Hamish McRae: Booming equity markets can feed back into growth

Economic View: If a company's share price is strong it has options: it does not have to rely on recalcitrant banks for a loan

Why not the other way round? It is one of the great questions that economists should always ask themselves when confronted with supposed causal relationships. For example, there is the present controversy over the association between the size of a country's national debt and its growth. Do high debts inhibit growth, or does slow growth tend to push up the national debt? The answer usually is that it is a bit of both, and the trick is to try to understand which is the dominant relationship at any one point of time.

Now apply the same question to the stock market. Equities globally have been booming, with the S&P 500 in the US at an all-time high and European and UK shares at five-year highs. The only developed market that is still way off its peak is Japan, for the Nikkei index at 14,300 is still nowhere near its all-time high of just under 39,000 reached at the end of 1989. But it is up nearly 60 per cent on the year, actually the greatest rise of any major market.

So shares are up. That must in some measure reflect greater confidence in global growth, but it also reflects the hunt for yield in a world where governments have driven down long-term interest rates. You can only get 1.8 per cent on UK or US 10-year government securities, but you can get dividends of 3 per cent or more from large companies. So even central banks are now buying equities for their reserves to try to get a better return. Since they are collectively responsible for the low yields, you might say they are hoist by their own petard.

There is, of course, a lively debate as to the balance of forces driving equities, with the "good" reason being hopes of growth, and the "bad" one being printing all this money.

But now let's look at it the other way round. Could the rise in shares be making a real contribution to global growth? Are strong markets less a signal of recovery but a driver of it?

There are a jumble of reasons why they might be so. Take three broad heads: the wealth effect, the cost of capital effect, and the confidence effect.

The concept of a wealth effect is simple enough: if people's assets have risen in value then they feel richer, indeed are richer, and so feel able to spend more, notwithstanding the fact that their incomes may not have risen much, or at all. The trouble is translating that idea into hard data, for while there are various studies, none that I have found seems conclusive. Not many people in the UK own large portfolios of shares directly, though Peps and Isas have created a new band of personal investors. In any case, not many people would splash out on, say, a new car just because their nest egg had gone up a bit in value. Changes in house prices, by contrast, do seem to affect demand, and changes in housing market activity are clearly important.

Still, at the margin changes in share prices must have some effect, and that effect can hardly be negative. The value of shares on the London Stock Exchange is around £2.5 trillion. Not all of that is owned by Britons, and only a tiny proportion by individual Britons, but the increase in value is so huge, say £300bn in four months, that even the tiniest proportion of that seeping into higher demand must be helpful.

In any case, we are talking of a global wealth effect, not just a domestic one. My very back-of-an-envelope calculation is that global shares have risen in value by something like $7 trillion (£4.5 trillion) so far this year. That is bigger than the GDP of Germany and the UK put together. That must have some positive impact on final demand, even if it is paper wealth and it is impossible to quantify.

Cost of capital: the issues here are the extent to which the cost of capital is a key determinant of corporate investment, and share prices are a key determinant of the cost of capital. On the first it is almost certainly less important than the prospect of profitable demand. In other words companies invest because they think a project will create profits, and the cost of capital, within normal limits, is a given. In any case the corporate sectors in the UK, US and Europe are all in total cash-rich. Equity capital in any case is only available to a relatively small number of large companies, for small and medium-sized enterprises rely on bank loans.

So the direct link between share prices and investment on the face of it would appear quite weak. There are, however, other links. For example, in the UK a rise in share values will, other things being equal, reduce pension fund deficits, and for some companies that is a material burden. Small companies seeking finance cannot easily make a share issue, despite all the efforts to promote markets such as London's Aim. But private equity firms are sustained by strong equity markets for a number of reasons, including the easier prospect of floating off their larger investments.

There is a further point. If a company's share price is strong it has options. It does not have to rely on recalcitrant (or troubled) banks for a loan. Equally, banks struggling to raise more capital will find it easier to do so. Markets are open.

That leads to the confidence issue. Higher share prices must be mostly a reflection of confidence, but there must be some feedback loop, too. Confidence is so hard to measure because you are relying on asking people, either as individuals or as executives, what they think. At a time of widespread gloom – understandable against the background of the relentless barrage of bad economic news – what people feel is inevitably downgraded. If, on the other hand, investors are making money, as they are, then that must act as an antidote to the spin.

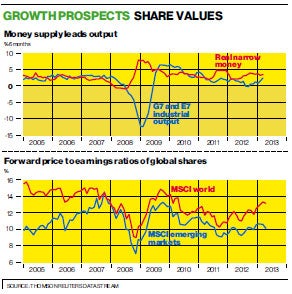

How justified is the modest boost to confidence? Well, real global money supply points to continued growth (top graph) and shares are still reasonably priced (see bottom one). But whatever you feel about growth prospects and share market value, it is hard to deny that the share recovery is anything other than helpful at this time.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies