Coalition programmes to boost financial support for British manufacturers and exporters have met only one quarter of ministers’ lending targets and fallen short by £1.5bn, The Independent can reveal.

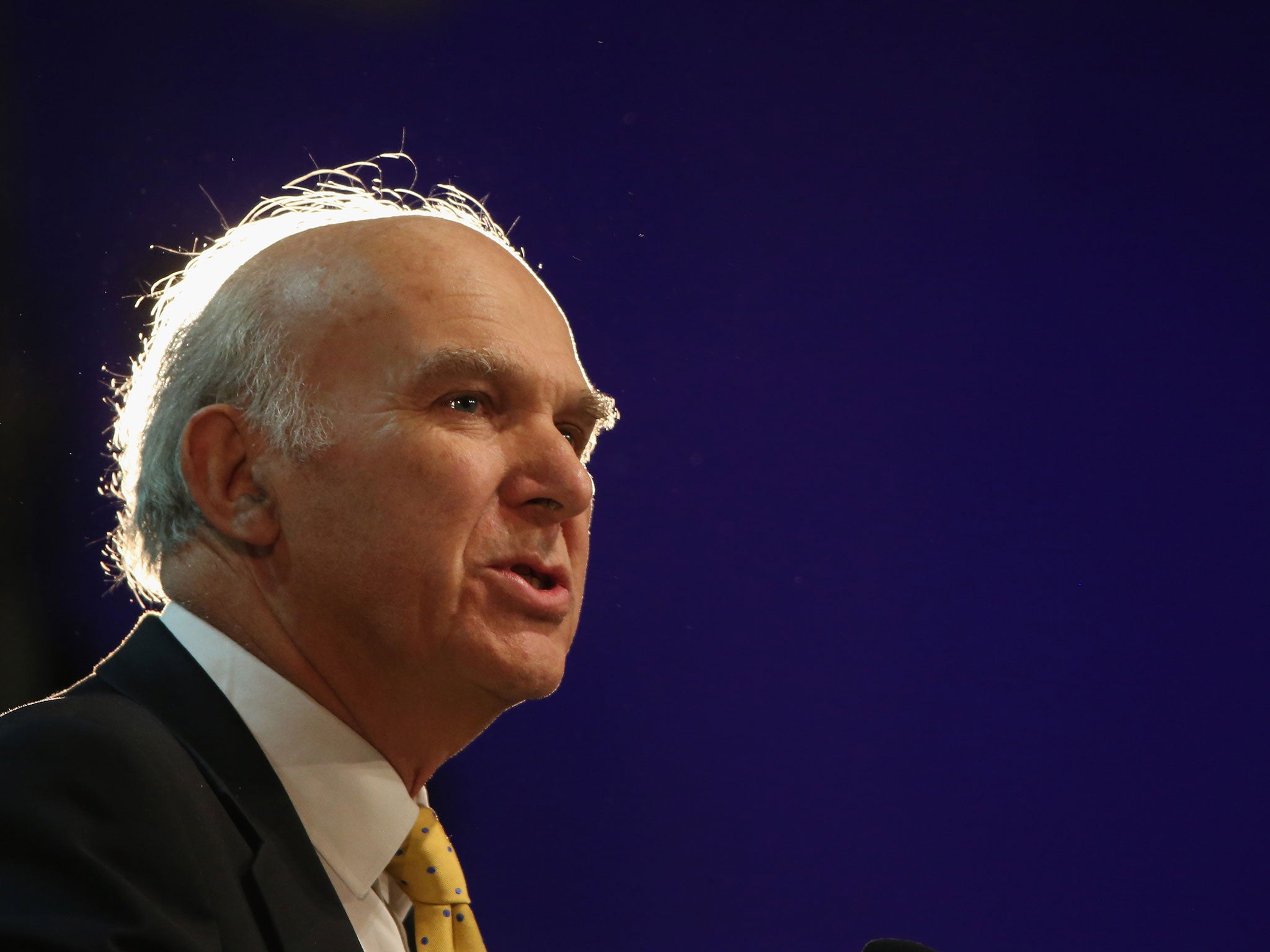

Vince Cable’s Department of Business, Innovation & Skills (BIS) forecast in March that the British Business Bank, the Green Investment Bank and the Export Finance scheme would collectively provide £2bn in credit for exporters, manufacturers and small firms in 2014-15. But the three schemes are now expected to create just £530m in new support by next March.

The figures, in the small print of the Office for Budget Responsibility’s latest report, will raise questions about the grip of the schemes’ administrators, who provided the OBR with the over-optimistic forecasts of their ability to increase lending just nine months ago. The figures also cast doubt on the assurances of ministers, including Mr Cable, that their policies are powerful enough to help the economy rebalance away from household consumption and towards investment and exports.

The shadow Business Secretary, Chuka Umunna, said Coalition industrial support programmes were failing to deliver. “It is deeply concerning that the OBR is expecting such a large shortfall in these programmes,” he said. “These schemes are simply not doing the job they need to do for British business.”

Mr Umunna said a Labour government would establish a “proper” British Investment Bank supported by a network of regional banks.

In March the BIS told the OBR that the British Business Bank, which has a remit to support lending to small firms, would increase its loans by £800m in 2014-15. Now the department expects that to come in at just £200m. Nine months ago ministers said the Green Investment Bank would create £1bn in new loans. Now the lender, which finances renewable energy infrastructure projects, is expected to create just £200m of new credit this financial year. UK Export Finance, which provides insurance and other financial assistance for exporting firms, was pencilled in to create £200m of credit in March; ministers now apparently think it will provide just £30m.

In its latest report the OBR noted “the tendency for new schemes to take longer than originally planned to deliver the amounts targeted” and said it had built in allowances for additional shortfalls in lending both this year and next. The OBR has created an underspend allowance in its latest forecasts of £300m for 2014-15 and for £1bn in 2015-16.

A BIS spokesperson said: “The Business Bank, Green Investment Bank and UK Export Finance are providing significant volumes of lending to British businesses and are playing an important part in supporting growth, which the OBR has just revised up to 3 per cent for next year.”

In the Autumn Statement the Chancellor, George Osborne, made no mention of the missed lending targets.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies