London-based financial information and trading data company Markit has filed papers with regulators in the United States to raise up to $750 million in an initial public offering of shares.

Markit did not immediately reveal the exchange on which it would list its shares or divulge how many shares it planned to sell. The initial amount it aims to raise could change.

When Markit received a $500 million investment from Singapore state investor Temasek Holdings last year, reports valued the whole of the company at up to $5 billion.

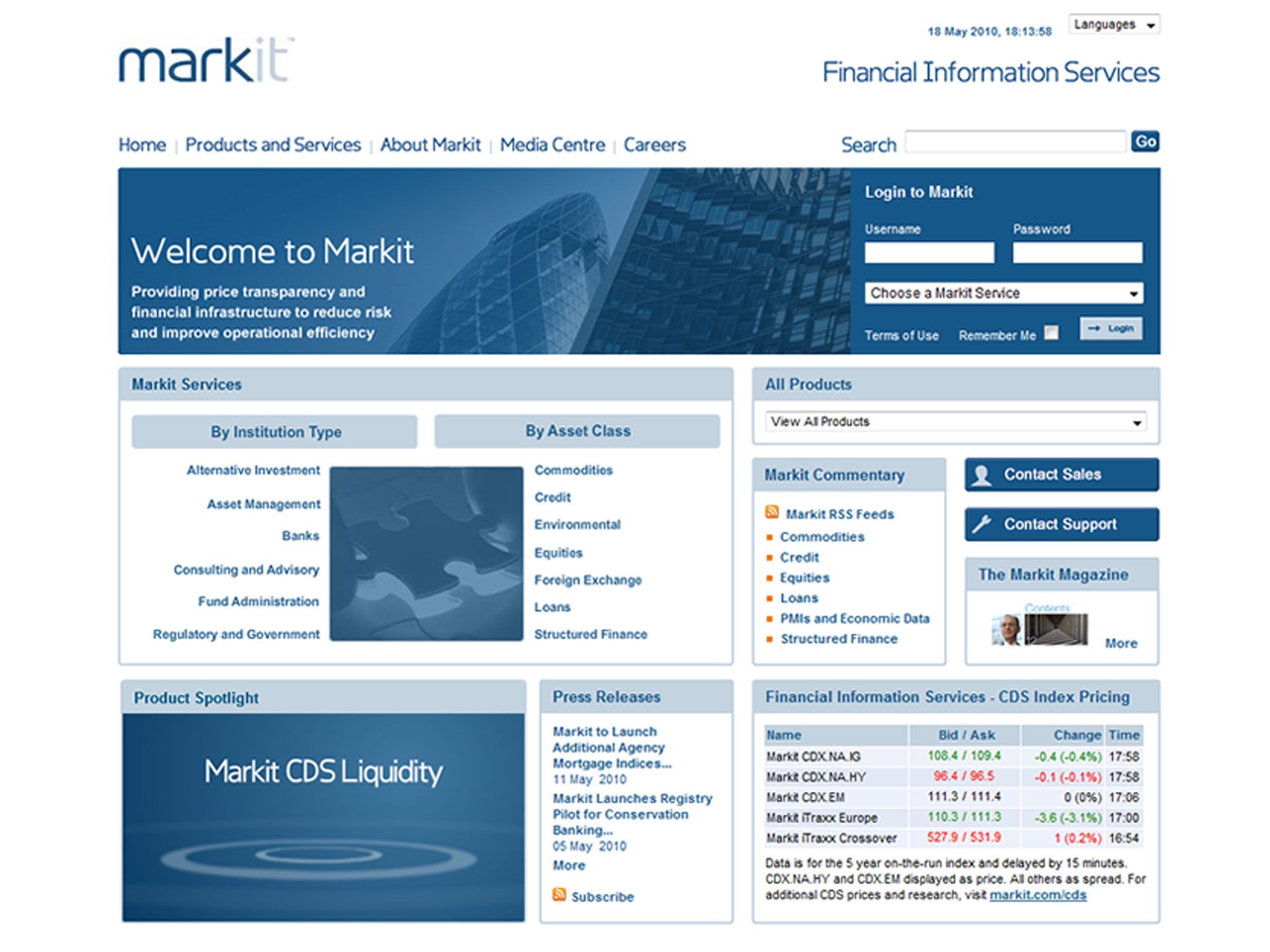

Markit competes with Thomson Reuters and Bloomberg in the provision of trading data and information and its major shareholders include Goldman Sachs, Bank of America and Deutsche Bank.

Markit reported revenue of $947.9 million for 2013, up 10 per cent, and has more than 3,000 institutional customers around the world.

Those customers include banks, hedge funds, asset managers, central banks, regulators, auditors, fund administrators and insurance companies.

Founded in 2003, Markit employs more than 3,000 people in 11 countries.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies