Hamish McRae: 'Old world' opportunities remain with higher returns from developed economies

Economic View: If Greece has gone one way, parts of China have gone the other. Shanghai is in many respects a first-world city

If the emerging countries are growing much faster than the developed ones, why has the performance of their share markets been so much worse? This week, for the first time as far as financial markets are concerned for the best part of a century, a developed country has been downgraded in status to an emerging one. The country is Greece and the agency that downgraded it is the New York-based MSCI. That news was unsurprising but it does rather underline the confusion investors face when allocating their savings.

The deal used to be that you would expect to get higher overall returns from emerging markets but such investments would carry greater risks. What has happened in Turkey is a case in point: it has been a very fast-growing economy and seemed to offer a reasonable degree of political stability, but suddenly that stability was shattered.

Over the past couple of years, however, the general mood has changed, for some of the highest returns have come from developed markets. Despite recent reverses Japanese shares are still up 58 per cent over the past year. But so too have some of the greatest adverse shocks. I cannot think of any recent occasion when banks in an emerging economy have been forced to give a "haircut" to large depositors. Yet that is what Cyprus has been required to do by the eurozone authorities and the International Monetary Fund.

So developed markets can give higher returns, but also bring higher risks. What should we make of that?

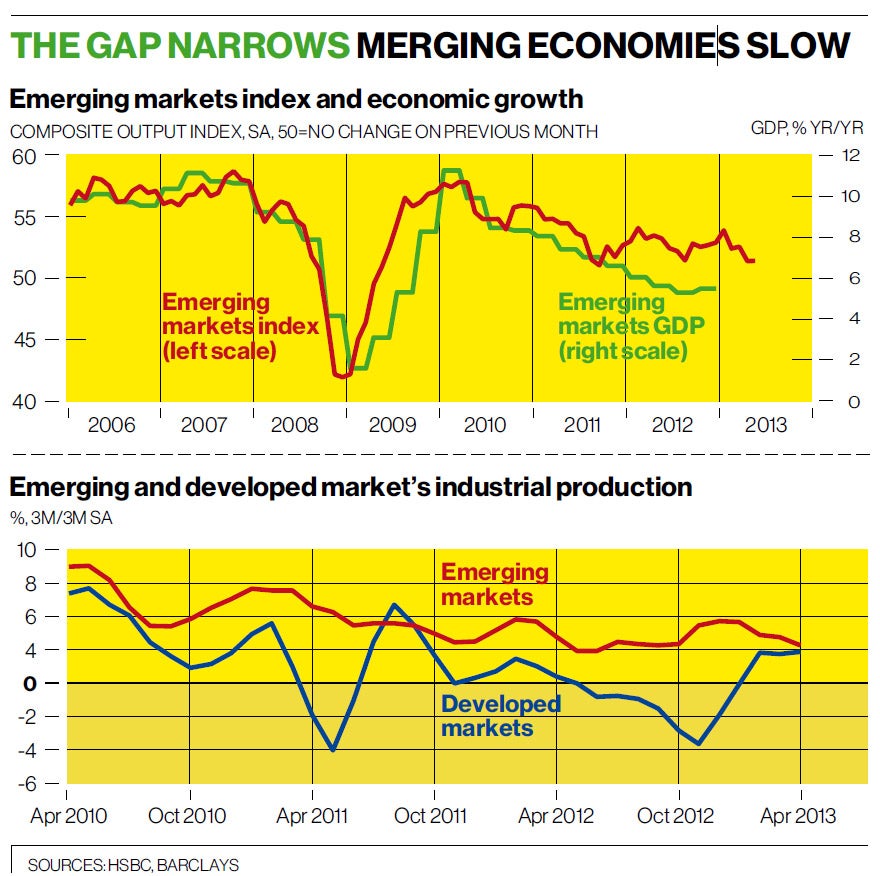

A couple of basic points and then a wider thought. The first basic point concerns growth. The emerging world, taken as a whole, did not experience a recession in 2008-09. In that sense it was not a global recession at all, but one of the developed world. As you can see in the top graph, emerging-market GDP dipped to around 2 per cent a year but then recovered to something close to its pre-crisis rate. However, there has been some slow down, for growth is running now at around 6 per cent, rather than the 9 per cent-plus in 2006-07. The forward-looking emerging markets index calculated by HSBC, the red line in the top graph, remains positive, but is also a touch below the pre-crisis levels.

Nevertheless, that 6 per cent growth does remain way above that of the developed world. If you take industrial production, you can see from the bottom graph how it remains pretty solid in the emerging markets but very uneven in the developed ones: the red line is both more stable and higher than the blue line.

The second point is that the emerging markets are an extraordinarily diverse bunch. It is a convenient catch-all expression, but rather like the BRICs (Brazil, Russia, India and China) acronym, it gives a spurious consistency to economies that are utterly different in every way from economic development to political organisation.

The emerging world is much less homogeneous than the developed one. That makes it harder to develop a consistent investment strategy, for what works in one country won't work in another.

Now the wider thought. It is that the distinction between developed and emerging is going to disappear. It was appropriate for a moment of time but the boundaries are becoming increasingly blurred. If Greece has gone one way, parts of China have gone the other. Shanghai is in many respects a first-world city, though it lags in some areas. It has been estimated that Shanghai labour costs will be the same as US costs in another four or five years, forcing labour-intensive activities out of China and towards other lower-waged "still-emerging" markets. Indeed, that has already begun.

So what will happen is that the investment process in the emerging world – let's keep the distinction for the moment – will become much more similar to that of the developed world. There will be a judgement about political stability and the currency risk, but you have to make those judgements now in the developed world. There will be a second set of judgements about the rule of law and the enforcement of property rights. Those for the moment seem quite a lot more secure in the developed world than in many emerging economies, but that may change. There will be a further set of judgements about the impact of regulation and taxation. Here you could argue that regulatory and taxation risk is probably rising in the developed world but falling in many emerging countries. And so on.

None of this explains the upheavals in emerging-market securities over the past couple of months. I think what has happened here, and it is an over-simplification, is a shift in fashion. It has been profoundly fashionable for the past four years to buy the "shift investments to fast-growing economies" argument. Now, with the growing evidence that the developed world is securely in a growth phase, that fashion has slipped downwards. There is an argument that because of the recovery in the West the growth phase may actually be rather longer in duration than it was in previous cycles. There is and will continue to be a big gap in growth, but the prospect of somewhat slower growth in the emerging world and somewhat faster in the developed will narrow that gap a bit. And if the growth phase is to last another five or more years, well, there will be many opportunities in the "old world".

A final thought. One of the curious features of the past few years has been the outflow of capital from the emerging world to the developed one. Many investors in the fast-growing regions have chosen to place their funds in the slow-growing ones. Diversification makes sense for both sides.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies