Household bills 'poised for biggest rise since the 1980s'

The UK is facing the most extreme price rises since the early Eighties including, economists are warning, household energy bills soon rising above £1,400 per year.

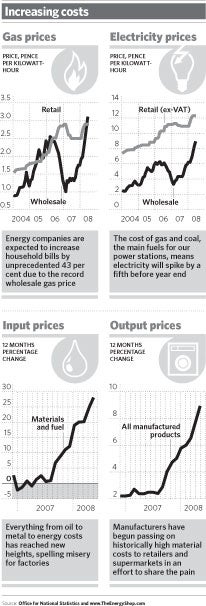

The UK is facing "the weakest period of economic growth since 1992", analysts said, after the Office of National Statistics revealed that factories have seen the cost of basic materials, from metal and oil to energy and basic food ingredients, jump by 27.9 per cent in a year.

The rises have already led to increasing prices as the country's manufacturers seek to offset some of the pain. The prices they are charging their customers for the end products, from washing machines to bicycles, surged 8.9 per cent over the same time a year ago.

"These are really awful numbers," said Philip Shaw, an economist at Investec Securities. "On some measures, you have to go back to 1982 to find numbers that are higher. Whenever you are making comparisons to the 1980s, you know something is going wrong."

He predicted that the rapidly rising prices, driven in large part by a surge in commodity prices, most notably oil, and a drop in housing prices meant that the UK was entering "the weakest period of economic growth since 1992". The situation has been made worse by a sharp fall in the value of the pound, which has lost more than 12 per cent from the high it reached against other currencies last summer. This is comparable to the value it lost in the months following Black Wednesday in 1992 when sterling was ejected from the European Exchange Rate Mechanism.

How much pain will be felt by the man in the street depends on how aggressively retailers and supermarkets – who are buying the factories' more expensive wares – foist their rising costs on to customers, who have already begun tightening their belts.

Some economists have predicted that retailers will absorb much of the increases in order to keep prices low and people shopping. They warned, however, that the country should brace itself for a far heavier, and less avoidable, shock: energy bills.

A ray of hope emerged last night when Saudi Arabia announced plans to call a meeting of oil producing nations and consumers to discuss how to limit prices.

Iyad Madani, the Saudi Information and Culture Minister, said after the Cabinet's weekly meeting: "There is no justification for the current rise in prices." He said Saudi Arabia would work to ensure there would be no "unwarranted and unnatural oil price hikes that could affect international economies, especially those of developing countries."

The wholesale price of gas for delivery next winter touched a new all-time high of 101p per therm yesterday, more than twice the level it reached last June. Joe Malinowksi, head of www.theenergyshop.com, said the spike will force energy companies to raise household gas bills by an average of about 43 per cent before the year is out, and electricity prices by at least 20 per cent. Spot gas prices, which is the price of gas bought on the day, have spiked to 60p per therm, also about twice the typical rate last summer.

"The companies don't have any choice now," said Mr Malinowksi, who urged people to lock in long-term fixed-rate energy deals now before the increases come, likely to be toward the end of summer.

Assuming the energy companies do raise tariffs – which would come on top of the aggressive round of increases earlier this year – the average household energy bill would break through the threshold of £1,400 per year. There is little hope for relief. Wholesale gas prices are indexed to the oil price, which relaxed only slightly yesterday from the all-time high of $139.12 per barrel that it reached last week – more than double what it was a year ago.

Energy industry executives have become increasingly vocal about the need for further price rises. They are trying to persuade users around the world to get used to the fact that cheap and plentiful energy will never return.

For the UK, the rapidly dwindling reserves in the North Sea mean that this year the country will import roughly 40 per cent of its gas, up from just over a quarter last year.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies