calculated by the fund manager Fidelity, shows how there were modest annual increases in the FTSE All-share index under Alec Douglas Home, Harold Wilson during his first term and Edward Heath. That itself is surprising, given that Douglas Home was there for only one year, Wilson presided over sterling devaluation and Edward Heath over the three-day week.

The outcomes during Wilson's second term and the Callaghan years are flattered by the high inflation of the second half of the 1970s, but to be fair to James Callaghan, the strong performance also reflects the fact that the gradual return to fiscal and monetary discipline began in 1976 with the IMF bailout. At the time it was deeply humiliating, but he deserves credit for acquiescing to what, with hindsight, was the turning point in UK economic management.

The solid rise in share values under Margaret Thatcher and John Major is less surprising as it coincided with the long global equity boom, while the more modest progress under Tony Blair encompassed the final years of the 1990s boom, the bursting of the dot.com bubble, and the subsequent recovery. By leaving office in June 2007, Tony Blair managed, in stock market terms, to sell at the top.

As for poor Gordon Brown, it is quite an achievement to be the only prime minister in the past 50 years whose period of office coincided with an overall fall in the stock market. But then he did manage to sell off most of Britain's gold reserves at an average price of $275 an ounce, which compares with $1,575 now, and with $240 in May 1979 when Margaret Thatcher took office, but $500 an ounce by the end of December that year.

Of course this says nothing about the future. On my back-of-an-envelope tally, the market is up about 7 per cent on an annualised basis during the life of the Coalition so far. Of course there may be some catastrophe around the corner. Nevertheless, the fact that it should be so unusual for a prime minister to leave office with markets at a lower level than when he or she got in must surely carry some sort of message.

That message surely is that is it very unusual for share prices to fall, at least in nominal terms, over any extended period. That gives some perspective on markets now. The reasons for caution remain as substantial as ever, and the predictive power of equity markets remain as weak as ever.

Remember that the last peak in share prices was just ahead of the nastiest global recession since the Second World War and both it and the previous peak, the top of the dot.com bubble, have, in the UK at least, yet to be surpassed.

But I have been intrigued by the decent performance of share prices worldwide in the past few months, and there are still a lot of equity bulls about. In fact their ranks are thickening. Today, for example, Baring Asset Management upgraded its stance on equities, "adopting the highest risk profile it has held in several years". It is particularly bullish about the UK and Japan.

There is, however, something else looming on the horizon: the tightening of US monetary policy. One of the main drivers of share prices – perhaps the main driver – has been the extraordinarily loose monetary policy of the main central banks, particularly evident in Japan in the past few weeks.

But nothing is forever. There are more and more stories coming through suggesting that the US Federal Reserve will tighten policy soon. According to the minutes of their latest meeting, several members of its governing body, the Open Market Committee, believe that it should end its quantitative easing policy by the end of this year.

The comment was qualified by "if the outlook for labour market conditions improves as anticipated", but the drift is clear enough. There have been false warnings before of a tightening of policy, but once it becomes pretty clear that something is going to happen, the markets factor that into their calculations.

That said, global money supply is still increasing at about 5 per cent in real terms (ie allowing for inflation) – so there is still a positive force pushing up asset prices. If the central banks print the stuff, it has to go somewhere. So I suppose there are still several months yet of generally favourable market conditions. When the growth of global money supply dips below the expected rise in global output, that driver will disappear.

By the end of this year, of course, our Coalition will be entering the glide-path towards the election in 2015, so I suppose it is a reasonable assumption that the first term of David Cameron as PM will yield another positive outcome.

Shares would have to do very badly indeed over the next couple of years for him to not to join the other eight prime ministers who saw markets rise during their period of office. But I suspect that it will be a single-digit annual rise under the Cameron-led government, rather than the double-digit performances seen between 1976 and 1997.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies