British households are set to become even more indebted than they were on the eve of the global financial crisis, according to the latest forecasts from the Government’s official forecaster.

Data contained in the Office for Budget Responsibility’s new report, published alongside the Autumn Statement, shows an estimate for the ratio of total household financial liabilities to total household incomes over the next five years.

What it presents is a dramatic picture of the household debt ratio rising steadily to 184 per cent of incomes. That is well in excess of the 169 per cent ratio reached in 2008, shortly before the global financial meltdown.

The OBR has been predicting for some time that the “leverage” of households will rise as the recovery progresses, but this is the first time its forecasts have shown the debt ratio surpassing the levels of six years ago.

The forecast of rising household debt is likely to cause concern to economists, many of whom argue that high household leverage makes economies more prone to financial shocks and subsequent deep recessions.

Lord Turner, the former head of the Financial Services Authority, said the latest OBR forecasts were a warning signal of how the economy was still reliant on debt, even though the Government’s deficit is set to be eradicated over the coming years.

“They [the figures] show the problem of the past debt overhang – not only in the UK but across the world” he told The Independent. “We know how to shift the debt around. But now the only way we can get growth is to go back to the level of private leverage that produced the crisis in the first place.”

Households have been reducing their debt in relation to their incomes since the 2008 financial crisis, by paying down mortgages and declining to borrow more. The present debt to income ratio presently stands at around 146 per cent, its lowest since 2004. But if the OBR’s forecast is correct the pre-crisis peak will be re-attained in early 2018 and will continue rising steadily thereafter.

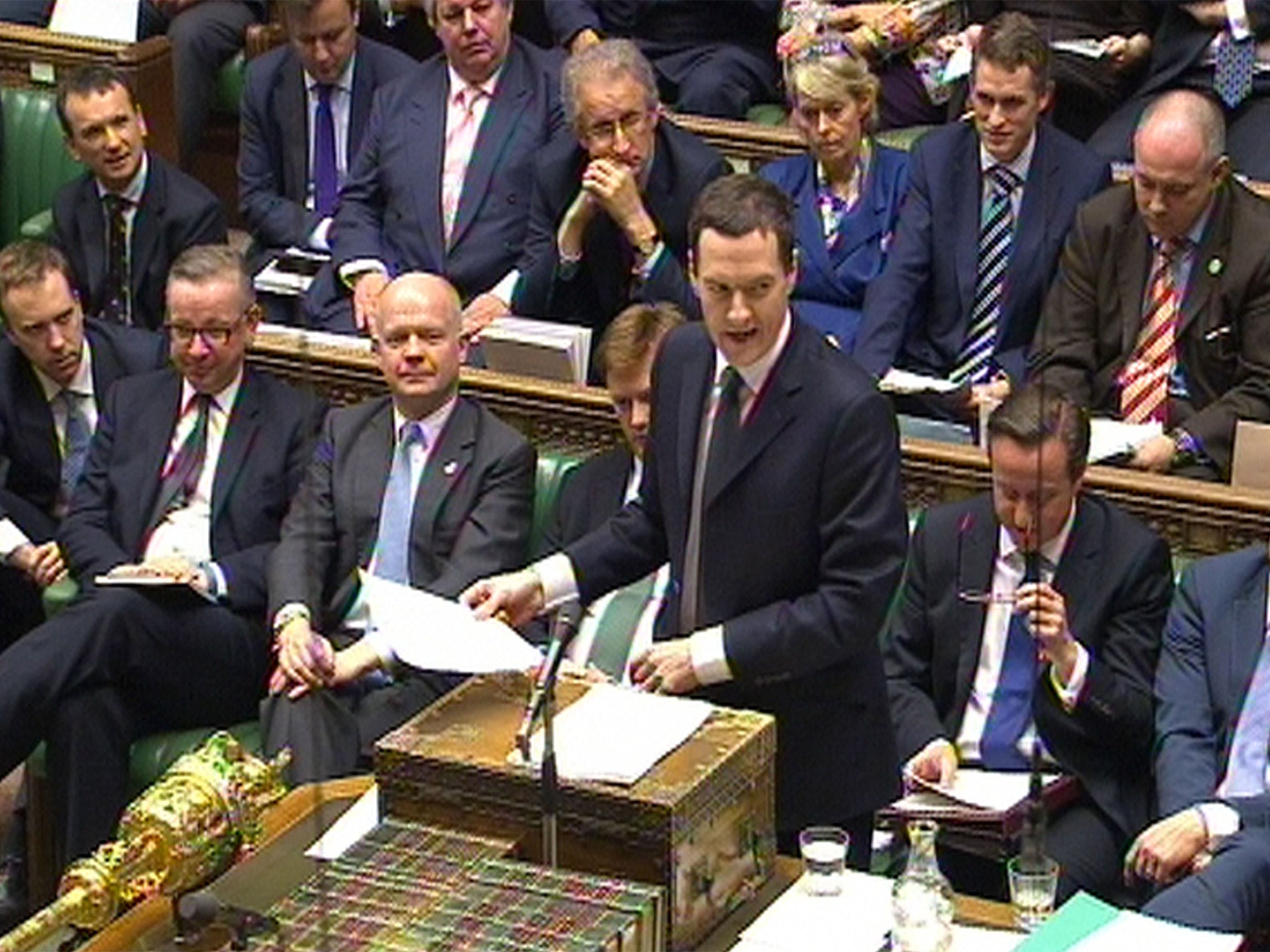

In pictures: Chancellor George Osborne delivers his Autumn Statement

Show all 8The OBR expects household debt levels to start rising soon as a result of people taking out large mortgages in order to buy more expensive homes, while incomes are only expected to pick up gradually.

The OBR has cut its house price growth forecast from its most recent report in March, but it still expects prices to grow at an annual rate of more than 8 per cent until the middle of next year.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies