Hamish McRae: Quietly optimistic about growth, in spite of the IMF

Economic View: Let's not get excited, but if the big three keep on bringing in the bacon, the Government will be able to get the deficit down

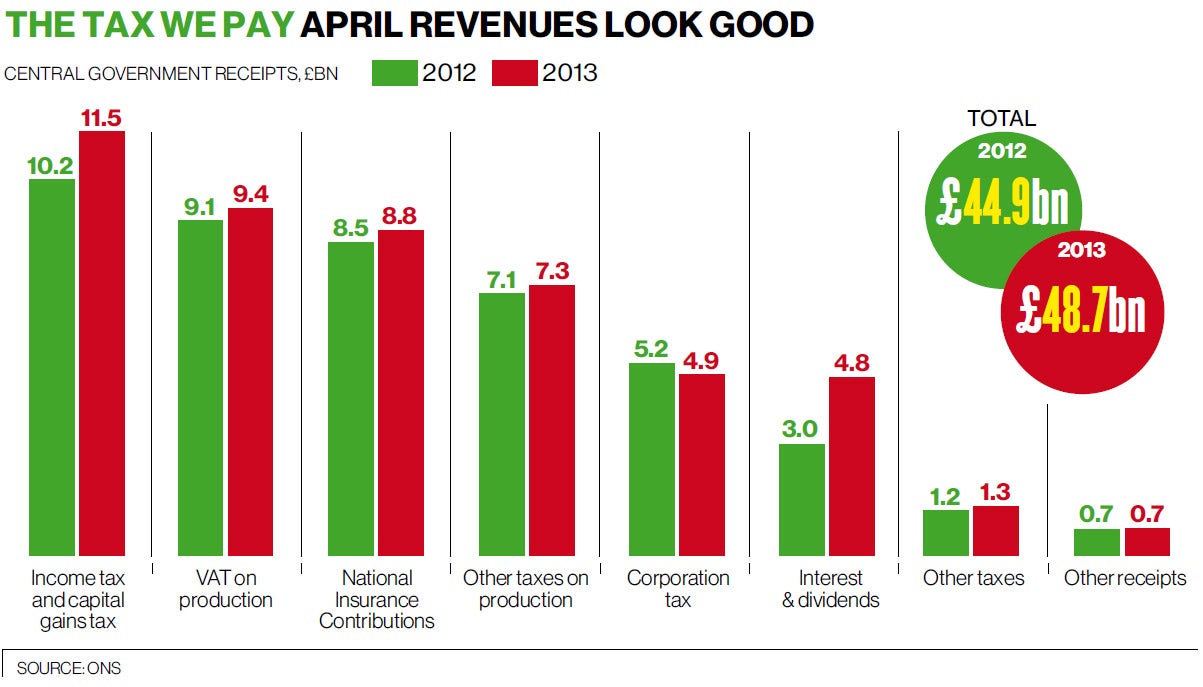

Here is an encouraging number: £48.7bn. That is the tax revenue that came in during April, the first month of the financial year. It is encouraging for two reasons. It suggests that it may be possible to get the Government's deficit down this year a little faster than forecast. And it suggests that the economy is growing decently, if not exactly creaming away.

As far as the deficit is concerned, the basic point is that during the last financial year the Coalition was stuck. After you allow for all the adjustments, the transfer of the Post Office's pension fund and other stuff, there was only the tiniest improvement last year on 2011-12, and that was achieved by scrunching down spending a bit below the level originally planned. Mindful of that lack of progress, this year's target was for only another small decrease, with the real burden rolled further forward. As the Prime Minister and Chancellor repeatedly point out, the Coalition has dealt with one-third of the deficit they inherited. That leaves two-thirds to go.

It is only one month but it is an interesting one. The figure above compares with revenues of £44.9bn in April last year, an improvement of 8.5 per cent. Now, do not expect that to continue, for there is one obvious reason why revenues have shot up: the top tax rate has come down. So high earners are taking more income, maybe including some funds held over from the previous year. The various changes in revenue, broken down by category, are shown in the graph, the particular point being that the biggest single revenue stream, income and capital gains tax, has gone up from £10.2bn to £11.5bn. By cutting the tax rate, the Treasury gets in more revenue, not less – exactly as some of us predicted.

That is what you want to happen. We have a plethora of little taxes that gather small amounts of revenue but there are three really big ones that matter: aside from income tax, the other two are VAT and national insurance contributions. As you can see they are both doing all right too, with VAT up 2.6 per cent and NICs up 3.3 per cent. It is, as I say, only one month, so let's not get excited, but if the big three keep on bringing in the bacon, the Government will be able to get the deficit down. If they don't, it won't.

The second reason to be encouraged is what these figures say about the economy. VAT covers about half of all the money we consumers spend. So revenues up by 2.6 per cent suggests spending is running up by something like that amount. You have to allow for inflation, and that depends on which measure you take, but on the CPI up 2.4 per cent, and if you allow for housing costs up only 2.2 per cent, that does suggest some modest rise in underlying consumption. This seems to me to be a more helpful measure of what is happening than other numbers, such as the retail sales figures, which jump all over the place and get revised anyway.

The NICs, up 3.3 per cent, would be consistent with two streams of data on the labour market: the rise in employment of about 600,000 year-on-year, and the low level of pay increases. Companies and individuals do not make national insurance contributions unless there are real jobs being created. So the fact that the revenue numbers are rising at this rate does confirm that there has been some reasonable growth during the past year. What is happening to tax revenue confirms the common-sense conclusion that the economy is growing steadily, not fast, but probably a bit faster than the official figures would suggest.

If this is right, and I think it is, it raises a string of questions. One is whether the Coalition strategy is proving right after all. The International Monetary Fund seems to think that the Government ought to borrow more, a view that personally I find a bit rum. We are borrowing 7 per cent of GDP, the largest deficit aside from Japan of any major economy. So what makes anyone think that we would grow faster if the Government borrowed 8 per cent, or 9 per cent, or whatever? Maybe the IMF is feeling guilty about the level of austerity it has helped impose on fringe Europe and wants to compensate. Who knows? But as and when our economic growth figures are revised upwards and it transpires that the UK economy has been growing all the time, the IMF will look pretty stupid.

That leads to a second issue, the reliability of our official statistics. As Kevin Daly, of Goldman Sachs, points out, the average upward revision of UK growth between 2001 and 2010 from the initial estimate to the latest available one is 0.4 per cent annualised, while the US growth figures are revised down by an average of 0.6 per cent. We underplay our growth while they brag about theirs, which you might think is an admirable example of the British art of understatement, but it does mean that our published GDP figures are a useless guide for policy. By the way, the so-called "final" estimate for GDP by the ONS is not the final one at all. The true final ones do not come through for several years and they almost invariably show that growth was faster than estimated.

Finally, these decent revenue numbers open up the question that the economy might pick up quite a lot of pace later this year. Thanks in part to the lower-than expected inflation it is plausible that the eventual number for growth this year might end up around 2 per cent, with growth back-loaded to the second half. Of course, there have been deep disappointments about growth for the past two years and those of us who expected an earlier pick-up have been proved wrong. But upward revisions are starting to come through, from example by the Bank of England, instead of downward ones, and these latest revenue figures are undoubtedly a welcome relief.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies