Hamish McRae: We created a climate where the poor just got poorer – ain't that a shame?

Ecnomic View: Those in power etween 2000 and 2008 should see what their policies did to living standards

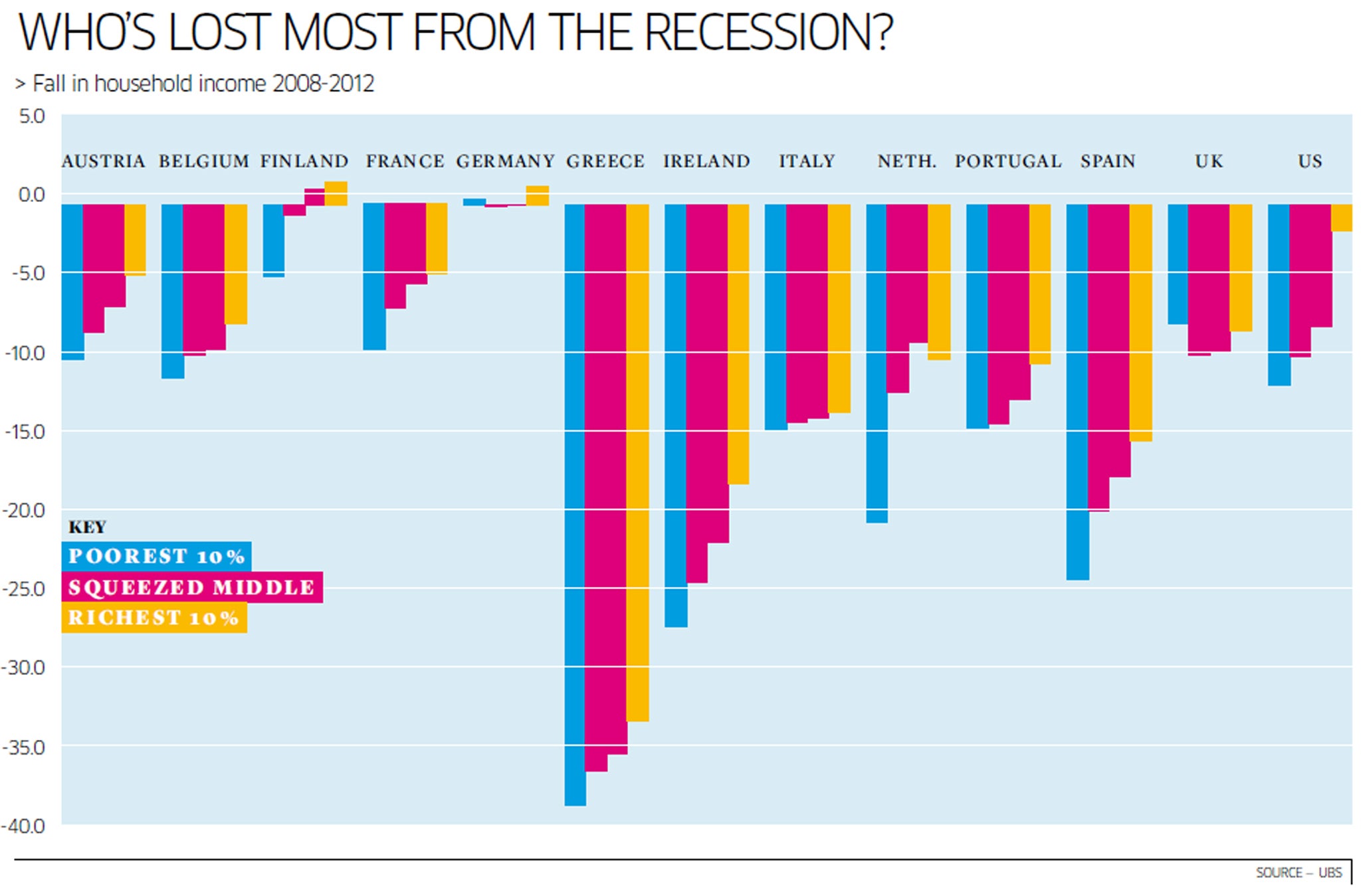

So who has been hardest hit by the recession, the poor or the rich? You may recall the chorus of the old music hall song, which runs like this: "It's the same the whole world over/It's the poor what gets the blame/It's the rich what gets the pleasure/Ain't it all a bloomin' shame?"

And that pretty much is what has happened in most of the world, for the poor have indeed been much harder hit than the rich – except in Britain, where we have indeed been all in it together. We seem to be about the only country in the developed world where the loss of income has been more or less evenly shared. I'll come to quite why in a moment; first, what has happened?

The graph shows real household incomes in a variety of different countries between 2008 and 2012. For clarity, I have just shown the bottom 10 per cent (blue bars), the two middle-income groups (red bars), and the top 10 per cent (yellow bars). There is, as you would expect, a huge variation between countries. For Greek incomes, the recession has been a catastrophe, with a drop in incomes of between 35 and 40 per cent. For Ireland it has been dreadful, with falls of between 18 and 26 per cent. Germans, by contrast, have done well, with hardly any drop in incomes for anyone and a small increase for the richest.

As you can see, British households have not – by these rather dismal standards – done too badly: a loss of rather more than 5 per cent, about the same as the French and the Americans. But, and this is the striking point, we are the only country where the rich have been hit as hard as the poor. In every other case, the richest 10 per cent have done better than the poorest, in countries as diverse as the US, Spain and Finland.

What should we take away from this? Well, for a start there should be come credit given to our government, and to Gordon Brown as well as David Cameron, for managing to give some protection to people at the bottom, and extracting resources from the people at the top to help fund it. Second, in the case of most countries, there is no "squeezed middle"; only in the UK does that seem to have been the case. Third, those declines in income on the eurozone periphery are utterly disgraceful and the rigidities of the eurozone must to some extent carry the blame. And fourth, anyone criticising German economic policy, and there are many, should take a look at that graph.

But what is the explanation for the poor, in general, being hit harder than the rich? Paul Donovan, an economist at UBS who wrote the paper that pulled these figures together, notes that there are two reasons why the poor have done worse. One is that the things bought by low-income groups have risen more in price than those bought by richer ones. You might say that necessities have gone up by more than luxuries. The other reason is that total incomes of low-earning households have fallen by more than those of high-earning ones.

There are a string of qualifications to be made to all this, of which I think the most important is that while inequality has increased within most countries, it has decreased between them. The gaps between North America and Europe on the one hand, and Asia and Africa on the other, narrow every year – and that narrowing has been happening even faster as a result of our recession.

A second qualification is that this study looks as income inequality, rather than wealth or asset inequality. Here I am fairly sure, though I have yet to see a good study of it, that quantitative easing has benefited the rich rather than the poor. QE has worked, insofar as it has worked at all, by increasing asset prices over and above the level they would otherwise have been. In an emergency, that was probably justified. The housing crash in the UK would have been worse without it, and you can even date the turnaround in house prices to the start of QE.

However, if you compare asset prices now with those immediately prior to the crisis, I am not sure that the rich are really better off than they were. They are richer, both relatively and absolutely, than they were in the spring of 2009, but they may not be back to their 2007 peak – particularly if they held a lot of their savings in Royal Bank of Scotland shares.

The biggest issue of all, surely, is what can be done about the underlying causes for rising inequality in much of the developed world. We can see pretty clearly that macro-economic stability would help, in that the instability of the past five years has made matters much worse. So you cannot protect the poor by puffing up a bubble, for it will be followed inevitably by a crash. In the long run, sound money and sound public finances benefit rich and poor alike, but are quite essential for protecting the poor.

So the answer will lie in structural policies rather than macroeconomic ones. Lifting skills, encouraging entrepreneurship, encouraging people to be good citizens as well as good employees, teaching people to manage their finances – it is that long list of detailed changes to the way western societies manage themselves that we all know about, but which are very difficult to put in practice. It is not really a political issue; it is a common sense one.

But the policymakers who were in power in the developed world between about 2000 and 2008 should take a look at that graph. That is what their policies did to living standards of people, particularly of the poor. It is, I am afraid, a bloomin' shame.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies