Hamish McRae: Let's celebrate US growth, but this recovery will be far from smooth

Economic Life: Even if US growth is sustained, there is a profound danger that it will be a jobless recovery

So now let's think about the shape of the global recovery. The United States is a bit less than one-third of the world economy but it is and will remain hugely important. There has been a turning point of sorts there, which will help nudge the rest of the world economy round the corner. In a few months even the laggards, which seem to include the UK, will be growing again.

What is much less clear is the path and nature of that growth, its sustainability, the extent to which the recovery creates employment, the long-term consequences for savers and home-owners and so on. Still, as a template against which people might fit their own expectations, here are some thoughts about how the recovery might pan out. Starting with the US.

I don't think the US recovery will be a straight line at all. Indeed there is a very good chance that there will be at least one negative quarter during the next few months. It is possible that there might be two negative quarters in a row, the technical definition of recession, making this downturn a double-dip or W-shaped recession. Actually I think there is more of a danger of a double-dip in the US than there is here. And even if US growth is sustained there is a profound danger that it will be jobless recovery, which is troubling in both social and economic terms.

There are a number of reasons for worrying about the shape of the US recovery. The most obvious is the extent to which is it artificial, in the sense that this turnabout has been puffed up by a barrage of unprecedented measures, including the car scrapping scheme, near-zero interest rates, a budget deficit of some 12 per cent of GDP, the special scheme whereby the US Treasury has bought $300bn of government bonds ... the list goes on.

But in a way I find the underlying weaknesses of the economy more troubling than the reliance on special schemes. Until a decade ago the US economy was a great job-creation machine. During the last recovery it wasn't. And such jobs that were created during the past growth phase have entirely disappeared.

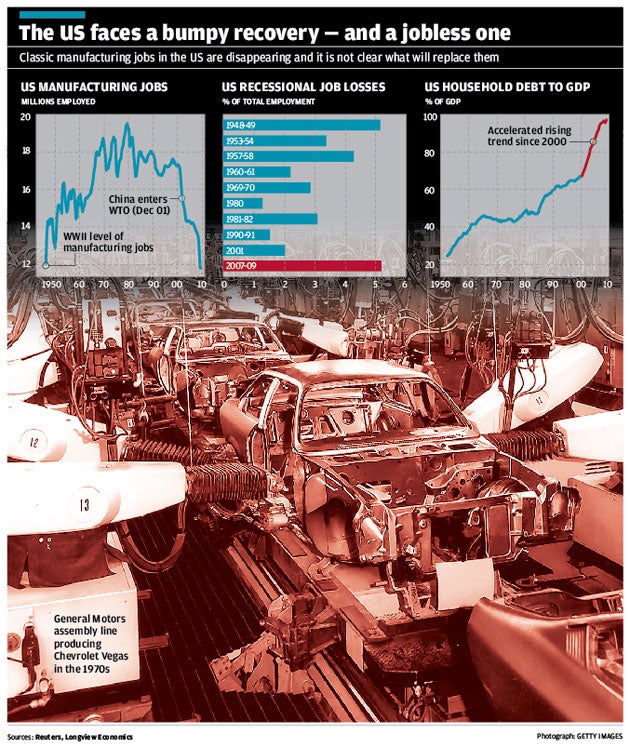

You can catch a feeling for this in the graphs. Chris Watling of Longview Economics has pulled these together, arguing the case that unlike in previous recessions the jobs that have been lost won't come back. There is a structural weakness in the US employment market, not just a cyclical one. One stunning thing I had not been aware of has been the collapse of manufacturing employment even during the past boom.

There are now fewer people employed in manufacturing than there were at the end of the Second World War, as you can see from the first graph. The numbers have been falling as a proportion of the workforce since the 1960s but the collapse in absolute numbers only began after 2000. Make of it what you will, but it coincided with the rise of China as a manufacturing nation and as an exporter to the US on a seismic scale. Moreover, job creation during the 2000s was quite muted when compared with previous cycles. It took nearly two years after the 2001 trough in the economy for the job market to pick up, whereas in previous recessions the job market recovered very quickly after the upturn in demand. And, most worrying of all, during this downturn more than 5 per cent of the workforce have already lost their jobs, making this the worst recession for job losses since 1948/9 (middle graph).

That will be a dampener on recovery and so far at least there has been no recovery in service industry jobs. Financial services are falling or flat; retailing ditto and other services are still showing no signs of wanting to take on more people. Eventually the job market will steady but I am afraid there is no sign of that yet.

One reason why companies will be reluctant to take on more people will be prospects for demand. US households have debts that are roughly equivalent to the country's GDP, double the proportion of the early 1980s, as you can see in the right-hand graph. The trend shot up after 2000. You could say that the last expansion was largely financed by borrowed money and that this expansion will instead have to be driven by real income growth. But if employment does not pick up, where will the income come from?

Put like this, it all looks a bit daunting and I think it is. There are however some more encouraging signs that the big adjustment that the US has to make has already begun. The current account deficit has halved to about 2.5 per cent of GDP as imports have been trimmed and the cheap dollar has helped exports and US household savings have risen. The financial balance sheet of households is turning round as house prices have stopped falling – and that helps put a floor on the loan losses incurred by the unwise mortgage providers.

Still, you can catch a feeling for the nature of the expansion: not much job creation; a big drive by households to trim their debts; consumption further held back by rises in taxation; and, eventually and inevitably, an increase in interest rates. There will be growth, sure, but Americans will not see much of that growth feeding through into higher living standards.

If that is right, what does it mean for the rest of the world? Five points.

One, the world cannot rely on the US consumer to supply much of the additional demand through the next growth phase. In that regard, this expansion will be quite different to the last one.

Two: other countries where households are heavily indebted, I am afraid including the UK, will not see much of an increase in living standards either.

Three: on past performance consumer demand will be relatively muted in Continental Europe. There is potentially more scope for German consumers to up their spending but you could say that they might well feel their previous caution has been vindicated by the experience of this downturn. Besides, Continental demographic prospects are even more adverse than in the UK and US. So there will not be much of a European consumer boom.

Four: that leaves the emerging world and a few energy-rich developed nations to supply the main source of consumer demand. There will naturally be investment demand from the world as a whole, but investment is typically less than 20 per cent of a developed country's GDP whereas consumption is more than 60 per cent. Besides, though China has now become the world's second-largest economy, I am not sure its consumers will be buying a huge amount of stuff from the developed world. So while an expansion driven by investment and by the emerging nations will probably occur, do not expect it to be a particularly vigorous one.

Finally, though, expansion is better than contraction, or – more precisely – sustainable expansion is better than contraction. In another few years' time a sustainable expansion should be established. It won't feel great but it will feel better than the past few months have. So celebrate the return of the US to growth, even if the coming months look difficult indeed.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies