Investment Column: Shaftesbury's exposure to London's West End will keep it propped up

Hogg Robinson; Gem Diamonds

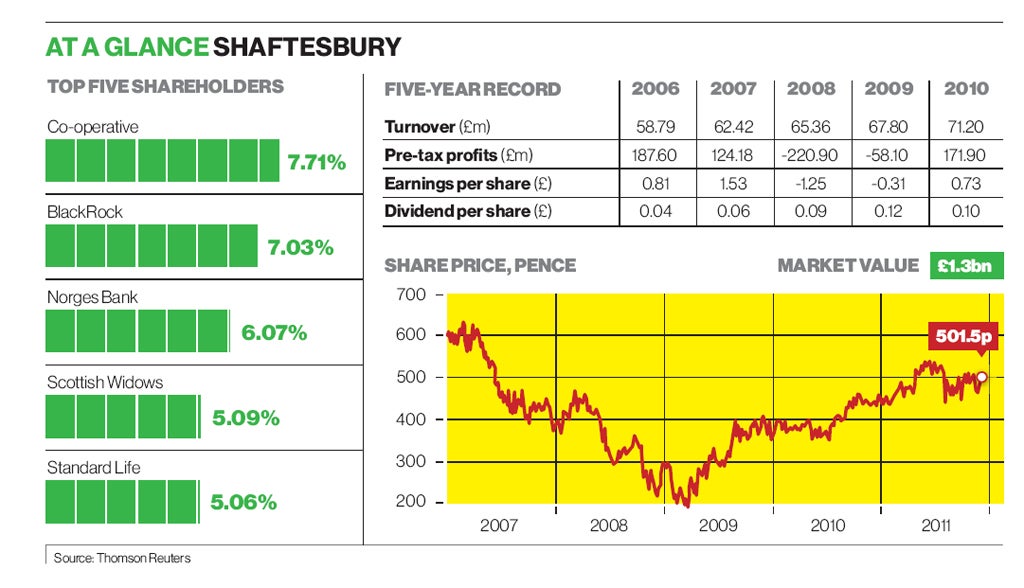

Our view: Hold

Share price: 501.5p (+19.5p)

The Chancellor's Autumn Statement confirmed that the UK is lodged in the doldrums. And European leaders are still attempting – and still failing – to solve the sovereign debt crisis. But there are bright spots.

One of the brightest is the commercial property market in the capital. It has been doing rather well of late, something that was in evidence when Shaftesbury published its full-year results yesterday. The company, which is focused on the West End, with more than 500 properties in and around Carnaby Street, Covent Garden, Chinatown, Soho and Charlotte Street, said its adjusted net asset values per share rose by nearly 12 per cent to 463p on the reporting benchmarks set by the European Public Real Estate Association.

Although that is the key metric for property firms, other indicators were also positive, including, from an investment point of view, the final dividend. The directors recommended 5.75p per share, which is ahead of last year's 5.25p per share. But despite all this, you can almost hear the bears grumbling about the economy, about what is going to happen next year.

Well, given the concentration of its portfolio, it should be remembered that Shaftesbury depends on the West End economy. And the thing to remember about the West End is that it is more resilient than the country as a whole. London, as Shaftesbury's chairman, John Manser, said, "continues to prosper and grow". "Its resilience reflects London's status as the leading tourist and global financial centre and the largest city in Europe," he added.

We agree, though, given the events in Europe, that we have become a tad cautious. If the euro crumbles, the resulting financial mayhem will hit London – we have little doubt about that. That could unsettle Shaftesbury's shares, which are not cheap.

The stock trades at a premium to the net asset value figure quoted above, which contrasts with the discounts in the wider sector. Although this premium is well deserved, in our view, and although Shaftesbury is certainly not one to sell, it could lead to some profit-taking if something (or rather something else) goes horribly wrong in Europe. Wait and watch for now.

Hogg Robinson

Our view: Buy

Share price: 55p (+0.5p)

The travel industry has suffered a year of severe turbulence in the travel industry; the tour operator Thomas Cook has been particularly badly affected. But shares in Hogg Robinson, the corporate travel management company, have soared this year, as investors have checked into its global growth story and reduced debt levels.

This partly reflects the geographical spread of Hogg Robinson's client base in 120 countries. But it is also a consequence of the broad range of services that the company provides to big corporates such as the HSBC and Pfizer, which are keen to keep a tight control of their travel expenses in an economic downturn.

The company's client retention rate is above 90 per cent, and its services range from handling reservations to data management on its proprietary technology. Hogg Robinson added a number of new clients, including the financial services companies AIG and Allianz, in the half year to 30 September, which helped it to increase its pre-tax profits by 22 per cent to £18.7m.

This enabled it to grow its interim dividend by 20 per cent to 0.6p. Further good news for potential investors – given the bleak time it suffered when its shares sank to less than 4p in December 2008 in the last recession – was that Hogg Robinson slashed its net debt by £16.9m to £68.9m over the half year.

Overall, we think Hogg Robinson, which trades on a modest forward earnings ratio of just seven, is well placed to steer its way through the global economic storm.

Gem Diamonds

Our view: Buy

Share price: 200p (-1.1p)

To decide whether or not to back Gem Diamonds, you need to look at the trends in the broader diamond market. And happily for the company, which said yesterday that it was pushing ahead with the expansion of its Letseng mine in Lesotho, we had some positive indications about the the goings-on in the wider market the other week.

As the analysts at Northland pointed out, the jewellery retailer Tiffany & Co recently quashed the speculation surrounding a possible slowdown in Chinese demand for diamonds with its trading update.

That bodes well for the wider market. The news on expanding Letseng, meanwhile, bodes well for Gem's ability to capitalise on the growth in the market. Again, Northland highlighted the limited production upside relative to a rival like Petra Diamonds; expanding Letseng will help in the near term, even if, as the analysts also point out, Gem "lacks the diversity of mine structures and deposits of Petra". So, buy for now, but keep a close eye on it.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies