Banker bonuses 'set to be slashed'

Banker bonuses were back in the spotlight today amid speculation the level of payouts earmarked for next year will be slashed.

eports that major British banks were holding talks to discuss reducing the staff bonus pot fuelled the debate on City handouts once more among ministers and business leaders.

It is estimated banks will pay out a total of £7 billion in bonuses for this year, but banks could reportedly be pressured to cut this by nearly half to £4 billion.

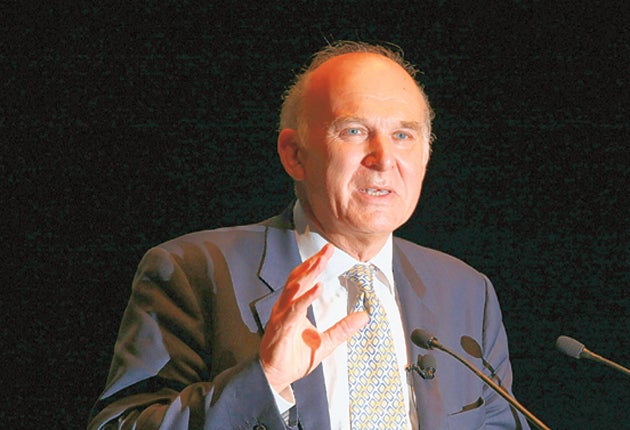

Business Secretary Vince Cable said it was reasonable for the public to want bankers to show "restraint" with their bonuses.

He said: "In these challenging times, millions of workers across the public and private sectors are working out how to do more for less and often undergoing pay freezes.

"Banks have been significant recipients of public generosity in the past few years. In return, it is quite reasonable to have high expectations of the way they conduct business and that they are encouraged to show restraint in how they reward themselves during this difficult time."

John Cridland, the newly appointed director general at the CBI, added that bankers should be able to show they have earned their windfalls.

He said: "The important part about executive remuneration and bonuses is that shareholders and other stakeholders can see that it is earned."

Richard Lambert, the outgoing head of the CBI, also said bankers would seem "arrogant and out of touch" if they carried on paying bonuses while the public sector wrestled with swingeing cuts.

The British Bankers' Association (BBA) played down reports it had hosted meetings with the banks to discuss pay rewards.

But a spokesman said banks would take into account public perception when calculating their bonuses

He said: "It is no secret the major UK banks that operate in Britain and in many other countries have sought for some time to get an international agreement on bonuses.

"Outside the UK, the concern on bonuses is either much more limited or hardly exists at all.

"The way that pay is structured has radically altered following the G20 agreements and the UK now has the toughest regime of all.

"A bonus awarded in the UK has to be against strict targets approved by the FSA, with the majority locked away for a number of years and mostly paid in shares, not cash.

"UK banks are also well aware of the public view and will take this into account when bonuses are decided. Right now, speculation about the size and the issue of bonuses is just that - speculation."

A new levy on banks' balance sheets is due to come into force at the start of next year. Ministers hope it will raise more than £8 billion over the next four years.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies