Hamish McRae: Politicians slow to spot a lack of cash to do things

Economic View: What on earth will happen to revenues in the longer term and what will that do to politics?

There are two ways of looking at these new public borrowing figures, the last before the autumn statement on 5 December. One is to note that they are some way adrift of the planned reduction in the deficit, for in the first seven months of the financial year the deficit has gone up, not down, and to wonder what the Chancellor will do about this. The other is to see this as a taste of what is likely to happen to government revenues in the long term and ask about how this is likely to change public perceptions of the state. A quick word about the first and then some deeper thoughts about the second.

Tax revenues so far this year are a long way short of the estimate by the Office for Budget Responsibility produced at the time of the budget. The OBR expected revenues to be up 3.7 per cent this year, whereas so far they are up only 0.4 per cent. There are several culprits. Corporation tax is running down nearly 10 per cent, against an expected rise of 4 per cent; VAT up just under 2 per cent against an expected 4.4 per cent; and while National Insurance contributions are higher than expected, and PAYE income tax is more or less on target, overall income tax (including self-assessment) is flat.

There are some offsets, for interest charges are down and spending seems a little below plan. But I don't think there is any getting away from the fact that the numbers are going in the wrong direction. That leaves two broad options. There is nothing George Osborne can do about tax revenues between now and next April, so either he finds ways of trimming spending or he accepts that the whole project has to be rolled forward another year.

I suppose there is the third option of trying to fudge it, and some people argue that taking the interest the government pays on debt held by the Bank of England under quantitative easing and setting that against the deficit is a fudge. But whether that is justified or not (I happen to be comfortable with it) it does not change the big picture. That is that we are stuck. Until there is somewhat better growth it will be very hard to make progress in getting the budget back to balance.

In the real world some things turn out better than you might expect and some things worse. Unfortunately the ones that have turned out better, such as lower borrowing costs, are much smaller than the ones that have turned out worse, in particular corporation tax receipts. If this is an embarrassment for the Chancellor and for the OBR, it is also a real concern for the longer term.

Anyone involved in politics deep down assumes that the state will have resources to do things. The whole language of politics is that "we will provide this" and provision involves spending. Of course this government has had to take a very different tone but even it has not fully changed its language. There is still a "we have to make difficult choices but we can still protect this" tone. In the early stages of a squeeze on spending, as we are still in the very early stages, you can sustain that language but as the squeeze goes on year after year, that line stops being credible. That leads to the wider issue noted above: what on earth will happen to revenues in the longer term and what will that do to politics?

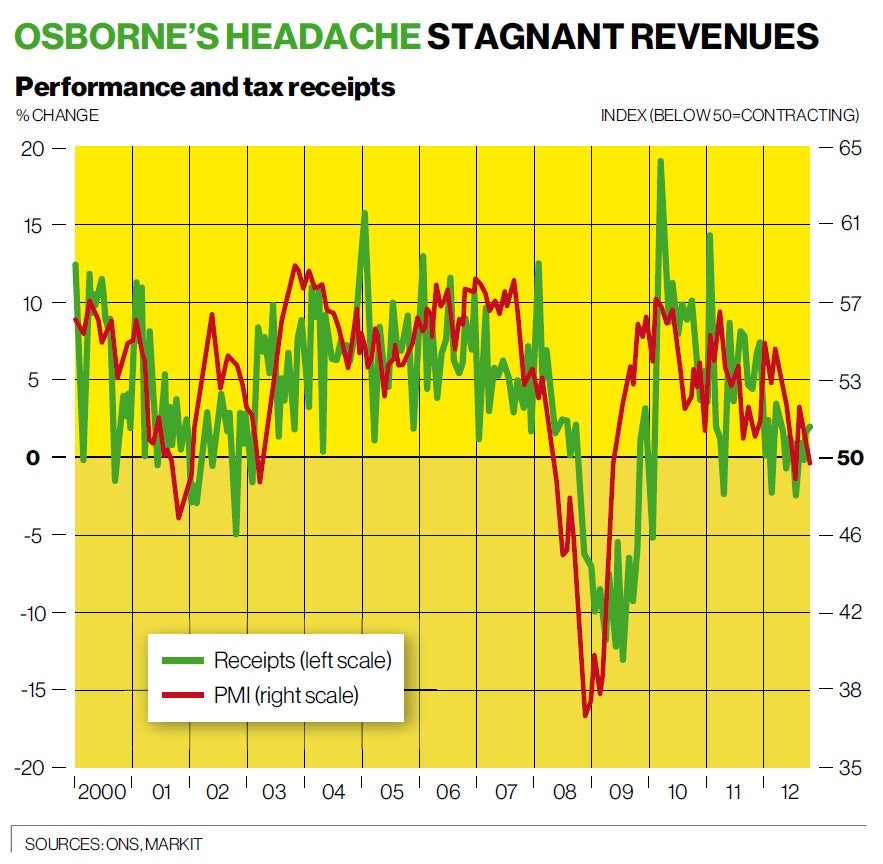

The graph gives some feeling for what has been happening. It comes from Chris Williamson at Markit and shows what has happened to the flow of tax receipts over the past 12 years plotted against what has happened to the economy as measured by the purchasing managers' index. (The PMI gives an advance indicator as to whether the economy is growing or shrinking.)

As you can see the movements of the PMI give a warning as to what will happen to tax revenues, for the red line fell before the green one in 2008 and recovered earlier in 2009. But there is something else that is worth noting. It is that right through the 2000-2007 period the government could assume that revenues would come in up rather than down. There as a little dip in 2002 but a quick recovery. The collapse of revenue in 2009 was beyond all experience but there was an equally remarkable jump in 2010 as the economy started to grow again. That jump in revenues did not do much to correct the deficit because spending was allowed to carry on rising but it did give some credibility to the coalition's plans. Those plans assumed that taxes would, over the next five years, come in solidly up year after year.

So from a politician's perspective there would eventually be money to do things. After a few years of austerity it would again be politics as usual. If you made a mistake and overspent one year, wait a bit and you could get back on course.

Now a gradual feeling is dawning on the more thoughtful politicians that it would not be like this any more. Indeed it won't be like that for the rest of their careers. This is not yet a general response. For the moment the rhetoric is still in terms of closing tax loopholes, making companies pay more, getting more out of the better off, trimming welfare payments and so on.

All that will happen and most of us would say not before time. The problem is that even when all this has been done, there still will not be much more money. Indeed it may be a struggle to preserve tax revenues at their present real value.

Most people in Britain have had no increase in their real income over the past five years and many have experienced a decline. So our own mindset has changed from expecting to be able to spend more to living better on what we have already got. That shift in mindset has yet to spread to politics, or if it has, it is not very evident. In a way, it is as though ordinary people are more financially aware than political leaders, a sobering thought indeed.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies