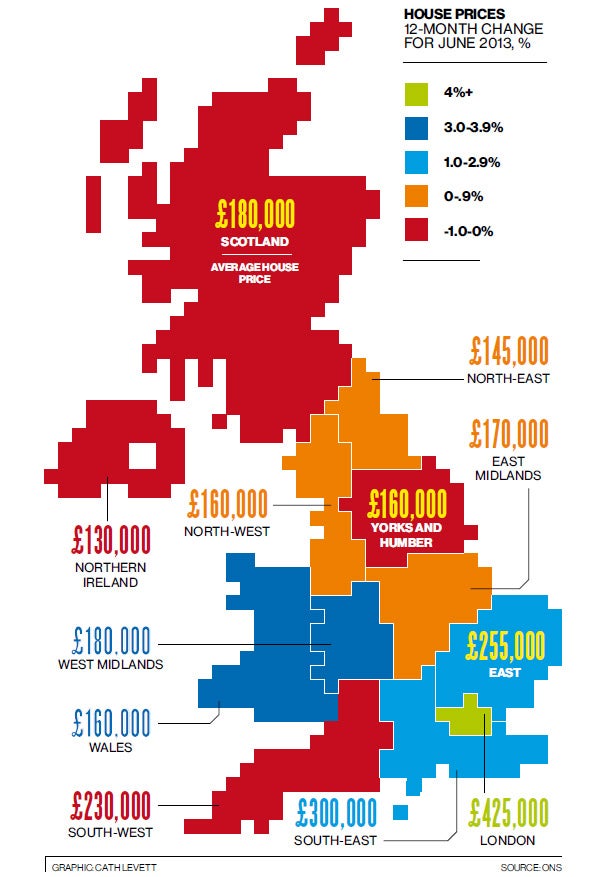

House prices picking up – but beware the north-south divide

Government hails rise as signal of economic recovery but critics fear a new property bubble

Britain’s housing market is coming back to life, after being almost halted by the banking crisis – but its revival is widening the north-south divide and stoking fears of the economy overheating.

Click image above to enlarge graphic

London’s house prices are rising at an 8.1 per cent annual rate, according to the latest figures, but in Scotland prices are falling by 0.9 per cent, and in Northern Ireland by 0.4 per cent.

The figures from the Office for National Statistics, covering the year to June, were hailed by the Government as evidence of an economic revival. Ministers were also buoyed by the public interest shown in George Osborne’s Help to Buy scheme, introduced in April, under which buyers of newly built homes with values up to £600,000 are eligible for a government loan worth a quarter of the price, on which they pay no interest for five years.

The scheme has attracted 10,000 applicants in four months. But it has been criticised on the grounds that it has increased the sums that potential buyers can borrow, which could contribute to another house price bubble.

Labour’s housing spokesman, Jack Dromey, warned: “David Cameron’s Government has presided over the lowest level of homes built than any other peacetime government since the 1920s. Their failure to build the affordable homes the country needs means there is real concern that this scheme will do little to bring the cost of housing within the reach of low- and middle-income earners.”

Merryn Somerset Webb, the editor-in-chief of Money Week, told the BBC: “I tend to think rising house prices are terrible news. It’s an entirely unproductive part of the economy.”

And Matthew Pointon, a property economist at Capital Economics, said: “Government boasts that their schemes to pump more credit into the housing market are now bearing fruit may soon come back to bite them, as housing costs become even more of a burden on stretched household finances. Meanwhile, more credit flowing into property means there is less available for the part of the economy that really does need it – businesses.”

Overall, house prices rose by an average of 3.1 per cent in the 12 months to June – but that figure was boosted by London and the South-east. Over the rest of the UK, the average rise was 1 per cent, because of the sluggish state of the markets in Scotland and Northern Ireland. Prices in Wales increased by 4.3 per cent.

The communities minister, Brandon Lewis, told the BBC: “There’s a real historical situation in our country where the house is probably the biggest asset anybody owns. It’s certainly one of the most expensive for most people and therefore they want to believe and understand they’ve got strong equity in that and good value in it. So rising house prices do make people generally feel better.”

The Communities Secretary, Eric Pickles, said: “This Government’s package of measures to boost the housing market is working, with housebuilding and housing supply on the up.”

The Help to Buy scheme is hugely popular with construction companies because it makes newly built houses easier to sell. The Home Builders Federation described it yesterday as “an unqualified success”.

The wrong medicine: ‘Boost supply, not demand’

Jonathan Portes

Director, National Institute for Social and Economic research

The first part of the scheme, for new-build houses, is already in place and has probably had some positive impact. But I don’t think there’s any case for the second part of the policy, to be introduced in January, essentially to subsidise higher loan-to-value mortgages. This was a bad idea in the first place, even before the market picked up. It was always likely to do more for demand than supply, and hence lead to a rise in prices, the last thing the UK needs over the medium term. We need more houses, not higher house prices, so the objective of policy ought to be to increase supply not boost demand. I think this policy risks fuelling an unbalanced recovery led by consumption and rises in houses prices – rather than increases in exports and investment.

Scott Corfe

Senior economist, Centre for Economics and Business Research

There’s certainly a risk the measure could boost demand, rather than supply and could see a mini house-price boom. The latest data from the ONS shows some pick-up in house building activity – but it’s hard to tell whether that’s enough to prevent prices increasing.

The second part of the Help to Buy scheme is going to make it easier to get mortgages, so one would assume that would contribute to demand. Our view at the moment is you could get something of a mini-cycle, with a pick-up this year and into 2014. Prices may come down in 2015 once the government cuts have come in.

Peter Bolton King

Global residential director, Royal Institution of Chartered Surveyors

The first part of the scheme has had a two-fold effect: it has helped the construction industry, which has been in an appalling condition, and given people a step on to the property ladder. There’s no doubt that this has been a success.

The jury’s out on the second phase, but there is certainly a risk that in some places in the UK it could stoke house prices. Parts of the country will react differently: a lot of people up North have welcomed the scheme because they’re keen to see the market moving; but in London and the South-east that help isn’t needed.

Dr Howard Archer

Chief European & UK economist, IHS Global Insight

We do not expect house prices to race ahead in the near term, given likely extended low earnings growth and the fact that the housing market activity is currently still substantially below pre-crisis levels. Nevertheless, there is a serious and mounting concern that the Help to Buy mortgage guarantee scheme could eventually fuel a housing price bubble.

Carl Astorri

Senior economic adviser, EY ITEM Club

I don’t think that the Help to Buy Scheme should be dropped. The economy is in the early stages of a recovery and real output is still 3.3 per cent below its 2008 peak. House price growth will be faster than average earnings growth, but not dramatically so.

As a result, it’s unlikely the house price to income ratio will hit the highs seen at the peak of the bubble in 2007. Indeed, even allowing for the house price rises, residential property will still be 17 per cent cheaper in 2015 than it was at the peak of the bubble.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies