Hamish McRae: Easy money won't help economies weather this global banking crisis

The turning point for the banks but the beginnings of a deeper slide for the real economy? This week has been extraordinary. We were talking yesterday with some senior bankers and they agreed that the only similar time in terms of the febrile mood in London was the collapse of Burmah Oil and the plunge of equities at the beginning of 1975. For New York, well, what has been happening there is surely bigger than anything since the 1930s.

So those of us who thought that this period of financial stress was not as bad as that of several others post war have been proved wrong as far as the banking industry is concerned. Leave aside the Lehman Brothers business; what has happened to HBOS is seismic. If anyone had said in 2001 when the former great building society, the Halifax, merged with the proud Bank of Scotland (founded in 1695) that the two would within seven years be contemplating a forced marriage to save their skins – well it would have seemed absurd. So for bankers this has been a terrifying time.

But if you look more widely at the totality of financial markets it is still surely right that this is less serious than the 1970s or the 1980s. In terms of share price movements this is much less serious not just than in the 1970s but also than the early 2000s, at least so far. Currencies' movements have been relatively modest; inflation numbers not too bad when compared with the past; the interest rates on government bonds have remained extremely low. But banking matters because it is a servant to the real economy. Just as too much credit makes economies have speculative bubbles, so too little credit squeezes the life out of them. That is the danger now.

This is a global issue because banking is a global industry but let's focus on the UK. The question is whether the commercial sector will suffer in the same way as the housing sector has done. Some companies, particularly many large companies, have plenty of cash and are in a position to bully their bankers. They don't need to borrow and can screw the banks for the highest rate on their spare cash. I realised something was up at Bank of Scotland a month ago when I saw the rates of interest it was prepared to pay businesses for big deposits: a clear 1 percentage point more than rival Royal Bank. The Bank of England's special liquidity scheme, now wisely extended, helps all the banks but some banks have remained under more pressure than others.

Thus any company (or indeed individual) who has cash gets red-carpet treatment. By contrast many smaller companies are finding that the banks are putting pressure on them to cut back their overdrafts. It is not that money is too expensive; it simply is not available. So companies, even well-capitalised and profitable ones, are going into survival mode. Any unnecessary investment is postponed; any unnecessary costs chopped; hiring freezes imposed. We all hear little snippets: earlier this week I was told by a property adviser that he had just had a tussle with his fellow directors to give permanent jobs to the graduate trainees who had been promised them. In this instance they did get the jobs because that was the right thing to do, but other companies will be less scrupulous.

For the moment, however, there is still work around. You may have to go to Dubai or Abuja to get it but the world economy as a whole has continued to grow. The problem in the developed countries is the speed at which domestic demand is fading, for the faster companies adapt to cooler climes the faster their home economies become yet cooler. The world of officialdom has been cutting forecasts for next year, with the European Commission and the International Monetary Fund substantially more gloomy than they were even three months ago. We will get the Treasury's prediction for the UK economy next month in the pre-Budget report and it will not be pretty. Even nastier will be the prediction for government borrowing, which I could see going to £75bn or more. What rubbish all those forecasts of Gordon Brown were, the ones that suggested we would be in surplus now.

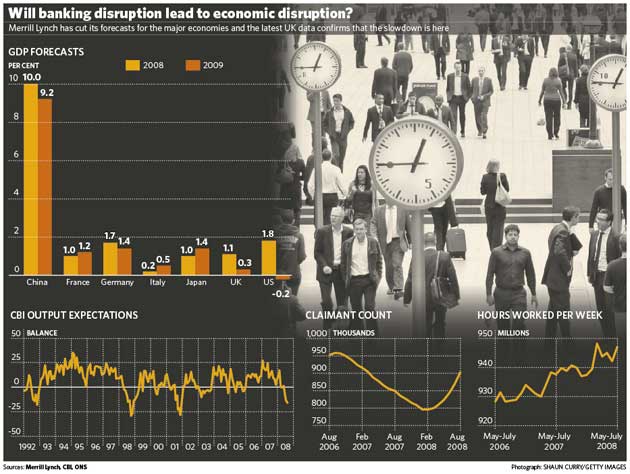

Private sector forecasts are usually quicker to pick up trends than the official ones and I have been looking at the new stuff from Merrill Lynch, just out. Merrill has just been doing a bit of rate-cutting, of which the two most interesting items area prediction of just 0.3 per cent growth for the UK next year (see top chart) and a minus 0.2 per cent for the US. The UK figure would be consistent with the technical definition of a recession of two consecutive quarters of negative growth but the US one really would be a recession on any sensible understanding of the word. Europe and Japan, by contrast, escape with slow growth.

This is interesting because the implicit message is that the financial disruption and the over-borrowed nature of the US and UK puts them in worse shape than the rest of the G7. You could say that we get more contagion from the financial woes than they do.

It is certainly a plausible argument and having grown faster than either Europe or Japan over the past decade it would be reasonable to expect us to do worse for a change. But does the latest evidence support that?

It sort-of does, but not conclusively. At the bottom is some information that came out yesterday, first the CBI's expectations for output and then two bits of data on the job market. The CBI survey does show a sharp deterioration in sentiment as you might expect. But note that we had a similar downward blip in 1998, after the revaluation of sterling, and output actually continued to grow. We did have a dip in 2001 and at that time the CBI survey proved correct. Take your pick. The more gloomy interpretation would be supported by the unemployment figures, which show on the claimant count measure a steady increase since February and were up 32,500 last month. Total employment also fell, albeit from a very high level. But it is worth recognising just what a high level of activity the economy was sustaining right through the first half of this year, as you can see from the rebound in the total number of hours worked in the second quarter. That will fall and unemployment will go on rising but we are retreating from a high base.

The real issue will be between economies that are over-borrowed but flexible and ones that carry less debt but are less flexible. Being over-borrowed is a bad position to be in during a period of financial stress because you are forced to de-gear fast. That is happening in our housing market and the task of the Bank of England will be to stop that happening in the economy more widely. It is not a question of pumping up an economy by an excessively lax monetary policy. The Americans have tried that and it doesn't work. It is a question of making sure that financial stress transmits to the economy discipline rather than destruction. The bell tolls for the Bank of Scotland but it also tolls for the rest of us.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies