Budget to close Jersey's hidden mail-order VAT loophole

George Osborne is preparing a crackdown on the flood of DVDs and cheap goods coming into the UK from the Channel Islands, undercutting high street shops.

His Budget speech on Wednesday will include a promise to tighten a loophole, which is allowing vast numbers of traders, including multinational firms, to sell goods over the internet free of VAT.

The dodge, which is legal, is costing the treasury hundreds of millions in unpaid tax. Its damaging effect has been increased by the raising of VAT to 20 per cent, making it impossible for high street stores to match the prices of goods sold out of warehouses on Jersey and Guernsey.

It relies on a quirk in the tax law called Low Value Consignment Relief (LVCR), which exempts goods worth less than £18 imported from outside the EU from VAT because it is assumed the cost of collection would not be worth the revenue raised.

When Britain joined what was then the Common Market, in 1972, a clause in the accession treaty placed Jersey and Guernsey outside the EU for tax purposes, to protect the islands' trade in fresh flowers and perishable goods.

The anomaly is being exploited by businesses such as Amazon, Asda, HMV and Tesco. The treasury believes the trade cost them £130 million in lost VAT in 2010 alone, but others believe the figure is much higher.

Richard Allen, of the pressure group Retailers Against VAT Abuse Schemes, said: "The government figure is ridiculous. They quoted a figure of £80m in 2005. You have only to look at the increase in sales online since then to know the government figure is ridiculous. We think its £165 million on DVDs and CDs alone."

He cited an estimate that up to 96 per cent of mail order sales of DVDs and CDs were being dispatched offshore to avoid VAT. The offshore trade in computer memory cards is probably even more lucrative. A whole range of other goods including computer accessories, contact lenses, plant bulbs, and cosmetics are escaping VAT through the same loophole.

Last month, Chris Holgate, owner of Devon-based stationers Refresh Cartridges, which relies heavily on web sales, told the BBC that if the loophole was not closed, he would have to consider sacking his staff and relocating in Jersey. "It's very difficult to grow a business when you are being handcuffed in such a fashion," he said.

Ian McCord, co-founder of Martian Records, which has shops in Exeter, Exmouth, Taunton and Weston-super-Mare, has written to his local MP, Ben Bradshaw, protesting about the off shore trade. He said: "Independent record shops are facing death by 1,000 cuts. VAT-free shopping is part of that, along with high rents and rates and competition from supermarkets."

Two years ago, the health food chain Holland & Barrett complained about mail order firms selling specialist food supplements and herbal remedies out of the Channel Islands. It was calculated that a firm set up in the Channel Islands in 2008 had cornered more than a fifth of the entire non-store UK market in vitamins and dietary supplements within its first year.

In 2006, the Jersey authorities tried to clamp down on the trade by ordering 17 companies to quit the island. In March 2007, Tesco was similarly forced to remove its CD and DVD mail order business.

Though it is widely known that goods sold online from Jersey and Guernsey are cheaper than in the shops, few people outside the islands understand why. When the treasury minister, Lord Sassoon, was asked about LVCR in the Lords this month, he had to admit that before he could answer he had to find out what it was.

He said: "We are reviewing the operation of this relief. Ministers hope to be in a position to announce any possible changes to LVCR in the Budget."

The legacy of Charles II – the Channel islands' 'tax havens'

* Ever since Charles II granted Jersey the right to raise its own taxes, the Channel Islands have enjoyed a large degree of autonomy over how they raise their revenues and who they tell about it. As a result, the Crown Dependencies have carved out lucrative niches for those seeking to minimise their tax bill.

Both Jersey and Guernsey are home to a bewildering array of off-shore companies, which benefit from the islands' famously low rates of direct taxation. On Jersey, there is no capital gains tax and a corporate tax rate of 10 per cent. There is a similar structure in Guernsey. Unsurprisingly, financial services play a huge role in the Channel Islands' economy, accounting for between 30 and 50 per cent of income. But campaigners say it is the lack of transparency about what assets are held on the islands – and by whom – that is the problem. According to one estimate, the super-rich have placed assets worth £250bn in Jersey to avoid tax. Legislators on both islands bridle at the term "tax haven" and insist they have improved disclosure and tightened regulations. Campaigners disagree and have put Jersey 11th and Guernsey 13th on a list of what they claim are the world's most secretive tax jurisdictions.

Fuel

The Middle East crisis has driven up the cost of fuel, which is expected to continue rising. Mr Osborne said yesterday he was "looking very carefully" at freezing the duty on fuel, which is due to rise by 5p a litre.

Income tax

Mr Osborne is expected to announce that he is merging income tax and National Insurance. This is a political risk because it means the basic rate will be 32p instead of 20p, and the higher rate (up to £150,000) will be 52p instead of 40p.

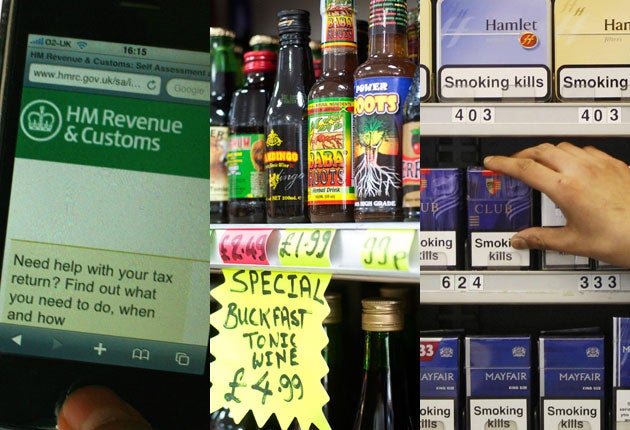

Alcohol

Duty on alcohol is expected to go up by more than the rate of inflation, again, which could put up the price of beer by 3p a pint. Some brewers fear it could be more. But the duty on low-strength beer is likely to be cut.

Cigarettes

The tax on tobacco is seen as both a useful earner for the Treasury and a way of deterring people from persisting with a harmful habit, so another 17p of duty on a packet of cigarettes is to be expected.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies