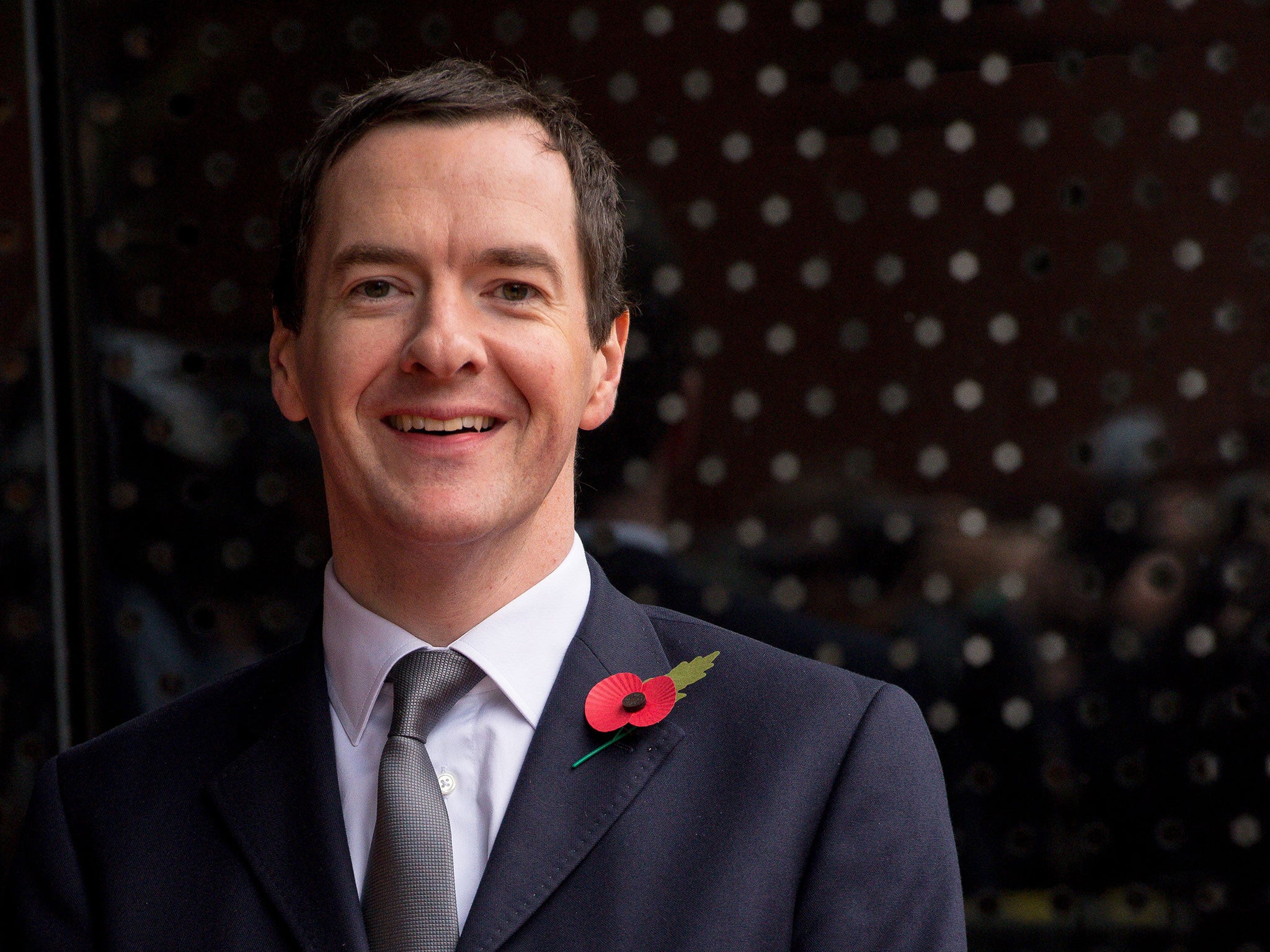

Tax credit cuts: George Osborne won’t blink in the row, but he may give his critics a wink

I suspect he will fast-track the rise in the personal tax allowance to help the lowest paid

When Amber Rudd, the Energy and Climate Change Secretary, spoke to Westminster journalists nine days ago, she exuded confidence as she answered questions well beyond her own brief. Although she ruled out standing for the Conservative Party leadership, several hacks were so impressed that they added her to their list of candidates to succeed David Cameron when he stands down before the 2020 general election.

A few hours later, Ms Rudd learnt that politics is a game of snakes and ladders. She was suddenly left speechless on the BBC’s Question Time programme by a tearful Michelle Dorrell, a now former Tory voter who protested that she and her children would not make ends meet when her tax credits are cut next April.

That emotional TV clip will be played again over the coming week, when the Government’s £4.4bn cuts to the state-funded wages top-ups will be centre stage. On 26 October, the House of Lords may vote for the cuts to be phased in over three years, or even blocked completely. A constitutional clash looms because ministers claim that peers have no right to amend a financial measure backed by MPs. Some peers claim they have every right because the cuts are being railroaded through. There are dark threats from ministers to curtail the powers of the Lords. On 29 October, the Commons will debate the cuts, giving a platform to the growing number of Tory MPs who are nervous about them.

George Osborne, who announced the squeeze in his July Budget, has also been playing snakes and ladders. Like his former parliamentary aide Ms Rudd, he is not enjoying it. After the Budget, he was anointed David Cameron’s heir apparent in the Westminster village. But times change quickly, and the front-runner in any race are a target. So potential rivals for the Tory crown, notably Boris Johnson, are calling for a change of heart on tax credits. One Tory critic of the Chancellor warned that he is “digging himself deeper into a hole” and would “bury his own leadership prospects unless he backs down.” Another opponent said: “Tax credit cuts are his baby. He will not be able to escape the blame if this becomes our poll tax.”

Margaret Thatcher’s refusal to budge over her hated flat-rate charge for council-run services led to her downfall in 1990. However, there are other lessons from the Thatcher era. Mr Osborne will want to show the same steel as the Iron Lady, and will not want to hand victory to his Labour and Tory critics. He knows that her Chancellor Sir Geoffrey Howe, who died this month, received plaudits for getting the pain of his cuts out of the way early in the parliament, a useful model for the 2020 election.

Perhaps a more accurate parallel is Gordon Brown’s insistence in 2007 that there would be no losers from his decision to scrap the 10p bottom rate of income tax, which hit low earners like the current tax credit cuts. He was forced to make a very expensive U-turn to compensate the losers.

There is another dangerous parallel in some Tory minds: Nick Clegg allowing the Coalition Government to treble university tuition fees. It wasn’t so much the policy as his broken election promise. Asked about tax credit cuts during this year’s election campaign, Mr Cameron replied: “No, I don’t want to do that.” He has not been crucified like Mr Clegg yet, because the letters to individuals outlining next April’s cuts have not been sent out. But his answer could become another damaging clip that is played again and again on our TV screens. If that happened, it would cut through to many more people than the losers. It could undermine the Tories’ attempt to portray themselves as the “party of working people” and revive their image as the “party of the rich.” These welfare cuts cannot be billed as hitting the “scroungers” because they will hit the “strivers” the Tories purport to champion.

Mr Osborne insists that the figures from think tanks, pointing to losses of more than £1,000 a year for three million people, are misleading because they do not take account of the £7.20 an hour national living wage he will introduce next April and the rise in the personal tax allowance to £10,800 at the same time. The Chancellor rejects the idea that his higher wages floor was a Budget firework display to divert attention from his nasty tax credit cuts. He insists that it is the start of a fundamental shift to a higher wage economy with lower taxes and lower welfare bills for taxpayers. That shift is welcome, since it doesn’t make sense for the state to subsidise poverty pay.

Yet something must be done take the calm the storm over tax credits and Mr Osborne knows it. This affair could knock him off his perch as leader-in-waiting. He has already been lucky enough to get a second chance. His “omnishambles Budget” of 2012 appeared to have killed off his leadership ambitions, but he bounced back. If he does not defuse the tax credit bombshell in his autumn statement on November 25, he may not get a third chance.

He does not want to make a U-turn that would undermine both his central mission of clearing the deficit and his reputation for taking tough decisions. So he won’t blink on tax credits. Instead, he will wink at the Tory MPs whose support he covets in order to succeed Mr Cameron. I suspect he will announce a separate measure to help the low paid most affected by the tax credit squeeze, perhaps by fast-tracking the rise in the personal tax allowance; taking some workers out of national insurance (a 12 per cent tax once people earn £8,060 a year) or raising the living wage further and faster.

In other words, Mr Osborne will try to have it both ways.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies