Hamish McRae: Expect a recovery, certainly, but not a return to business as usual

Economic Life

Can it really be so bad? The answer as far as UK government finances are concerned is clearly: yes. Actually the picture is even worse than that set out in the Budget in the sense that those deficits cannot be sustained. The next government will have to cut spending even further and increase taxation revenues.

But as far as the world economy is concerned? Here I'm not sure. We may be at one of those inflection points, the moment when the official forecasters finally catch up with reality and surprises start coming through on the positive side.

While we were all focusing on the Budget, the International Monetary Fund came up with yet another downward revision of its forecasts. I can't remember whether this was the third or the fourth downgrade, but it made its previous efforts look pretty rum. The two things that took the headlines were a forecast for UK growth that was significantly worse than that of the Treasury, and some bizarre calculations, subsequently withdrawn, about the scale of the possible losses of the British banking sector.

There is not much point in getting worked up about either. My instinct is that the Treasury forecast for this year of the economy shrinking by 3.5 per cent may even be too pessimistic, but we will see. If the Treasury turns out to be right (and its projection is in the middle of the consensus) this recession will turn out to be less serious than the early 1980s, though worse than the 1990s. As for the bank losses, who knows? The markets seem to think we are past a turning point, and the banking analysts are at least as reliable – or unreliable – as the IMF boffins.

No, what matters in the IMF forecasts is whether the big message they carry is right. That message is the world economy is taking a huge hit but that in a couple of years it will be back to its fast canter, with the developing world leading the pack.

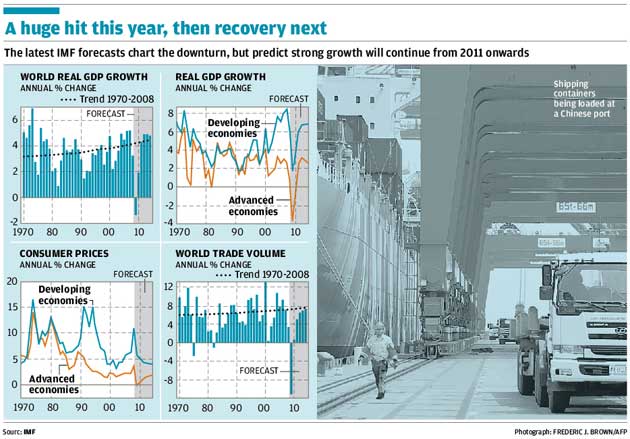

The graphs give a feeling for this big picture. The proposition of the first is that the trend growth of the world economy is still intact and creeping upwards, despite the big bang this year. That seems to me to be reasonable, given that the motor of growth now comes from the emerging economies as much as the developed ones. Not only are these economies much larger than they were a generation ago, both absolutely and in relative terms; the lessons learnt by China and India are spreading to the other emerging economies and the performance of the whole is being lifted.

You can see the way these economies have streaked ahead over the past decade from the next graph, as well as the very simple message that taken as a whole they are keeping growing through this cycle whereas the developed world is not.

There is also one huge difference between now and all previous downturns: inflation throughout the world is under control. Of course there have to be worries about the impact on inflation of the various measures now being taken to boost the banking system, including the "quantitative easing" of the Bank of England. But I have not seen a single projection that suggests inflation will return to the level of the early 1990s, let alone the 1970s. That potential constraint on economic policy is no longer an immediate concern.

On the other hand, world trade has taken an enormous blow, as the final graph shows. The one statistic I find really shaking is that Japanese exports are running at half the level of a year ago. That is unreal, something you cannot plan for. It is particularly serious for Japanese car companies as their domestic market is so depressed. So what should we think about this?

There are two responses and there is merit in both. The first is to say that this is principally an inventory adjustment, albeit a vicious one. It took a while for manufacturers to recognise the scale and speed of the downturn in consumer spending worldwide and clearing the pipeline of stocks has accounted for most of the downturn in the first quarter. If that is right, and I think it is, there ought to be some sort of bounce in the second half of this year. This would be consistent with the fact that the economies that have relatively large manufacturing sectors, such as Japan and Germany, seem to be harder hit than the UK and US.

The second response is less positive. It is that there may be some permanent change to consumer behaviour, as people adjust away from feeling they need so much new stuff. The idea that people should be paid to buy a new car would have seemed outrageous three or four years ago, when politicians here and elsewhere seemed intent on hitting the motor industry with higher taxes and higher fuel prices. If consumption is to grow more slowly, as it will in many developed economies including our own, that is bad for world trade. If Americans in particular feel they need to realign their priorities away from acquiring more possessions and towards spending more on services, that would have a ripple effect on manufacturing and trade throughout the world.

Now, it may be that Chinese and Indian consumers will eventually take up the slack, but remember that US consumption accounts for about 30 per cent of the world total.

This is important because for the world to get back to that rising post-war trajectory, consumption has to pick up again. To some extent of course it will. But intuitively most of us feel there will be a few sombre years, not just as a result of credit overhang and the banking bust but also the blow to the growth psychology of the last boom.

How to pull this together? Try this. Most of the bad news for this year is now discounted. Expectations are so low that the surprises will come through on the positive side. In that sense the IMF forecasts may well be too gloomy. But beyond this year, while there will indeed be a recovery, we should be very careful about assuming it is back to business as usual. It certainly won't be here in the UK as the next government starts to pull us back from the dreadful scene outlined by the Chancellor. It won't be back to business in the US either as the excesses there will also take years to work off. Continental Europe will see slowish growth too, while Japan is really in a lot of trouble.

So while there will be growth, there won't be much of it in the developed world. That will hold back activity elsewhere too. The prospect therefore is of several years of recovery, sure, but slow and uncertain recovery: two steps forward and one step back.

This is not a dreadful prospect. It is not as bad as the plight the world economy faced in the early 1980s, when it was still trying to cope with runaway inflation. But it is not a symmetrical V-shaped recovery, more a V with the upward leg sloping much more gently than the downward one – or even a W, with the initial bounce not being sustained. Still, at least it won't be an L!

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies