Hamish McRae: Lengthy stagnation for West in a two-tier world

Economic View: In this slow-growing world, how can we protect our savings from being whittled away by inflation?

It is time to look forward. The next few days will be dominated in the UK by concerns about the Autumn Statement, the hole in fiscal accounts, and so on. The next few weeks will be dominated in the US by worries about the fiscal cliff and what Congress will do about that. But the investment community has to look beyond these preoccupations, and in the past few days the various banks and consultancies have started to publish their expectations for 2013 and beyond. If you were to try and sum them up simply, the outlook is for a continuing recovery in the developed world, but one that runs at different speeds in different regions, and strong but bumpy growth in the emerging markets.

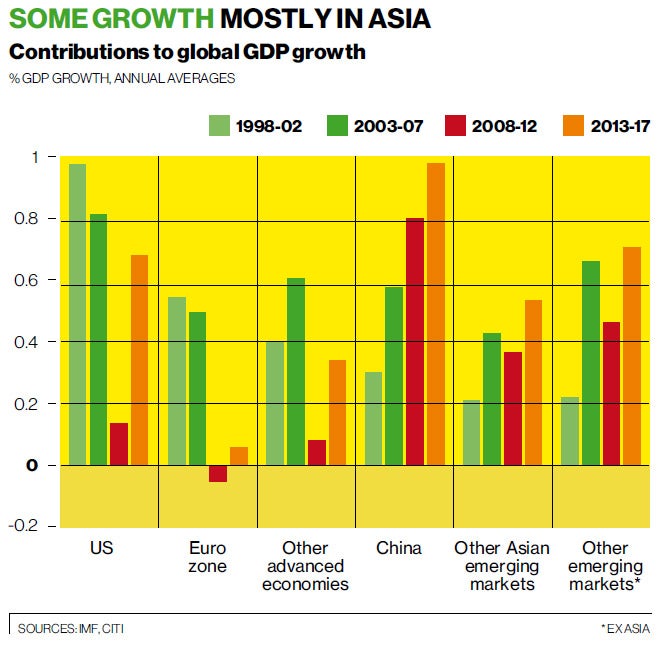

A good starting point is some work by Willem Buiter and colleagues at Citigroup, which bravely looks forward to 2017 and beyond. You can see from the graph how the baton of global growth is being passed from the US and Europe on the one hand, to China and the rest of the emerging world. Between 1998 and 2002 the US was the largest single contributor to global growth, followed by the eurozone. From 2013 to 2017 the largest single contributor will be China, followed by the rest of the emerging world (ex-Asia) and then the US. The contribution of the eurozone will be very weak indeed.

The principal force holding back the advanced economies, as has been widely noted, is the legacy of the debts incurred in the boom/bust cycle, and Citigroup asks how far deleveraging has gone. The position varies from country to country, with the UK, for example, having a particularly large build-up of private-sector debt in the boom years, but having a modest start in cutting that debt back. Even less progress has been made in much of the eurozone.

Two countries stand out. One is Germany, where private debts actually fell during the boom years. As a result private debt is lower now than it was in 2001, which is pretty astounding. The other is the US, where people have paid back or otherwise cleared debts and where Citigroup reckons that private deleveraging is pretty much done. That in part explains why the US economy will manage much better growth than Europe from now on. As for Europe, Citigroup expects both Spain and Italy to have sovereign bailouts, and on balance expects Greece to leave the eurozone.

By contrast to all this, the bank expects China to continue to be an economic powerhouse, and though it will grow somewhat more slowly, it expects its economy to have passed that of the US by 2025. India and Russia (and maybe Brazil) will by then be bigger than Japan – a changing of the guard indeed.

I suppose the overall message from all this is that the debt burden carried by the West (and particularly by Europe) is even heavier than we all realised, and that it is not just our governments who are to blame but us as individuals too. As a result two-tier growth stretches ahead for some time, but within the slow-growing developed world, the US will do quite a lot better than Europe.

This broad outlook is pretty much in line with the other chunks of economic analysis published recently. For example, the OECD's latest Economic Outlook expects a better recovery in the US than in Europe, with only the weakest of recoveries in Europe in 2014. But it expects strong growth in China of nearly 9 per cent in 2014, and India growing at 7 per cent then. It is indeed a two-tier world. Overall global output is well up on the peak of early 2008. World trade is well up too. But sitting in Britain or Europe, all that one can see is seemingly endless stagnation.

How can one translate this disagreeable prospect into some sort of investment strategy? Or more prosaically, how can we in this slow-growing world protect our savings from being whittled away by inflation?

I have been looking at various investment outlooks, and the consensus there seems to be that the least bad strategy – one that gives some sort of stake in global growth – is a mixture of equities, property and good corporate (but not sovereign) bonds. Thus Aberdeen Investment Management notes that companies are in reasonably good shape and equities are cheap relative to bonds. I see too that Middle Eastern money is coming back into the London office market again, where it can earn some sort of positive return, unlike in most other cities.

But that is a very downbeat observation, and the obvious question it raises is: when might business and investment confidence recover? Is there some sort of turning point out there that we cannot yet see?

Have another look at that graph. If those projections are right, the US economy will between 2013 and 2017 become again a real engine of growth. Sure, it will not be adding as much total demand as China, nor as the emerging world taken as a whole. But you would not expect that. If it does start to grow solidly again, and assuming there is some sort of fix for its fiscal woes, it would start to regenerate the "animal spirits" (Keynes' expression) that drive yet further growth.

Nothing – not even the present pervading gloom – lasts forever. If it is true that in the US, personal deleveraging has more or less run its course, that would signal some sort of transition. I have a feeling, looking for example at the strong car sales in Britain, that the end to personal deleveraging here may be in sight within another year or so. If consumers in the States really pick up the pace, then that feeds into a recovery in business confidence that will go beyond US shores.

If this line of argument is right, then what we are seeing at the moment is a typical early-cycle pause in the recovery. That recovery has been exceptionally weak in nearly all the developed world, and will remain so for some time yet. Europe and Japan will lag behind the US. But we should not write off the recovery just because it has been disappointing: this is still a growth phase.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies