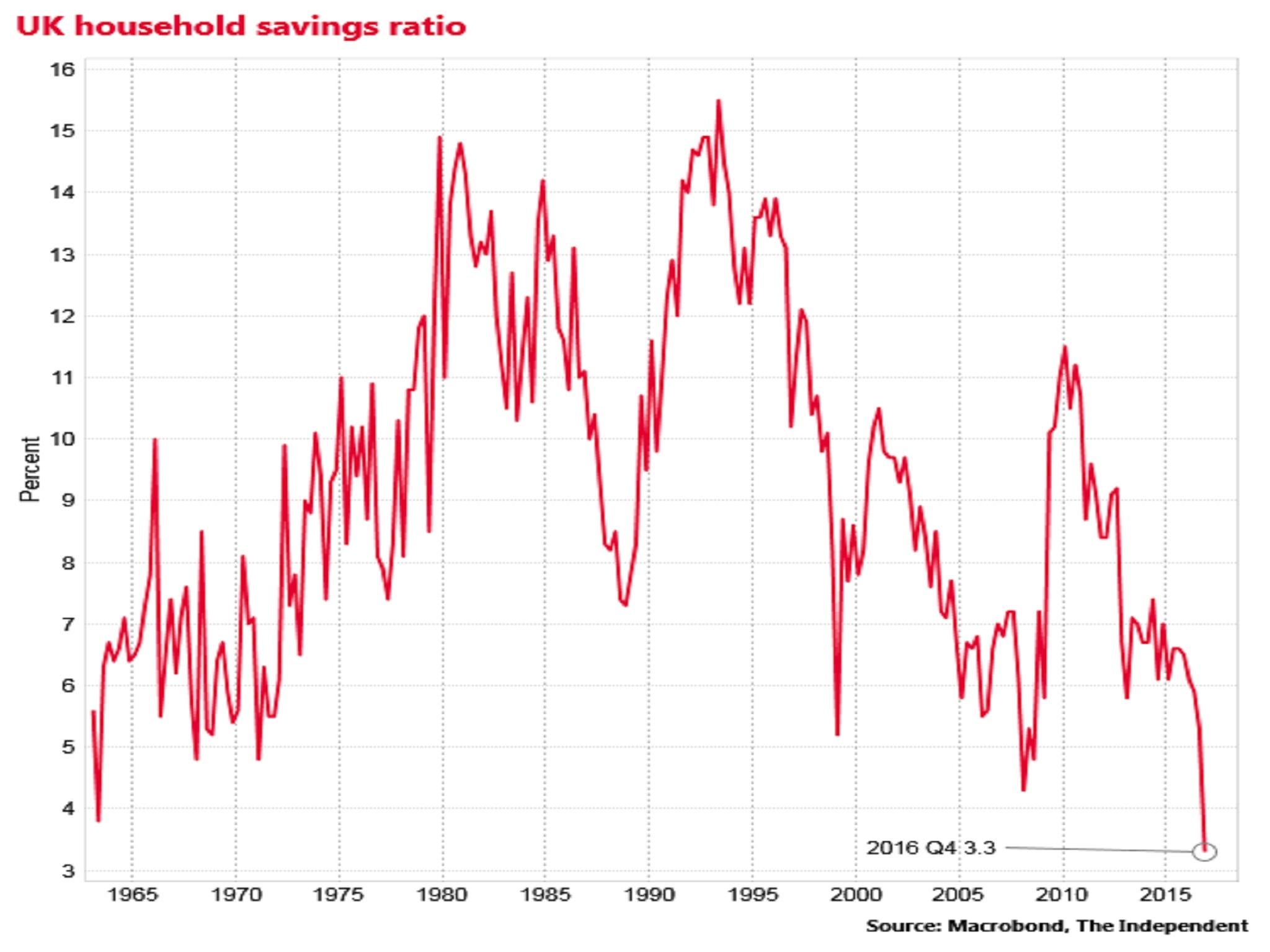

The UK’s household saving ratio dived in the final quarter of last year, hitting its lowest level on record, according to the Office for National Statistics.

The ratio – which is the difference between aggregate spending and income in the household sector – slumped two percentage points to just 3.3 per cent, down from 5.3 per cent in the third quarter.

This was due to a strong increase in spending by households, even as their available income declined.

However, the ONS said the quarter’s dramatic move was driven by technical factors.

“While at a historic low, the fall in the saving ratio is partly due to changes in imputed factors and the holdings of pension funds, rather than any significant changes in the real incomes of households,” said Darren Morgan of the ONS.

Saving ratio slumps

It also stressed that estimates of the saving ratio are often revised over time.

Nevertheless, robust consumer spending has supported growth since last June’s Brexit vote, enabling the economy to defy expectations of a recession. And the saving ratio has been on a declining trend since the beginning of 2016.

Economists are divided over whether consumers, as a collective, will continue to spend more than their income this year, thus prompting further falls in the ratio.

The Bank of England in its February Inflation Report projected a fall in the saving ratio, supporting consumption and overall GDP growth of 2 per cent.

But the Bank estimated a 2017 average for the savings ratio of 4.5 per cent, already 1 percentage point above its Q4 2016 level.

“Given that higher household borrowing was a key part of the [Bank of England’s] strong forecast for GDP growth, there must be a good chance that this will not be achieved, strengthening the case for a lengthy period of monetary policy inaction,” said Martin Beck, economist at the EY ITEM Club.

The latest ONS reading also throws the Office for Budget Responsibility’s projections into doubt.

At the time of the March Budget the OBR projected the saving ratio to be 5.1 per cent in the final quarter of 2016, declining only to 4.8 per cent by the end of this year.

Separately, overall GDP growth in the final quarter was confirmed by the ONS at 0.7 per cent and full year 2016 growth at 1.8 per cent.

But Q3 2016 growth was revised down from 0.6 per cent to 0.5 per cent.

The ONS also reported a dramatic narrowing in the UK’s current account deficit in the final quarter of 2016, falling from 5.3 per cent to 2.4 per cent, its lowest since 2011.

This was predominantly due to a surge in exports, showing the positive impact of sterling’s slump since last June’s Brexit vote.

An automatic increase in the sterling value of earnings on the UK’s foreign investments relative to sterling earnings of foreigners on investments here also contributed to the current account narrowing.

But Samuel Tombs, economist at Pantheon, warned that this did not mean the level of the pound was now necessarily safe.

“The sharp reduction in the current account deficit – and hence the UK’s need for external finance – does not mean that sterling is immune to falling further,” he said. “The stock of overseas investors’ assets in the UK equates to a massive 547 per cent of annual GDP. Sterling would depreciate further if only a small proportion of these investors took flight. Signs that the UK is heading for a hard Brexit could be a trigger for such a fire-sale.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies