OECD says UK is worst placed in G7 to withstand global downturn

Britain is the worst placed among the world's major econ-omies to withstand the impact of a global slowdown – and the only one forecast to be in recession this year, according to the respected Organisation for Economic Co-operation and Development. The OECD says that the sharp downturn in the British property market, and the increased importance of housing in the economy, has led it to slash its forecasts.

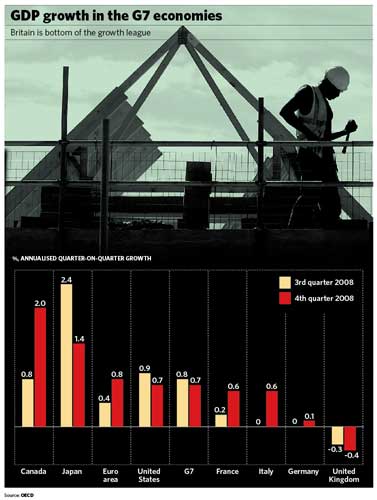

The British economy will shrink by 0.075 and 0.1 per cent in the third and fourth quarters respectively, says the OECD, an annualised rate of minus 0.3 per cent and minus 0.4 per cent. Two quarters of negative growth satisfy the conventional definition of recession. Every other economy surveyed by the organisation – the US, Germany, France, Italy, the eurozone and Canada and, especially, Japan – will see their economies grow during the remainder of the year.

The only good news from the OECD is that the scale of the British slowdown will push inflation down. "House prices exert crucial influences on UK activity," the OECD's acting chief economist, Jorgen Elmeskov, said. Growth in Britain, he remarked, "is going to more or less stagnate in the second half of the year, and we see that as generating enough slack in the economy eventually to bear down on inflation".

The think-tank's forecast came as the latest figures from the Chartered Institute of Purchasing and Supply showed that the building industry – which accounts for 6 per cent of the economy – contracted for the sixth month running in August. Nat-ionwide, meanwhile, reported that consumers became increasingly pessimistic about job prospects last month, an attitude somewhat justified by the monthly Report on Jobs from KPMG-REC, which revealed yesterday that permanent placements are falling at the sharpest rate since November 2001 and salary growth is at the lowest in more than five years.

The OECD's uniquely poor outlook for the UK will come as an embarrassment for ministers, who have long argued that the UK is better placed than her competitors to cope with economic problems. In his Budget speech in March, the Chancellor, Alistair Darling, said: "Britain is better placed than other economies to withstand the slowdown in the global economy."

Even though Mr Darling said over the weekend that the economic times the country faced were "arguably the worst they've been in 60 years", he is now claiming that "I have been optimistic throughout my chancellorship". Yesterday, sterling continued the rout sparked by the Chancellor's weekend comments, falling to a fresh low against the euro of 81.62p and a two-and-half-year low against the dollar of $1.7853.

Most poignantly, during interviews yesterday Mr Darling referred to his Mansion House speech in June when he said: "In fact, both the OECD and the IMF expect us to be among the very best performers in all major developed economies. I agree." It remains to be seen whether he still agrees with the OECD's latest opinions.

The gloomy OECD report predicts British growth of 1.2 per cent for 2008 as a whole, down from the 1.8 per cent figure set in June, and slightly below the current consensus among independent forecasters. However, many of these are now revising their growth forecasts lower, with one or two – such as Capital Economics – going so far as to predict that the economy will actually shrink across 2009 as a whole. The bulk of City economists see a recession, albeit short and shallow, as an increasingly likely outcome over the next 12 months, driven by the collapsing property market, with growth not reviving properly until 2010. The Government's housing recovery plan, revealed yesterday, has made no difference to the view from the City. The Bank of England recently said that growth next year would be "broadly flat", conceding the possibility of some quarters where the economy declines and is, thus, in recession.

Formally, the Treasury has to stick to its Budget forecast for British economic growth of 2 per cent for 2008 and 2.5 per cent in 2009, both looking overoptimistic, and with serious implications for the public finances. Such a collapse in growth as suggested by the OECD would leave Mr Darling with a succession of "black holes" in his Budget plans, with at least £10bn needed to plug the gap left by lower tax revenues from depressed growth, as well as the various tax concessions made in recent months.

There was encouragement for the Bank of England and its peers, however. The OECD believes the monetary policies being pursued by the world's central banks at the moment were appropriate in the circumstances.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies