Hamish McRae: Money tightening takes centre stage as danger looms that the Bank of England may repeat previous mistakes

Economic View: Maybe electorates actually want moderate fiscal and monetary policies

The great debate about the appropriate pace for fiscal tightening is over. The debate about the pace for monetary tightening has begun.

The revised growth forecasts for the British economy by the International Monetary Fund, 2.9 per cent this year and 2.5 per cent next, has killed stone dead the notion that the (not very fast) pace of fiscal consolidation would abort the recovery.

Even the fringe European countries that had a much more severe squeeze imposed on them seem to be returning to some growth, though there you could reasonably argue that the cuts were too drastic. As far as the UK is concerned the issue now is whether growth is too fast to be sustainable, not too slow.

Monetary tightening is quite another matter. The financial markets have tightened monetary control a little by pushing up long-term interest rates. That has been associated with some recovery in sterling, which also has the effect of tightening policy. But as far as the UK is concerned that is some way off. It is possible that one or two members of the Bank of England Monetary Policy Committee (MPC) will have voted for an increase in rates at this week's meeting, but it would be quite astounding were it to up rates today. We have to wait for a couple of weeks to get the MPC minutes to see who voted for what, but none of the contributors to consensus forecasts expects a rise before September and the majority do not expect a move until next year.

But is that wise? Of course we have to wait to see how the year unfolds: whether, for example, unemployment falls convincingly below 7 per cent this summer, whether inflation remains below 2 per cent, and so on.

There is, however, a danger that the Bank will repeat its mistakes of previous years – increasing rates too slowly during a boom and cutting them too slowly when a slump looms.

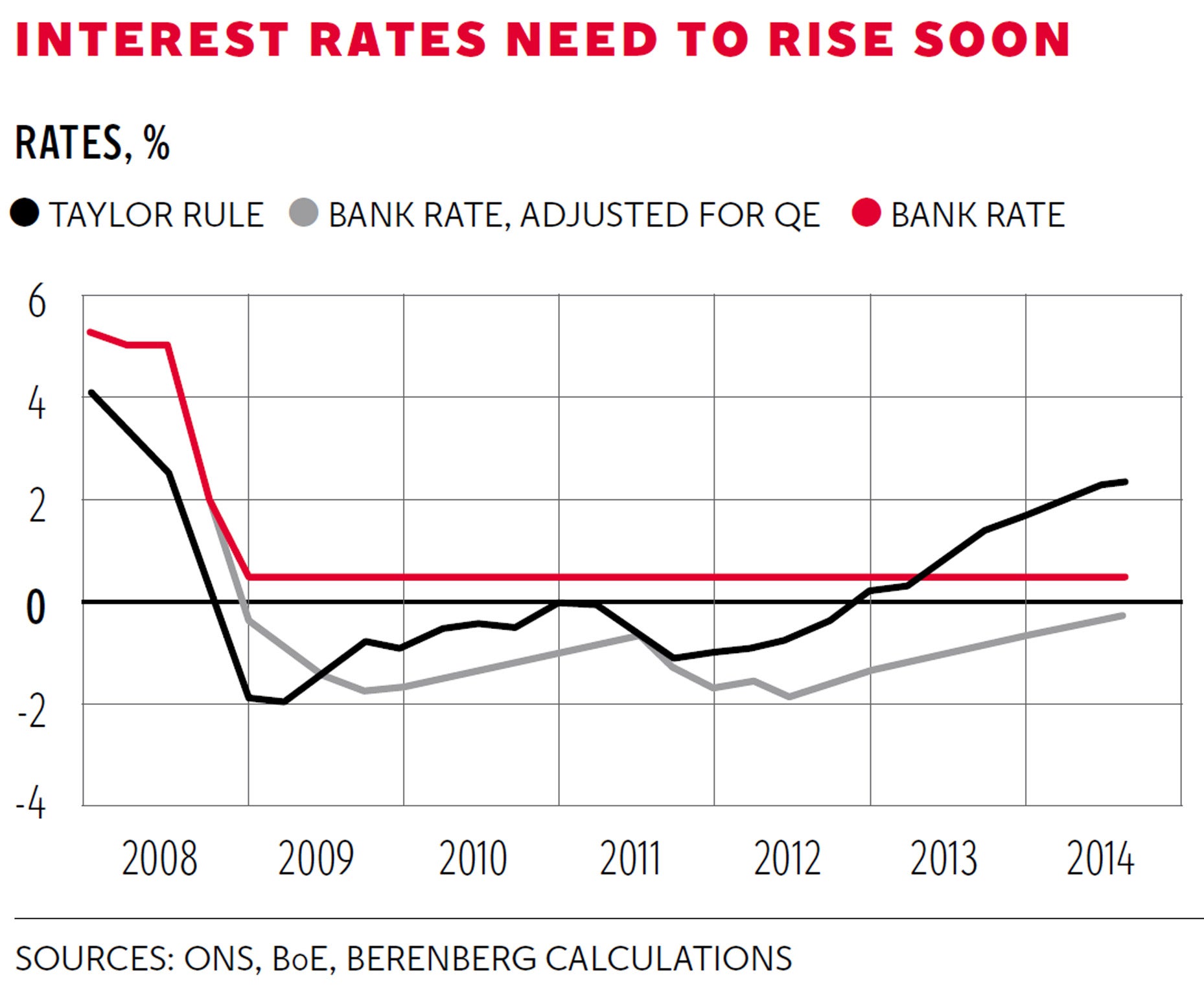

Have a look at the graph. It shows three things. First, the red line, is what has happened to base rates. There is a grey line which shows a calculation of the equivalent of base rate, allowing for the impact of quantitative easing (QE). You cannot have negative interest rates, or at least it is very complicated to do so, so the Bank used QE to give the effect of negative rates.

Then there is a black line showing what interest rates ought to be under the Taylor rule. That is a formula developed by the US economist Charles Taylor as a guide to central-bank policy, taking into account a number of factors about an economy including actual inflation and employment levels compared with targets for both. As you can see, relative to the Taylor rule, the Bank was too slow in cutting rates back in 2008, but now should have started to increase them.

These calculations have been done by Rob Wood, the chief economist for Berenberg Bank and previously head of the UK economics team at the Bank of England. He expects the Bank to tighten policy earlier and faster than it itself projects.

Though there is only a 35 per cent chance that the first increase in rates will come this year, there will be four rises of 0.5 per cent in 2015 and 2016, bringing rates to 2.5 per cent by the end of 2016. The working assumption is that the Bank will begin asset sales, unloading the first part of its huge holdings of gilts, in 2017. But sales might come sooner, in which case the increases in interest rates could be delayed.

The intellectual argument for starting tightening sooner is partly that the economy has much more momentum that the Bank thinks – that is the Berenberg view – but also that the distortions created by an overly loose policy become progressively more damaging the longer it lasts. These costs are not just people ploughing too much into property, and buying increasingly risky securities in the hunt for yield. They are also the social costs of increasing the wealth of the present owners of assets, while making it harder for the less rich to accumulate wealth in the first place.

There is an even broader issue here, which is the asymmetry in democracies' monetary policy. Policy has been very loose in time of slump, but has not been sufficiently tightened during booms.

There is an inbuilt bias. You can see that clearly in the string of letters by the Governor of the Bank of England to the Chancellor about inflation being above target and not a single one explaining why it is below target. But there is also a corresponding bias in the US, noted by the British economist John Llewellyn in a paper out yesterday. His argument is that the misuse of both fiscal and monetary policies in democracies has been tragic. Now that fiscal policy has reached its limits the burden is on monetary policy, with the costs noted above.

The result will be a long period of low interest rates, financial repression, more developed countries having to reschedule their debts, and a failure to convince electorates that structural reforms are necessary to boost real growth.

It is a powerful argument, if a depressing one. It may well turn out that Western democracies are to have a long period of depressed economic growth.

The argument against him is that governments have been scared by the recession, with just about every serving government thrown out.

The principal survivor has been Angela Merkel, and arguably Germany is the only country to have followed a responsible fiscal policy, as well as being the main force for monetary prudence at the European Central Bank.

Maybe electorates actually want moderate fiscal and monetary policies. In the UK, our modest austerity policy still commands general support and I suspect that a return to a more-cautious monetary policy would be welcomed too.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies