Big Six energy producers under fire over excessive profits ahead of grilling by MPs

Report accuses firms of artificially inflating prices through lack of competition

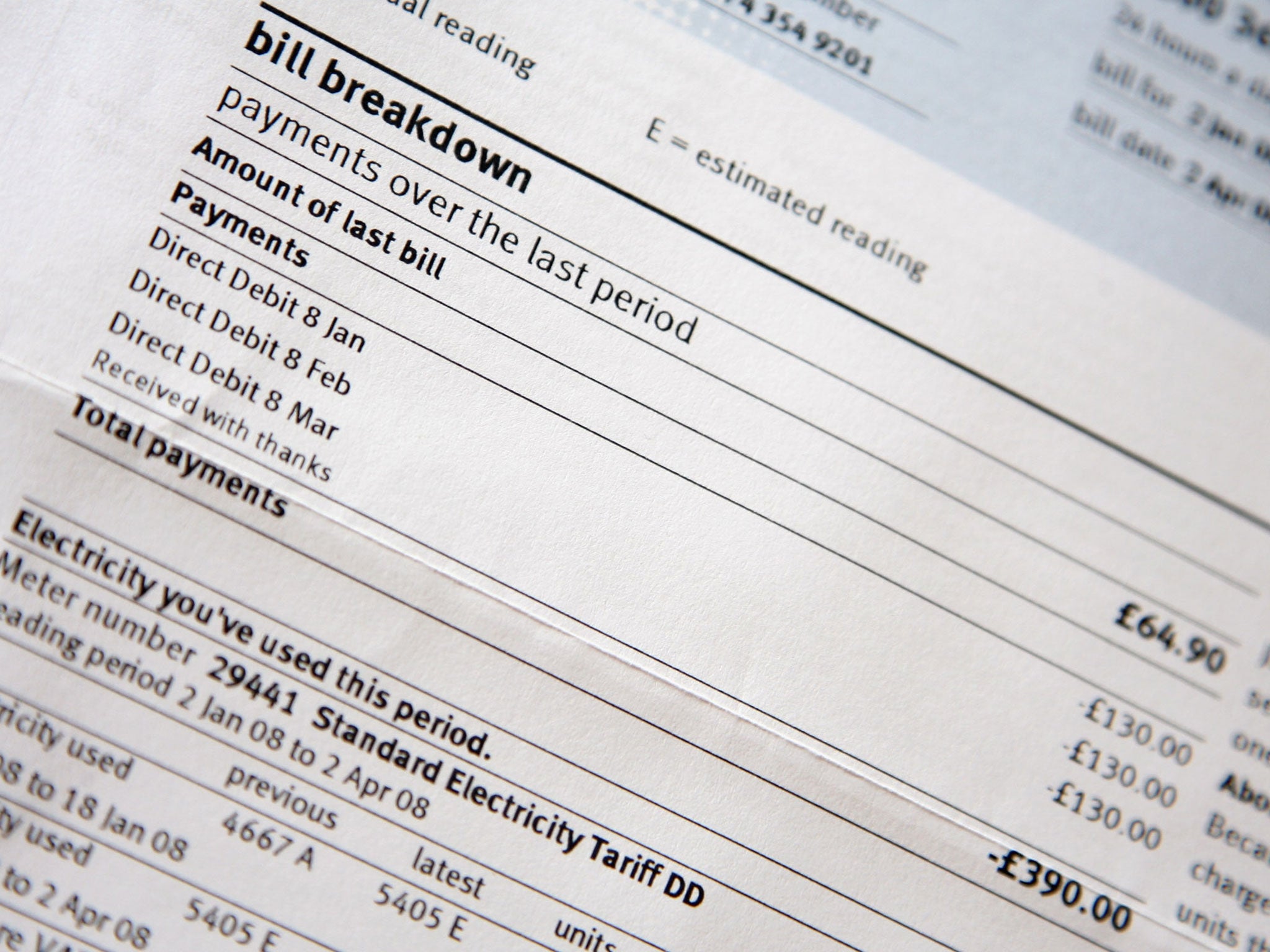

Energy bills are being artificially inflated by a lack of competition in the supply market, according to a damning new report, which argues increased competition could cut £70 off the average annual dual-fuel bill by 2020.

On the day MPs are due to grill representatives of the Big Six energy providers, IPPR, the think-tank behind the report, is calling for “greater fairness in terms of costs charged to energy consumers”.

It also finds that the gap between the most and least efficient energy supplier has widened since 2007.

Will Straw, an associate director of IPPR, said: “The key question for the Big Six is why profits of 5 to 6 per cent are acceptable in a competitive market. In 1998, as the market was liberalised, the regulator believed 1.5 per cent was an adequate margin for energy suppliers. Profits in other sectors like supermarkets are as low as 2 per cent.”

The MPs will today question the energy giants on a range of issues, including reasons for the increase, the difference of pricing policies between energy suppliers and how the transparency can be improved.

The IPPR report and the Select Committed come the day after research by the industry regulator Ofgem cast doubt on claims by the Big Six that recent bill hikes had been driven by rising wholesale prices.

Just days after Scottish Power became the fourth of the Big Six providers to hike energy prices recently, Ofgem revealed that wholesale gas prices had only risen 1.7 per cent in the past year. The four utilities have increased their gas and electricity prices by up to 11.1 per cent in the past few weeks alone, with the other two expected to follow suit shortly.

Ofgem found rising wholesale gas prices should only have pushed up the average dual-fuel energy bill by £10 over the period.

It estimates that the average net profit margin has more than doubled over the past year from £45 per household to £95.

The Big Six, however, were quick to shoot down Ofgem’s analysis. “The Ofgem methodology is at best an approximation of what companies’ hedging profile is,” a spokesman for Centrica, the owner of British Gas, said.

“We buy a certain amount of gas more than two years in advance, and if you look at the 24-month figure to October 2013, there has been an 18 per cent increase in wholesale cost.”

Ofgem has based its estimates on how it believes a representative supplier would buy gas and energy in the forward market – to smooth out volatility in the wholesale prices – and works on the basis that companies start to buy energy 18 months ahead of time.

But the Big Six countered that each supplier had a different “hedging strategy”, buying gas and power between 12 and 24 months ahead, meaning costs vary.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies