Royal Mail sale: Taxpayers lost out on £1bn, says MPs' committee

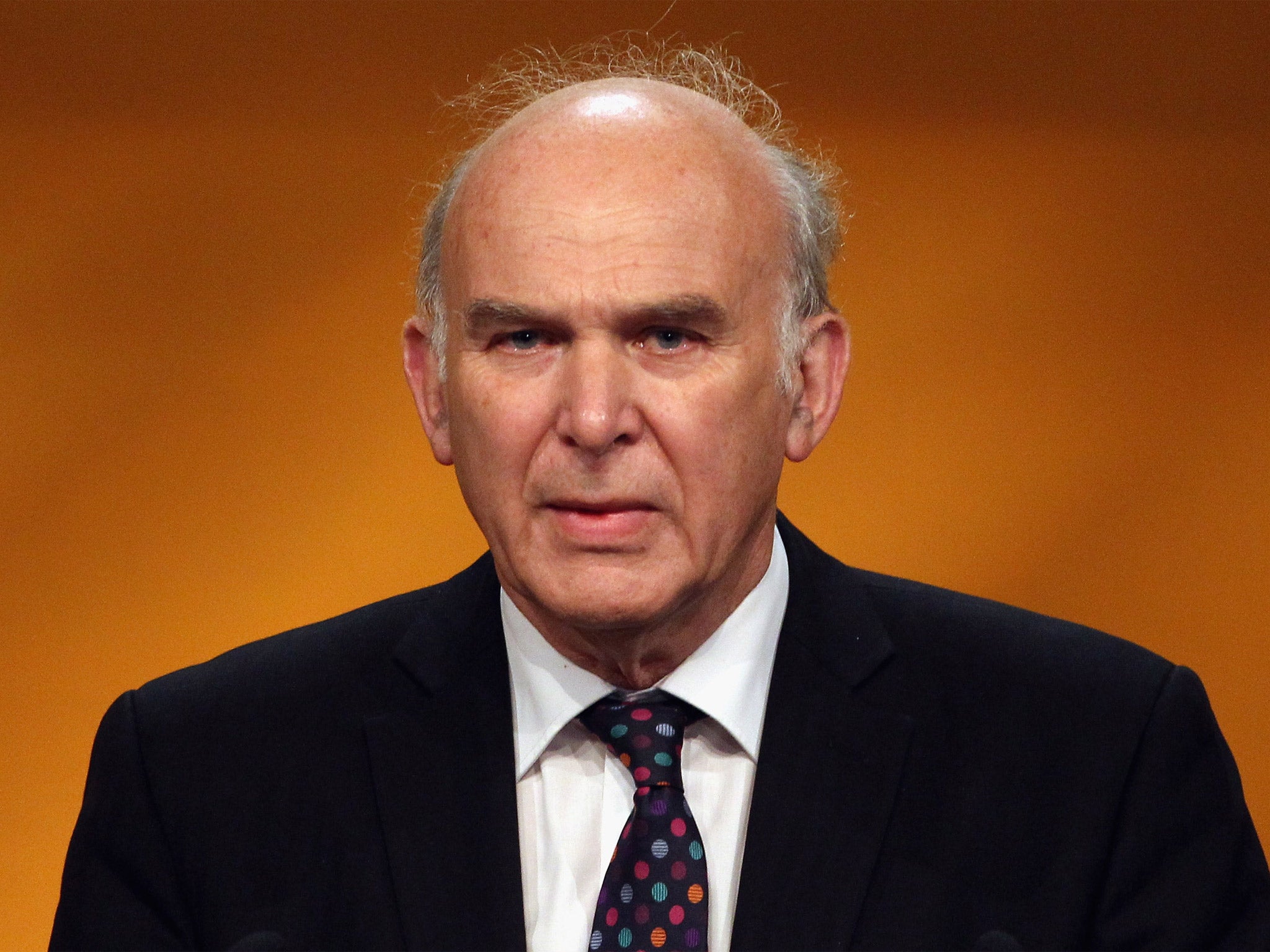

Select committee criticises 'not credible' Vince Cable and his department for relying too much on its City adviser, Lazard

MPs have slammed the Business Secretary Vince Cable over the Royal Mail privatisation, declaring that some of his claims for the success of the float had not been “credible” and concluding that the postal service was sold too cheaply.

They say taxpayers lost out on about a billion pounds as the shares surged by 38 per cent on their first day of trading, and continued to rise.

Earlier this week, the Government ordered a review into how privatisations could be handled better in future, hiring Lord Myners, the former City minister, to investigate.

Yesterday, a select committee said Mr Cable’s claims that Royal Mail’s high share price was based on “froth” – a temporary rise – was not “a credible response” to that increase.

Adrian Bailey, the Labour MP who chairs the Business, Innovation and Skills Committee, said: “The Government cannot blithely dismiss as ‘froth’ our committee’s concern that the low issue price of this prime public asset has cost the taxpayer around a billion pounds.”

The committee criticised Mr Cable and his department for relying too much on its City adviser, Lazard, which it said gave poor guidance to the Government and was too focused on getting the share sale done and not enough on gaining maximum value for the taxpayer.

The MPs appeared irritated at the “blanket refusal” of Mr Cable, City advisers and the Conservative minister Michael Fallon, who was charged with handling the float, to admit that anything had gone wrong. Royal Mail’s shares were sold on 10 October at 330p but had hit 615p by mid-January. They have since dipped to 474.3p.

The committee went on to condemn the undervaluing of buildings that the Royal Mail is now likely to sell. These include three sites in London, valued by Mr Cable’s department at £200m, which the National Audit Office put at £330m to £830m. It added: “What is more disturbing is that the Government ignored established NAO recommendations either to remove such assets from the privatisation process or to insert clawback provisions on the future sale of the properties.”

It also had harsh words for Mr Cable for his original refusal to disclose the identities of the “priority” investors recruited as long-term backers to support the flotation. At one select committee meeting, he said he could not give their identities for fear of them suing the Government – only to publish them the next day after criticism in the media.

The names proved critical as they showed that Lazard had also been a big investor through its asset management arm, and was one of the several supposedly long-term backers who sold their shares almost immediately at a huge profit.

The committee acknowledged that it had found no evidence of improper behaviour by the companies advising the Government, but said advisers on share issues should be excluded from becoming preferred investors in future.

A spokeswoman for Mr Cable’s department said the committee’s conclusions contained “factual errors and misunderstandings”.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies