Hamish McRae: Progress made amid all the plodding

Economic View

What is the difference between convalescence and muddle-through? Answer: convalescence is what the world economy is doing and muddle-through is the authorities' reaction to that.

That is too harsh, but you see the point. We have had a year when the world economy has plodded on and the world's financial leaders have plodded on and we are going to get another year of much the same. But during this year there was modest progress in fixing some of the long-standing problems of the world economy and to focus on the imperfections and disappointments is to ignore the progress.

Start with the biggest current issue, the possibility that the United States will end the year going over the so-called fiscal cliff. There may or may not be some last-minute agreement in Congress but whatever the political outcome, some sort of fiscal tightening is going to take place in the coming year.

The issue is how swift and how coherent this will be. Actually, during the course of the past year the fiscal deficit has narrowed a bit, so you could say that the tightening has begun. But if the authorities are dealing only tardily with official debts, there has been real progress in the private sector in coping with its debts. The biggest sign of this has been in the housing sector, where repossessions have dropped and prices and activity are climbing. As a result household balance sheets are improving and that is supporting consumer confidence. These are early days. But turning points matter and the US housing market seems to have passed one.

Or take Europe. Many of us feel that the problems of the eurozone have by no means passed a turning point and that the long-term future for the currency remains grim. But in the short term, the past year has been one of modest success. The EU authorities have managed by a combination of threats and cheques, to keep Greece in the eurozone. The president of the European Central Bank, Mario Draghi, has managed to bring down the bond yields of countries on the periphery by his threat, still not carried out, that the bank would buy distressed sovereign debt if countries stuck to agreed programmes. One result is that Ireland is not able to borrow again from the markets; another, that some of the highest investment returns in the past year have been in distressed sovereign debt.

In addition, several of the fringe eurozone countries have made progress cutting their costs: wages have fallen and exports have risen as a result. For example, Portugal is back in current account surplus, having had a deficit equivalent to 10 per cent of GDP three years ago.

Here in Britain, the economy and the public finances have been disappointing, though the financial markets, whose job it is to look forward, have ended the year on an optimistic note. Sterling is back at $1.62, within a cent of its high point of the year and the FTSE 100 index is within one percentage point of its high too. Simon Ward at fund managers Henderson notes that when shares and the money supply, adjusted for inflation, end up year-on-year, the following year shows solid growth. A more scientific way of looking at things is to see the way in which we too are correcting errors of the past.

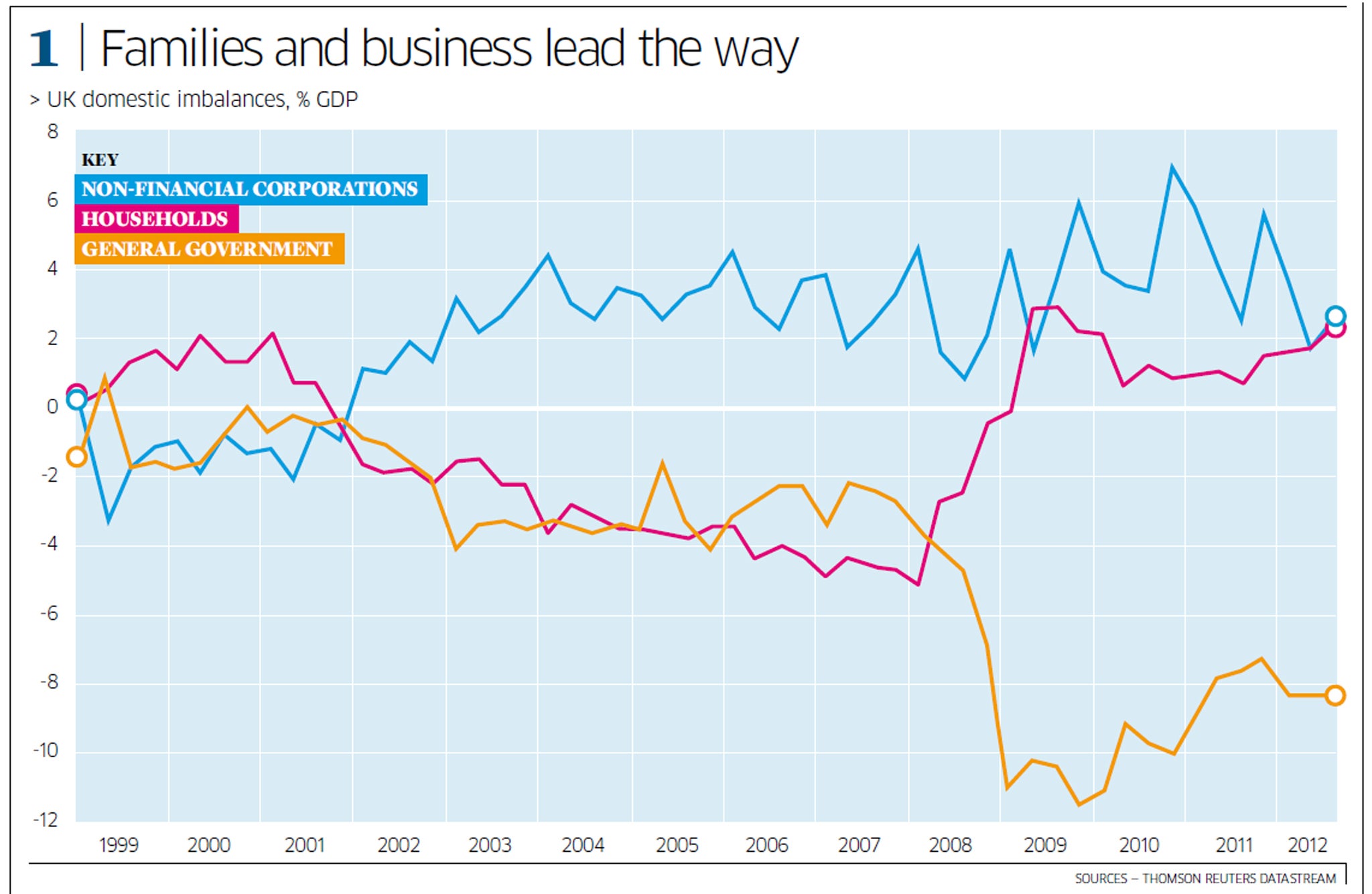

The graph shows domestic imbalances over the past 13 years. As you can see our companies (excluding the banks) have moved into solid surplus and have been for several years. Business, taken as a whole, is cash-rich. The public sector remains in massive deficit, though not quite as massive as it was in 2009, having been in smaller deficit right through the boom years. But the really remarkable thing is way the personal sector, that is us, has switched from deficit to surplus.

Our move from overspending back to saving again is in sharp contrast to that our Government. Faced with a crisis, and having overspent for much of the previous decade, we flipped into responsibility personified. At a personal level we are four years into our convalescence. Every year that passes enables us to get our finances into better shape.

The investment bankers Jefferies, who drew attention to this in a commentary last week, made the point that people paying down debt is a necessary pre-condition for a sustainable recovery. The question is how much debt we need to pay down to feel comfortable again. Are we borrowing less from the banks because they are taking too tough a line with potential borrowers or is that once caught, twice shy? People do not want to put themselves in hock with the bank if they don't need to.

Looking ahead, most people seem to expect more of the same: another year when policies will be less than great but when businesses and individuals in the developed world regain their confidence. That feels right to me.

There is a temptation to suppose economic policies can have a lot of impact but the experience of the past few years surely shows us something different. If we have several years of badly judged economic policy, then governments and central banks can do a lot of damage. With hindsight we had that from about 2002 to 2007. Three errors reinforced each other: excessive fiscal stimulus, excessive monetary stimulus, and weak financial regulation. But, except perhaps in a crisis, in any one year what governments do or don't do matters less.

So even if the US does make a bosh shot at reforming fiscal policy and the eurozone fails to contain the tensions, the healing process being undertaken by the private sector will continue. The same goes for us. Eventually we will have to get our fiscal deficit under control again – that gold line on the graph has to come up to zero. Every month that passes with people and companies paying off debt will make the recovery more secure. Another year of slog? Well, yes, but I think we knew that.

A lengthy bear market for bonds is looking even more likely now

There are always things that, as a writer, you wish you had put more strongly. You think you made some point, then when you look back a couple of years later, you find that while you did write what you thought you had, you phrased it more softly than you remembered. So here goes.

I have become increasingly sure that last summer we passed a turning point: the end of the 30-year bull market in Government bonds and the beginning of a bear market that may well last another 30 years. If you take UK 10-year gilts as a benchmark, this time last year these were just above 2 per cent. Last week, they ended just below that. But during the course of the year they dipped down below 1.5 per cent – to 1.47 in late July and 1.46 at the end of August.

The reason is widely appreciated. UK Government securities were seen as a safe haven for flight capital. The future of the euro seemed wobbly and gilts were viewed as an alternative to German Bunds and US Treasuries.

However, those levels were the lowest that 10-year gilts had ever been: yes, ever. This is remarkable – all the more so in view of the Government's stalled deficit-reduction programme and expectations for high inflation.

Why has this happened? It is partly that safe-haven argument but also the result of a deliberate drive to push down yields. We have had experience of this, for example in the 1930s and 1950s, as governments sought to cut the cost of servicing the national debt, inflated after the world wars. But as far as I can check, this is the first time such repression has been deployed in peacetime. There is cover for the policy: no one says the Government is deliberately trying to do down savers; instead the argument is couched in terms of boosting the economy.

But when future economic historians look back on this period, they will conclude this was a deliberate policy to cut the cost of servicing debt. They will also observe that last summer was the bottom of the cycle and wonder that investors were so gullible as to fall for it.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies