Hamish McRae: Next year should be good for the UK and other economies, but can the markets continue to rise?

Economic View: The better the economy does, the quicker rates rise and the greater the pressure on shares

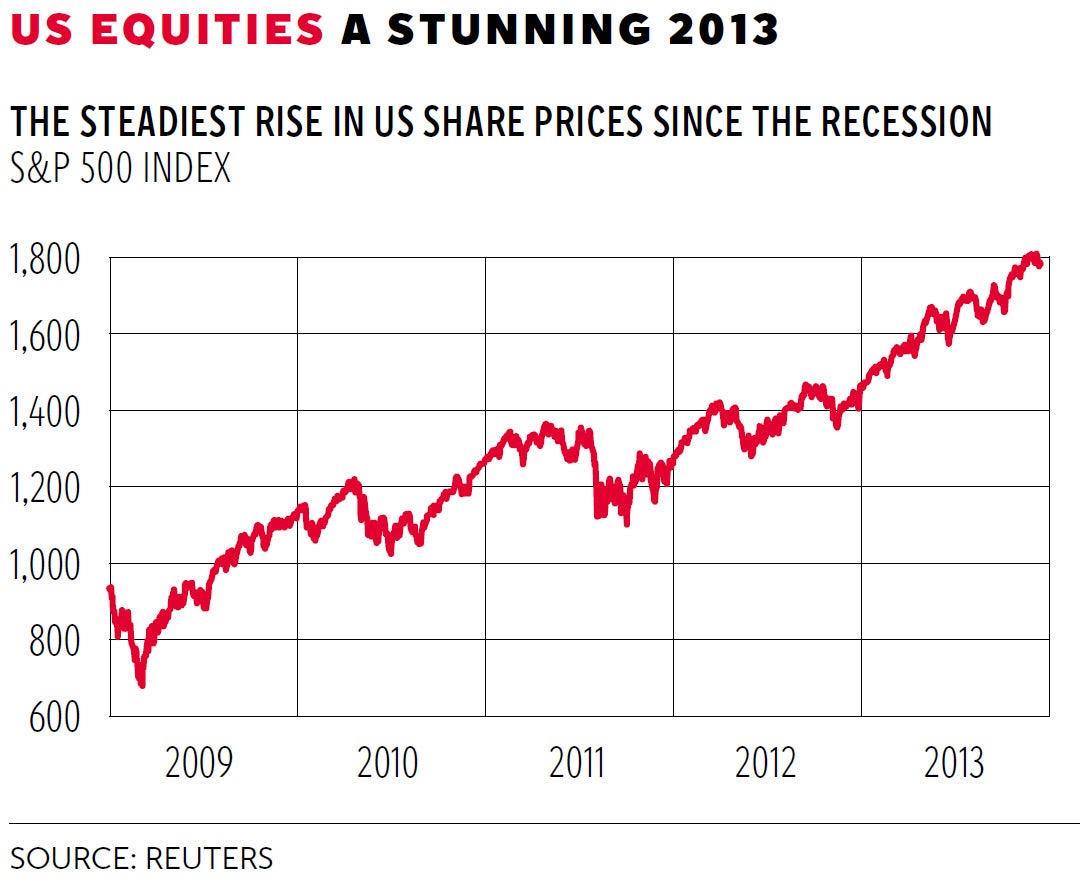

As it canters to the close, there is no doubt that from both an economic and a financial market perspective 2013 has been a reasonably successful year. All major equity markets are up on a year ago, the US stunningly so. Growth here in the UK has picked up pace, as even the "tripple-dippers" acknowledge. The US has gone over its fiscal cliff (remember that?), picked itself up and continued growing. Even Europe has turned a corner, for the eurozone has moved out of technical recession and most of the Continent is now growing, albeit slowly.

It is true that it has been a less positive year for the Brics, with Russia under pressure from lower global gas and oil prices, Brazil peaking out and India heading into elections next May against a much more disappointing growth performance than two or so years ago.

China is fascinating, for it seems to be making the transition from growth led largely by investment to one where consumption starts to take up the slack.

So its growth at around 7 per cent is the slowest for a quarter century (yes, stunning, isn't it?), but on a long view that is a necessary and welcome development.

The new programme of reforms may turn out to be almost as significant as the great Deng Xiaoping changes of 1978/9.

So what can we say about 2014? I think we may have another rather good year for developed world economies, but maybe a less positive one for their financial markets.

The logic behind this is that this will be the year when growth will be deemed sufficiently secure that financial conditions will start to get back to some sort of normality.

There are obvious and inevitable elements to this, of which the most important will be the tapering down of the monthly Fed purchases of Treasury debt.

There is also a reasonable bet that the UK will see its first rise in interest rates, which would be rational.

If, as is plausible, the UK is the fastest-growing of the large developed world economies, it is reasonable to expect it to be the first to increase interest rates.

Even if official rates are pegged, long rates will inevitably move up and the only issue there is the profile of the increase.

What is normal for nominal 10-year US and UK sovereign yields? Say 4 per cent? Well, it certainly was not 1.5 per cent, the level hit in the middle of last year, so we have already moved some way back to normality.

You then have to ask how equities will cope with normal monetary conditions.

There will be a massive divergence between the Anglosphere and the Continent, simply because the return to normal will take much longer in the eurozone.

If you want some fun, have a look at the "10 outrageous predictions" from Saxo Bank, which start with the EU creating a wealth tax on savings above €100,000 (£84,000) in exchange for a return to a Soviet-style economy.

I don't particularly recognise that one, but the next, the European elections creating a strong anti-EU alliance, including UKIP, seems a more likely runner.

Others, recession in Germany, include the Brent oil price falling below $80 a barrel, and consistent with that, the US economy slowing as deflation takes hold.

The purpose of that exercise, the thing that makes it really useful, is to make you think: what if? I find it hard to envisage deflation taking hold in the US, simply because there is huge liquidity not just there but around the world, that will move into US assets if they ease back in price.

The money has to go somewhere. On the other hand, if demand for oil and gas shades down worldwide on the back of lower demand from China and the emerging world, and increases in supply from the US, we could have a sizeable fall in energy prices.

That would be very helpful to the whole of the developed world, for one of the two things that have held back the growth phase of this cycle so far has been that we have not got the expected boost from lower energy and commodity prices that usually accompany recession.

The other thing that has held back the developed world has been a damaged banking system, which the US fixed reasonably swiftly and we have more or less fixed by now.

But for much of Europe that is a task ahead. The big question for Europe in 2014 is to what extent it can manage to do so.

This is where the negative surprises are most likely to come from. The best way to see this whole period is one of slog.

It takes a long time to pull out of any recession and one that is associated by a financial crisis takes even longer. Thanks to the extreme measures taken by governments and central banks, the recovery was secured just about everywhere bar fringe Europe.

Now it is the transition from recovery to normality, you could say from convalescence to health, and that does not happen smoothly.

So while it is perfectly rational to expect a "good" 2014 for most economies, including the UK, the bumps could come in financial markets.

Look again at that graph for the past five years of the S&P 500. Surely there can't be another year of straight-line increases? There is an implicit bet on everything turning out towards the positive end of the possible range, and it would need much to dislodge it.

Here we can perhaps be a bit more positive, if only because valuations are in the middle of their historic range rather than towards the top end of them. Arguably we have some catching up to do. But there is a paradox. The better the UK economy does, the quicker that first increase in rates, and the greater the pressure on share prices. Markets march more or less in step. If Wall Street does go flat or turns down, then ours will struggle to shake off the blues. And that first rise in interest rates? My forward guidance is: at the latest November next year.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies