Hamish McRae: China's economy will grow fast in the next five-year plan – we must watch and learn

Economic Life: The chilling question is what we can do here in the UK that countries on the other side of the globe cannot do just as well and at lower costs. Oh dear

A quieter year after the hubbub of last one? That is certainly not the perception we get from Cairo but remember this is the Chinese New Year, not our one, and the symbol of 2011 is the rabbit – traditionally a time for building, for family and for calm.

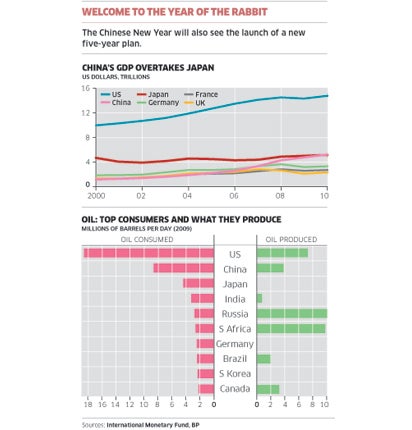

Whether or not you take the Chinese annual symbols seriously, you have to take what China does seriously and this is as good a time as any to try to think through how the world's second largest economy will affect the rest of us in the months and years to come. For this is not just another year; it is the start of the new five-year plan taking the country through to 2016. As you can see from the top graph, China has now passed Japan in economic size. Ten years ago it was smaller than the UK or France, an extraordinary turnabout. There is still a long way to go before China passes the US, as you can see, but in another five years' time everyone will be aware that the target of passing the US in economic size will be in China's sights.

So what should we look for in the coming months?

Well, I think the first thing will be a reassertion of the 8 per cent GDP target as a rate at which the country can comfortably grow. Things have gone rather faster in the past few years – astoundingly so when you think of what has happened to the West – and there is an immediate need to rein back. China offset the decline in export demand from the US by increasing domestic investment, including house-building, and consumption. It had plenty of scope to do so, for savings ahead of the downturn accounted for more than half of GDP. But in recent months there have been rising concerns about inflation, now running at around 5 per cent, and the issue is how to damp down the economy without over-compensating. Meanwhile the country has to absorb the stock of unoccupied housing: to grow into the investment that it has made.

So there is the short-term issue of how to tighten policy safely. Can it be done? All one can say to that is that this remains in large measure a command economy and the authorities have managed for 30 years to engineer the greatest burst of economic growth the world has ever known. You could argue that as the economy expands it has become progressively harder to tighten policy. But the experience of the past three years, and in particular the decoupling of China (and India) from the fortunes of the old developed world supports the notion that the Asian economic time zone can manage the balancing act for a while yet.

If that is right, our worries should be more about the continuing burden that China will put on resources, including energy supplies, and the impact of rising Chinese export prices, than about any sudden halt to growth. China is now the world's second largest consumer of oil, after the US, and third largest importer, after the US and Japan. Indeed if you look at the amount of oil it uses, the Chinese economy is much closer to that of the US than the overall GDP figures would suggest (see second graph). Incidentally China is now the world's largest emitter of carbon dioxide, larger even than the US.

In a sense we in the West are experiencing the opposite forces to those we faced in the long boom to 2008. Then we benefited from cheap imports from China, which helped hold down goods prices generally, but until at least the end of the period, we also had reasonably low commodity prices. This helped us sustain solid growth without serious inflation. Now we are no longer getting quite as big a benefit from cheap Chinese exports, as wage rates and prices there have risen somewhat, but we are importing inflation from the high raw materiel and energy prices, particularly of oil. I am afraid the only sensible assumption is that this unfortunate combination will continue.

However, the new five-year-plan is sensitive to all this. From a macro-economic perspective, the aim is to allow domestic consumption to grow in line with overall output. From a micro-economic perspective the aim is to nudge the economy away from industries that use large amounts of energy toward higher-end activities. There are seven strategic industries: energy saving and environment protection; new-generation information technology; bio-technology; high-end manufacturing; new energy sources; new materials; and clean-energy vehicles.

It is hard to quarrel with any of that. I suppose the question is to what extent China will be able to create the new cutting-edge technologies that these industries require. Up to now Chinese economic development has been mostly catch-up – applying technologies developed elsewhere. For example, China is building more high-speed rail lines than the rest of the world put together, which is amazing. The line from Shanghai to Beijing is scheduled to open later this year. But while the Chinese government is managing the expansion of the network, the technology has come from Europe and Japan.

Past experience would suggest that the development of these new industries will involve a mixture of imported and home-grown technology. It would also suggest that by the end of the period, i.e. in five years' time, China will be exporting these technologies to the US and Europe. That leads to the somewhat chilling question of what we can do here in the UK that other countries on the other side of the globe cannot do just as well and at lower costs. Oh dear.

I think the sensible response is to accept that this burst of growth will continue for some while yet and that it is normal and natural for the benefits of new technologies to spread around the world. We here in the UK benefit from the internet, the lap-top and millions of innovations large and small of the information technology revolution. It is more important to be able to apply technology intelligently and efficiently than it is to develop it in the first place. But I suggest we should, in this year of the rabbit and over the period of the five-year plan, pay more attention to the technologies that are being developed in China and seek to learn as well as to teach.

The transformation of China is bigger than anything that has happened in our lives and it has still many years to run before the big bang is over and China reaches some sort of a steady state. One final point: one of the main aspects of the plan is a continued movement of the country's people from the country to cities. HSBC estimates that a further 200-300 million people could be urbanised over the next 20 years. That is the population of four or five British Isles and the shift is happening in what is in historical terms the blink of an eye. At some stage the ageing China will go ex-growth and become more like any other developed economy. But not yet.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies