Manufacturers' investment intentions at weakest in six years finds CBI Industrial Trends survey

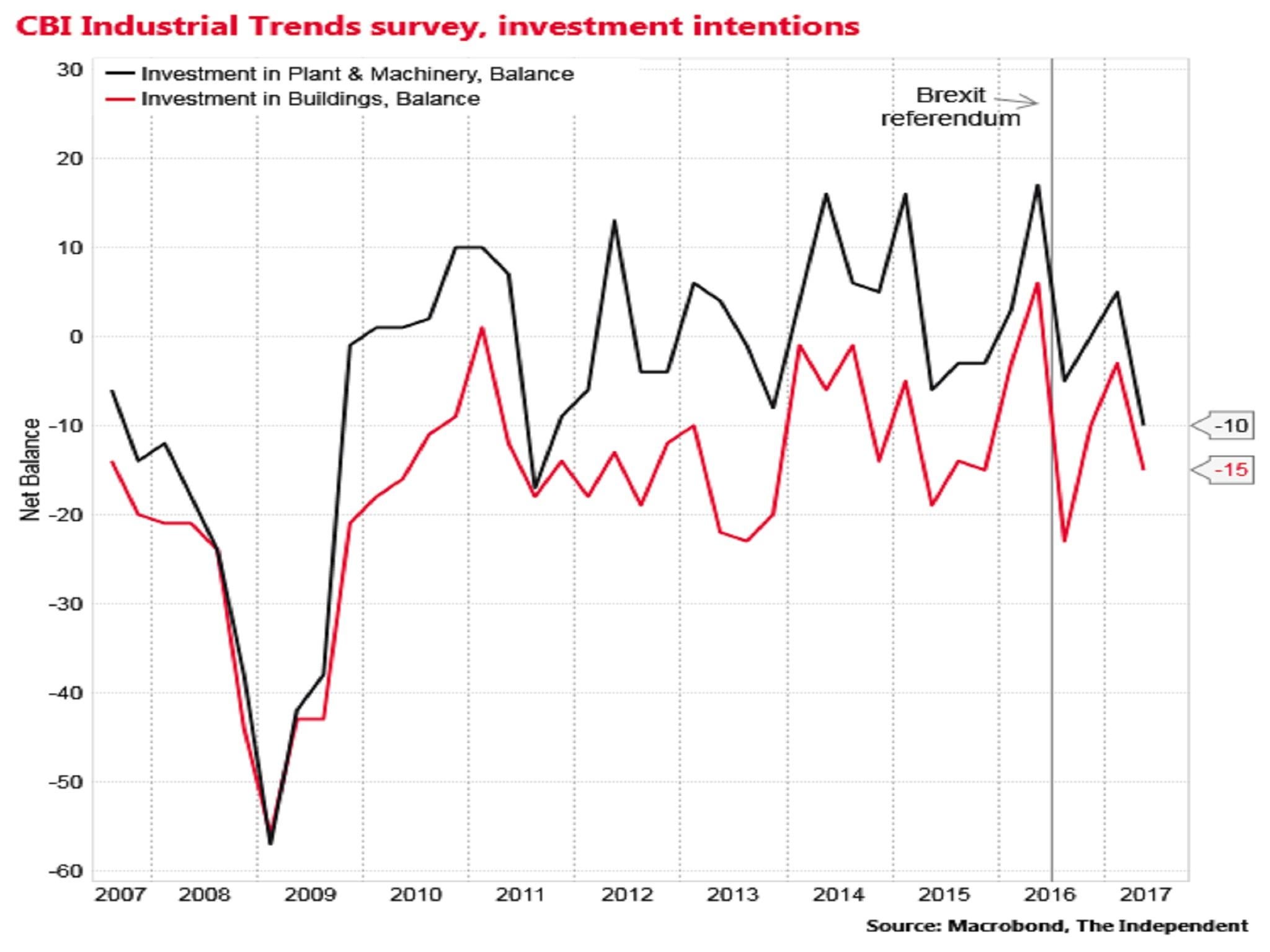

The net balance of firms planning increases in spending on plant and machinery fell to minus 10 per cent, down from 5 per cent previously, and the lowest since 2011

UK manufacturers' investment intentions have softened again, according to the latest CBI Industrial Trends survey, raising further concerns about the robustness of the economy as the two-year Brexit divorce negotiations are set to begin.

The net balance of firms planning increases in investing in plant and machinery in the second quarter of 2017 fell to minus 10 per cent, down from 5 per cent previously, and the lowest since the third quarter of 2011.

The balance of companies planning to invest in buildings also slipped to minus 15 per cent, down from minus 3 per cent in the first quarter.

The proportion of firms attributing these weaker investment plans to “inadequate net returns” rose to the highest in a decade, the CBI said.

According to the Office for National Statistics, total business investment volumes fell by 0.9 per cent in the final quarter of last year, resulting in the first calendar year fall in 2016 since the financial crisis.

Weakest intentions in six years

“Manufacturers likely will suffer whatever the outcome of Brexit negotiations. Either trade barriers will be imposed or sterling will appreciate after a ‘soft Brexit’ and so are holding back from investment", said Samuel Tombs, an economist at Pantheon.

Howard Archer of IHS Global Insight said the slide in investment intentions in the CBI survey was notable.

“Demand for capital goods will likely be constrained as business confidence is likely increasingly pressurised by slowing UK economic activity and by mounting uncertainties over the Brexit process now that Article 50 has been triggered and likely difficult negotiations with the EU come increasingly to the forefront,” he said.

The Bank of England now expects the level of business investment by 2019 to be around 25 per cent lower than it did before the Brexit referendum.

The monthly results from the CBI survey also showed a slight deterioration.

The net balance of manufacturers' total order books in April declined to 4 per cent, down from 8 per cent in March and the weakest since January, although still above the level at the time of last June’s EU vote.

The export order balance fell to 3 per cent, down from 10 per cent in March.

Optimism among firms declined to 1 per cent from 15 per cent previously.

However, export prospect expectations improved to 30 per cent, from 19 per cent previously, reflecting the boost to the sector from the 13 per cent trade-weighted depreciation of sterling since the referendum vote.

“UK manufacturers are enjoying strong growth in demand from customers in the UK and overseas, and continue to ramp up production,” said Rain Newton-Smith, the CBI's chief economist.

“Even so, the combination of the weak pound and recovering commodity prices means that cost pressures continue to build, and manufacturers report no sign of them abating over the near-term.”

The net balance for domestic price inflation expectations was 29 per cent, unchanged from March.

The CBI survey was conducted between 27 March and 12 April, prior to Theresa May's announcement of a June general election.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies