Hamish McRae: Why bad news hasn't fazed the markets

Economic View

A bounce, a pause, and then a sustained recovery that gradually gathers pace – that at least seems to be how the markets interpret what is happening to the world economy now. There have to be reasons why the presumably bad news of the US fiscal cliff and all the stuff emanating from Europe have had zero negative impact on financial confidence. The more I think about it, the less convinced I am that the main negative reason for market confidence – that if things go belly up the central banks will print more money – is really an important factor. So the real drivers must be on the positive side. What might they be?

There is, I suggest, one overriding reason, which is that the big assurance that growth will pick up over the next 18 months is outweighing the smaller individual items of concern. In other words, the general outlook is increasingly positive, even though many of the specifics are still negative and may well remain negative for some time.

The case for the "general positive" goes like this. The best starting point is the US. A few weeks ago everything was held back by the prospect of heading over the fiscal cliff, with people warning of dire consequences if Congress did not come up with a decision. Well, it has come up with the non-decision that has led to "sequestration", the imposition of automatic increases in taxation and cuts in spending mandated under previous legislation. Many were concerned that this would lead to an overly swift tightening of fiscal policy, and maybe it has. But so far at least the economy seems quite unfazed. Consumption continued to rise through January, notwithstanding the automatic increase in payroll taxes, and employment has also continued to climb.

It is early days, but so far it seems the gloom-mongers have been proved wrong. I would not go so far as to say that this is evidence that fiscal tightening does not restrict demand in the way that the economic models predict. But it may be that other forces are outweighing its impact.

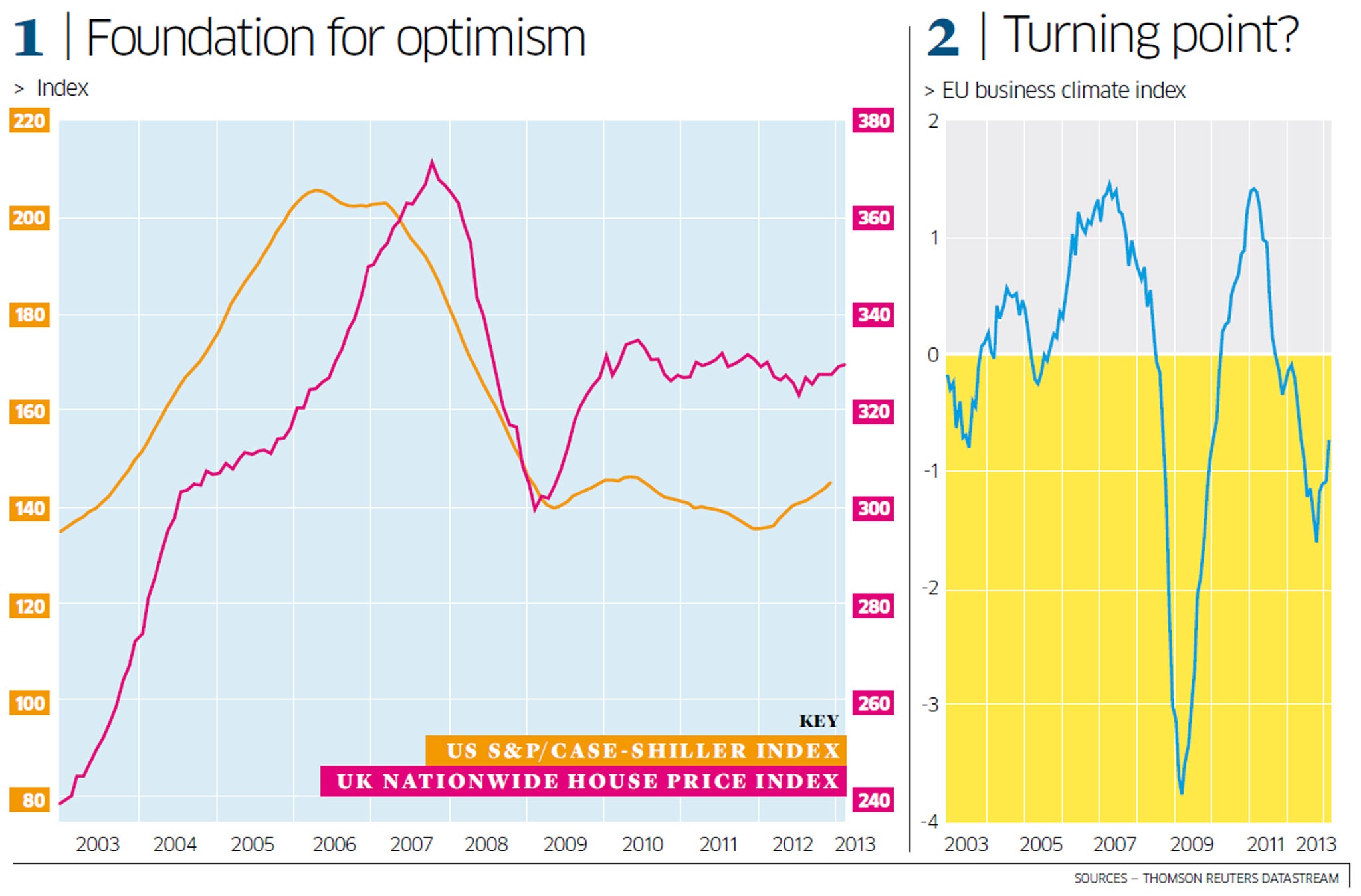

The principal such force is the US housing market. All the indicators are turning up: sales of existing homes, sales of new ones, the price of those new homes, the numbers of mortgages, and since the beginning of last year, the classic index of house prices, the S&P Case-Shiller index – the orange line in the main graph. It has not come up much, but from the point of view of a prospective homebuyer it is not now going down, and that is a huge difference from the position of two years ago.

Think of this in terms of personal balance sheets. If your principal asset is rising a little in value, other things being equal, your net debt starts to come down. Getting personal debt under control has been a preoccupation of Americans for the past four years. But as Capital Economics noted in a recent paper, they may be getting their debts to a level that they can live with. At that point the general repression overhanging consumption is lifted. Add in any further impact from strong share prices, which admittedly only affect a minority of the population, and you begin to see positive forces strong enough to offset the negative pull of tighter fiscal policy.

You can apply the same logic to the UK. Our house prices bumped off the bottom and have as you can see from the red line stabilised somewhat closer to their peak. As with the US this is not a bull signal for the housing market; the point is simply that house prices seem unlikely to fall, and that of itself is an assurance. Our own consumer sales have held up well despite the squeeze on incomes, presumably supported by stable housing market conditions.

And Europe? Well here the conditions vary so massively across the region that generalisations are useless. Thus in Germany the state of the housing market is not a significant indicator of economic demand. Only around 40 per cent of homes are owner-occupied and individuals are, by US and UK standards, under-borrowed. So movements in house prices matter much less. In Spain, by contrast, the surplus of homes will overhang the market for several years to come, and the general expectation seems to be that prices have not yet adjusted to reality. So that will depress demand.

But I have shown in the right-hand graph another indicator of a turning point, picked out by GFC Economics. It is the EU business climate index. As you can see there is a weak upturn, still negative but not nearly as negative as last autumn. Insofar as any forward indicators say anything coherent, you could interpret this as signalling a return to growth in the second half of this year.

It is as though the European business community is able to look beyond the present slump and see stable demand within six months. That would be within the time frame of equity markets.

This is not a thorough explanation of the present market enthusiasm, and it is worth pointing out that the enthusiasm is by no means universal. The Dow is past its previous "high", and the DAX, the main German share index, is within about 3 per cent of its one. We are still some 7 per cent shy of the all-time high for the FT100 index of 6930 on 31 December 1999. However, French shares are well down from their all-time high and Japanese shares are a million miles from their high of 38916 on 28 December 1989.

So you have to have to apply a public health warning to any explanation: it may be quite wrong. What I think should be said, though, is that all turning points are by their very nature impossible to spot at the time and that there is such a thing as the business cycle. There "ought" to be several years of OK growth ahead, and maybe the markets are catching a sniff of it.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies