Bank of England chief economist says monetary stimulus stopped ‘left behind’ from drowning

New economic modelling research from the Bank suggests all regions of the UK have benefited from the monetary stimulus in terms of incomes, employment and wealth

Andy Haldane, the Bank of England’s chief economist, has launched a defence of the Bank’s much-criticised monetary stimulus programme, stressing that it has delivered economic benefits to all regions of the country, not just London.

A host of politicians – including Theresa May – have slammed the Bank’s low interest rates and money printing since the 2008 financial crisis for hurting savers and exacerbating wealth inequalities in Britain.

The Prime Minister has also linked the Bank’s monetary policy to the complaint that the economy is not working for everyone in Britain and that many people outside London and the South East of England feel “left behind”.

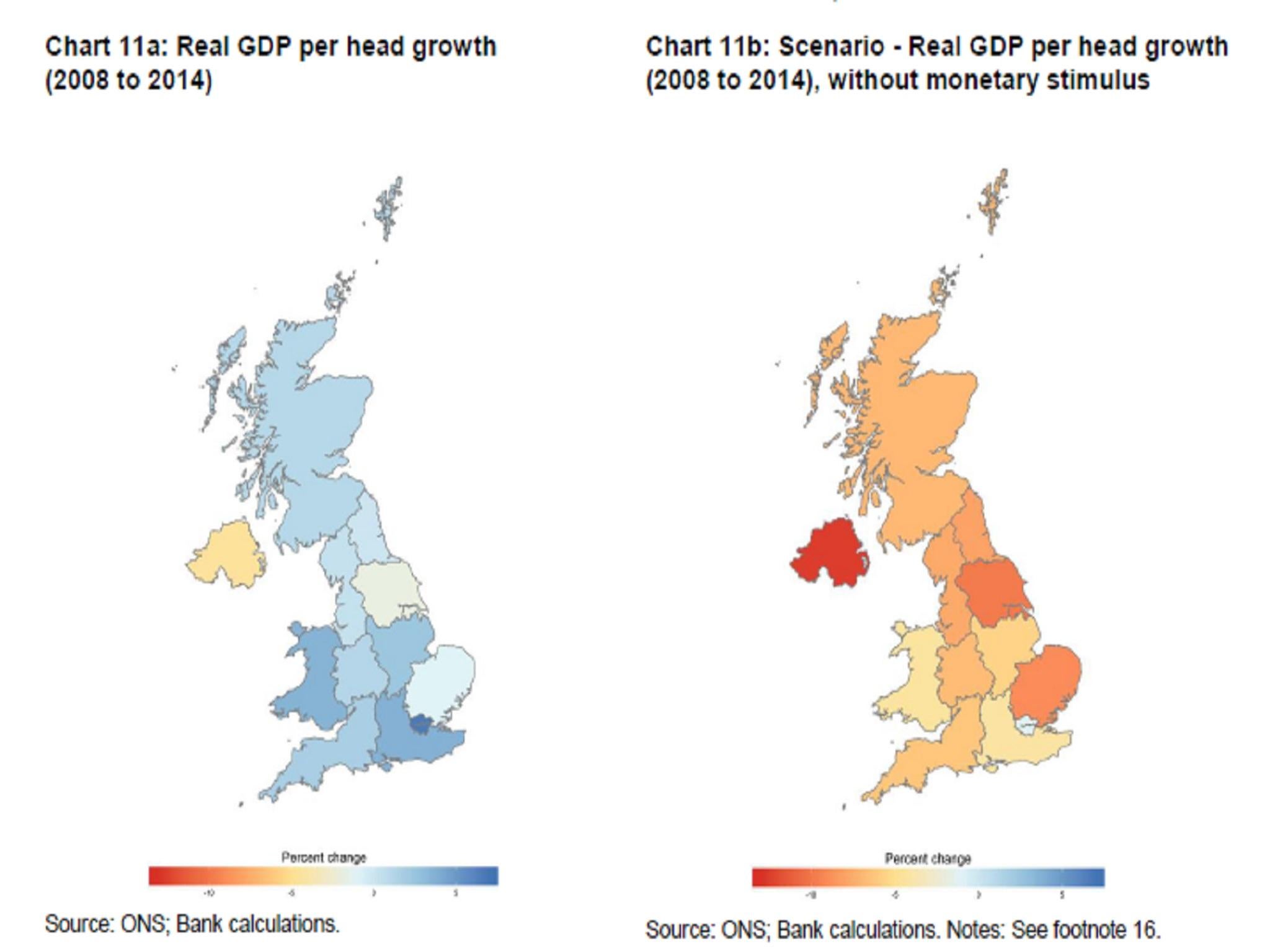

But Mr Haldane, in a speech in Redcar today, has unveiled new economic modelling research from the Bank, which suggests all regions of the UK have benefited significantly from its monetary stimulus in terms of incomes, employment and wealth, relative to a world in which the Bank had sat on its hands.

No region left behind

“It is clear monetary policy has played a material role in lifting all boats since the financial crisis broke. Indeed, without it, it is plausible to think the vast majority of regional boats would have sunk,” he said.

By way of example, he said that incomes in the North East of England would have fallen by around £1,600 per person, an extra 50,000 people in the region (“the equivalent to losing seven Nissan factories”) would be out of work and the average North East household’s wealth would have been £60,000 lower.

The Bank cut interest rates to 0.25 per cent in the wake of the Brexit vote and re-started its money printing programme to help the economy adjust.

Critics have said that the unexpectedly strong performance of the economy since the June referendum has shown that the Bank panicked.

But in his speech Mr Haldane also pointed to Bank modelling that suggests this new stimulus package will boost employment by 100,000 nationwide over the next three years, relative to the Bank not acting.

A host of other senior members of the Bank have defended its monetary stimulus against the charge that it has done more harm than good in recent weeks, including deputy governor Ben Broadbent and external Monetary Policy Committee (MPC) member Gertjan Vlieghe.

Mr Haldane, who also sits on the Bank’s nine-person MPC, said he was happy with the Committee's decision in November to signal that the next move in interest rates could be either down or up – seen as a response to the prospect of an inflationary overshoot due to the steep drop in sterling since June.

But he added that he still saw “a material chance that growth could under-perform relative to expectations during the course of next year”.

He said the probability that this could force its policy interest rate down to the “zero lower bound”, where borrowing rates cannot practically be pushed any lower, was between 15 and 40 per cent.

“My personal views is that this provides grounds for not proceeding too hastily with any tightening of the monetary policy stance,” he said.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies