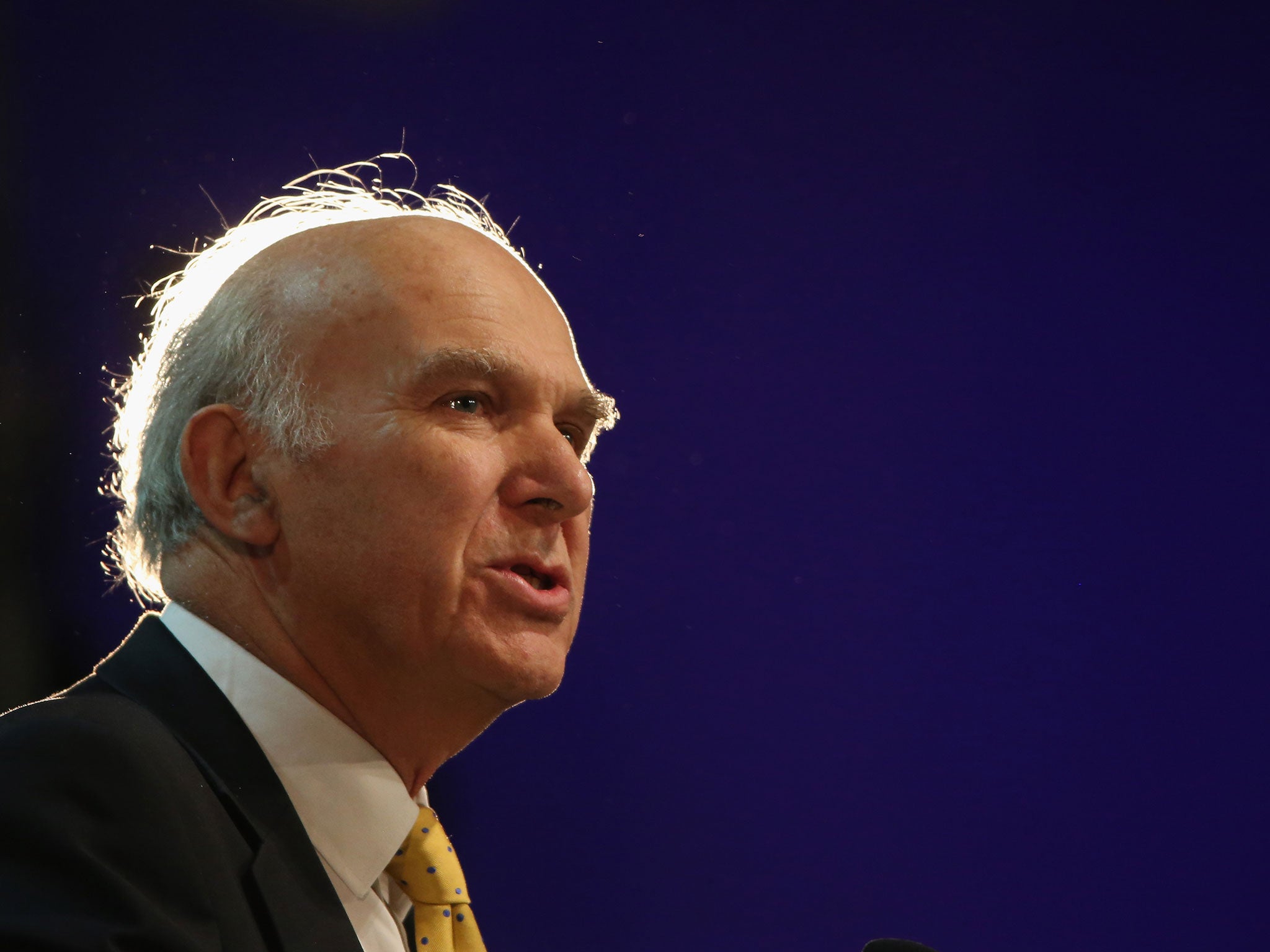

Homeowners in London could be “very badly exposed” if the Bank of England raises interest rates in the coming years, the Business Secretary, Vince Cable, has warned.

Speaking about the housing market to The Independent last week, Mr Cable noted statistics showing that a third of mortgages in London were lent at four times or more the borrower’s income.

The Bank of England took action last June to ration the number of high loan-to-income mortgages created by banks. At that time the Bank reported that two-thirds of loans worth more than 4.5 times income were being made in the capital, where house prices are extremely high relative to average incomes.

Yet the legacy of those loans could still pose a serious problem for residents of the capital if interest rates rise in the coming years, according to the Business Secretary. “People would be very badly exposed if interest rates went up,” he said.

That view contrasts with the relatively sanguine perspective of the Bank of England over the impact of an interest rate hike. Research from the central bank released last year suggested that the majority of people with mortgages could cope with a gradual and limited rise in rates. The Governor, Mark Carney, recently stressed that rates are likely to rise over the coming years despite plummeting inflation.

Mr Cable identified a severe shortage of new housing supply as the central problem in the property market, saying it is pushing up prices, forcing families to take on more mortgage debt and increasing the financial vulnerability of many households.

He said he wanted councils to be able to borrow much more to invest in council house construction. He recalled that in the 1970s councils were the dominant builders of new houses, but that now they make virtually no contribution. “We’ve got the balance wrong. Councils are the missing bit of the jigsaw,” he said.

The latest official statistics show that house building fell by 20 per cent in England in the second half of last year, despite ministers’ claims that supply is finally rising to meet demand.

The Coalition has given councils some additional borrowing capacity to invest in housing, but Mr Cable said he wants to move to a European-style regime where local authorities can borrow liberally against their assets.

Figures from the Council for Mortgage Lenders show that in 2014 the average mortgage loan to income multiple in London was 3.65, versus a national average of 3.23.

House prices were up 17.8 per cent year-on-year in Greater London in the final quarter of 2014. Nationwide they were up 8.3 per cent over the same period.

The average cost of a house in London is £500,000, while average earnings in the capital are £34,000, according to the Office for National Statistics. The average UK house price is £272,000 and average earnings £27,000.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies