ASOS shares plunge on third profit warning

Online retailer downgraded its outlook for next year warning profits will remain at "similar level"

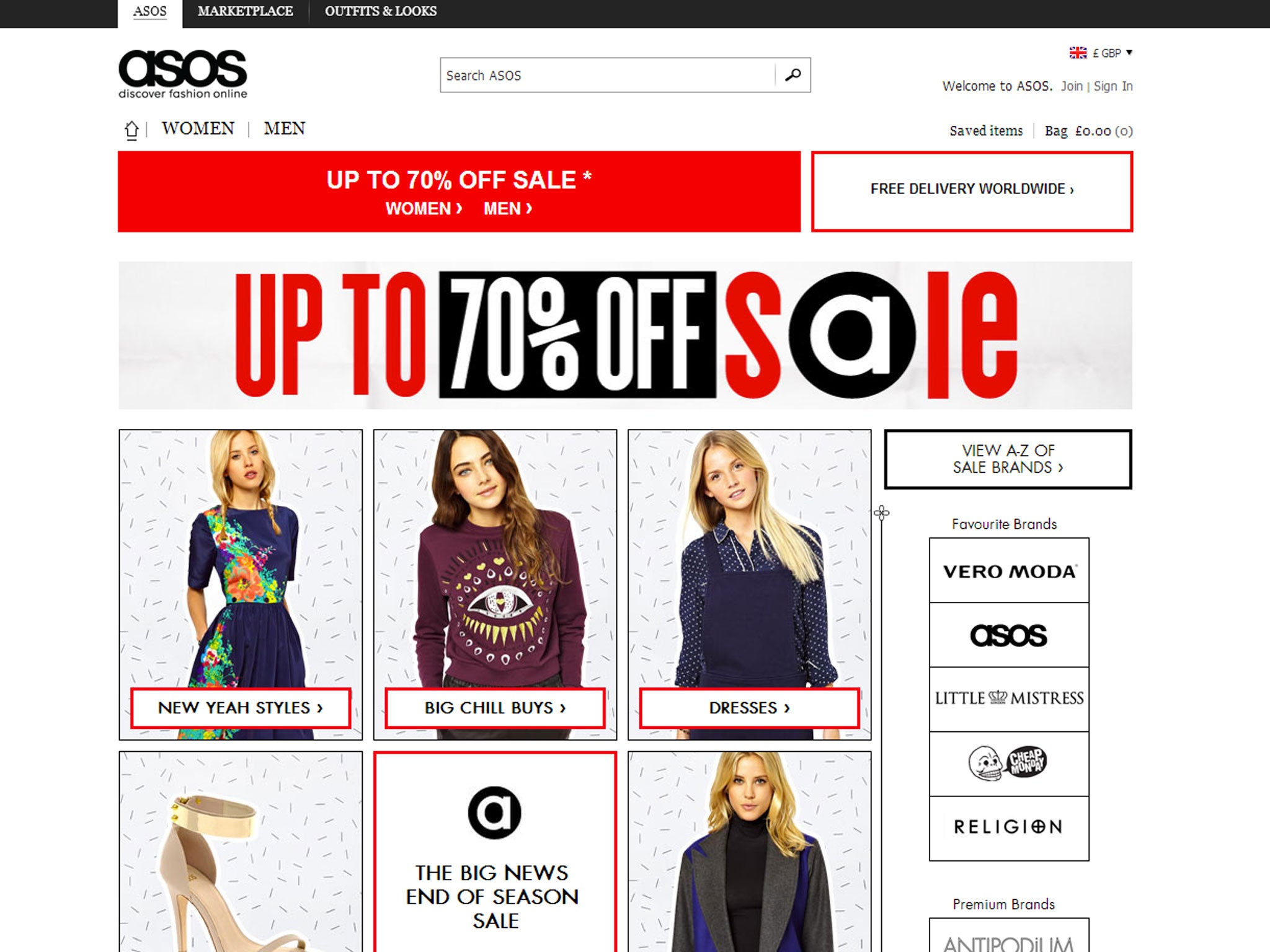

ASOS, the one-time stock-market darling, saw its share price plunge again in early London trading after it issued its third profit warning.

The online fashion retailer warned there would be no profits growth next year as it is forced to invest in its flagging overseas business. UK sales for the three months to August jumped 33 per cent, international sales, hit by the strength of the pound, were up just 6 per cebt.

Asos said that, with increased investment in its overseas business focusing on logistics, technology and pricing strategy, pre-tax profits for the year to August 2015 are now expected at around £45 million, compared with previous expectations of £62 million.

The company, which has been expanding internationally including in Russia and China, will now have to cut margins to sell clothes at more attractive prices to tempt shoppers.

Founder and chief executive Nick Robertson said: “In the last 18 months, we have seen a reverse in international fortunes. Sterling has increased and our clothes now seem more expensive overseas.”

Robertson said a dress in Australia is now 20 per cent more expensive: “Our product is amazing — look at our UK sales — but the price must be right for our market.”

Having floated in 2001 at 20p, Asos was trading above 7000p earlier this year, but today dropped as low as 2003.2p before recovering slightly to 2166p, although this was still a 10 per cent fall.

Asos issued its first warning of 2014 in March when it admitted that profits would be hit by the cost of new warehouses. Then in June, the company said profits for the year would miss forecasts by 30 per cent after the strong pound hit overseas sales.

Despite shares having dropped more than 70 per cent in seven months, Robertson defended his strategy.

“For investors it is a tough one,” he said. “As management and founders of this business we believe this is the right call to make. We are a longer-term investment case.”

Retail analyst Nick Bubb said: “This time last year the 49 per cent UK sales growth in the fourth quarter blew away expectations, so the comparison was pretty tough.

"But the 33 per cent growth in the UK a year on is very respectable at first sight. However, international sales growth is only 6 per cent... and came at a big cost to gross margins.”

Retail margins for the quarter were down by a massive 640 basis points. Asos also said that a devastating warehouse fire in Barnsley in June wiped £30 million from fourth-quarter sales.

Mike van Dulken, head of research at Accendo Markets, said: “Plans for significant investment, which is expected to curb any 2014-15 profits growth, is not what investors want to hear from what was a darling among growth stories.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies