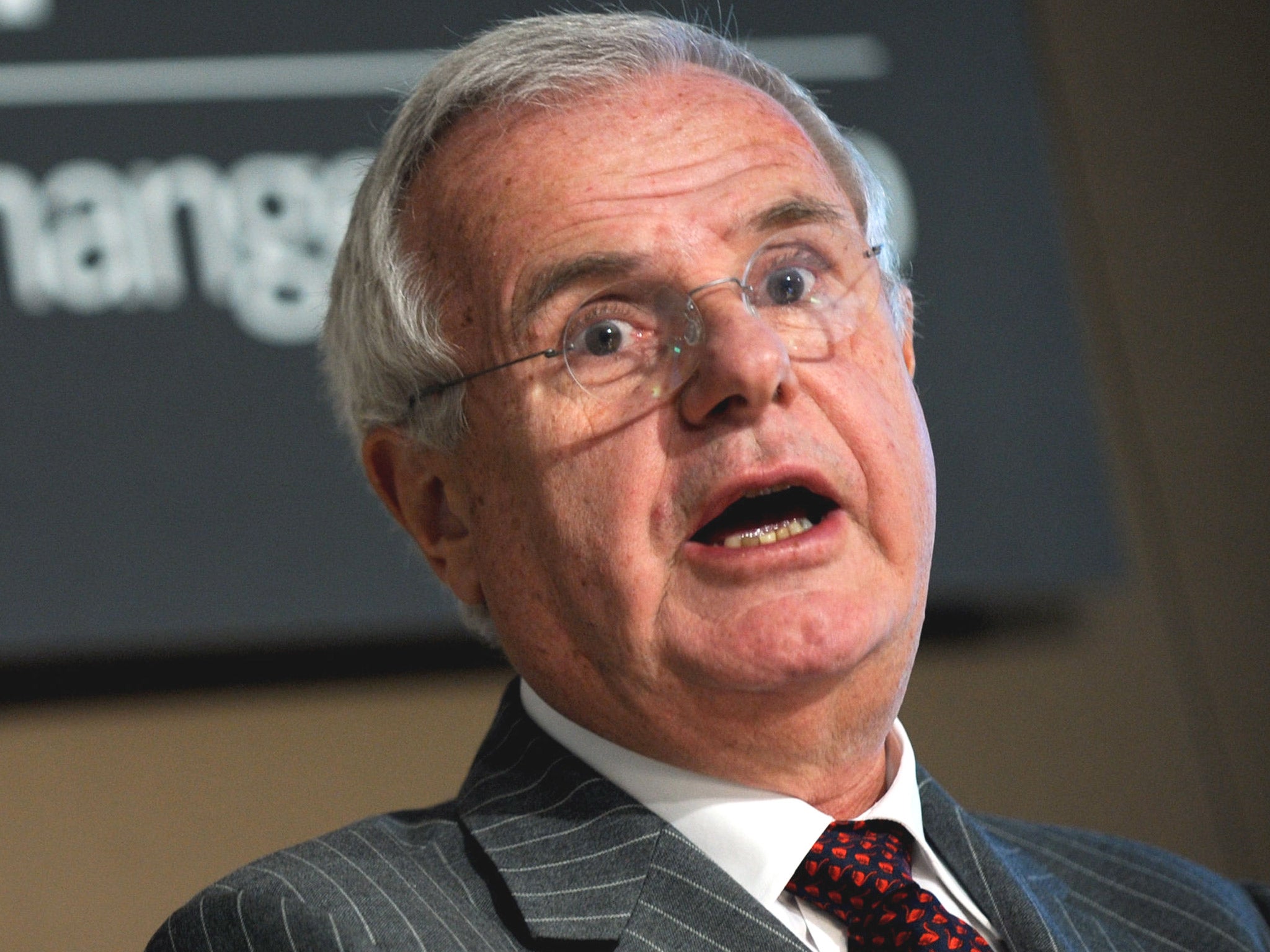

Lord Myners urges crackdown on companies buying UK firms as sterling slump spurs foreign interest

Lord Myners likened the UK market to a 'garage sale' in which 'everything is up for sale if the price is right'

Lord Myners has predicted that "five or six" of Britain’s biggest publicly listed companies could be targeted by takeover bids this year, underscoring just how important it is that regulators enhance controls to protect the best interests of UK corporations.

Speaking to the Today programme on the BBC on Monday, Lord Myners, who was financial services secretary to the Treasury under Gordon Brown, said that “companies are not just assets to be traded” but are “assets to be built up”.

He said that in the UK, we work in a "permissive zone" where the fate of companies is generally decided by a small number of City financiers, and he likened the market to a "garage sale” in which “everything is up for sale if the price is right".

He said that in “almost every other country” other than the UK “there is a public purpose test to ensure that [any corporate] takeover works to the broader benefit of society" and that Britain needed to “take back control of our businesses".

Lord Myners specifically referred to US food giant Kraft Heinz’s failed takeover of Unilever last month, and said that the UK’s current Takeover Code was not robust enough to protect the best interests of domestic corporations when hostile takeover bids are launched.

The Anglo-Dutch consumer goods giant which is listed on the FTSE 100 in February rejected a $143bn (£115bn) takeover offer from Kraft, saying that it sees absolutely no “financial or strategic” merit in a tie-up.

Kraft, which is controlled by private equity firm 3G Capital and veteran financier Warren Buffett, is best known for brands like Philadelphia spread, Capri Sun soft drinks, HP Sauce and Heinz ketchup, while Unilever’s brands include Domestos, Dove and Persil.

A deal would have been the third-biggest takeover in history and the biggest ever acquisition of a UK-based company, according to Thomson Reuters data at the time.

The slump in sterling in the wake of last June’s Brexit vote has generally enhanced the appeal of UK-listed companies for those looking to buy from abroad.

“International buyers emerged as a real force to be reckoned with towards the end of last year, as overseas trade acquirers – most notably those from the US and Asia - acted opportunistically to take advantage of a weakened sterling,” said Andrew Nicholson, head of M&A at KPMG in the UK said in a report published last week.

The world’s most valuable brands

Show all 10“With no sign of a bounce in the pound on the horizon, and the UK economy continuing to confound post-Referendum expectations, UK businesses will remain a target for hungry investors,” he added.

The pound has steadied somewhat in recent weeks, but remains well over 15 per cent lower against the dollar since the referendum and some say it could fall further once Article 50 is triggered, officially kicking off Brexit proceedings.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies