'Money manager to the stars' is accused of $30m Ponzi scheme

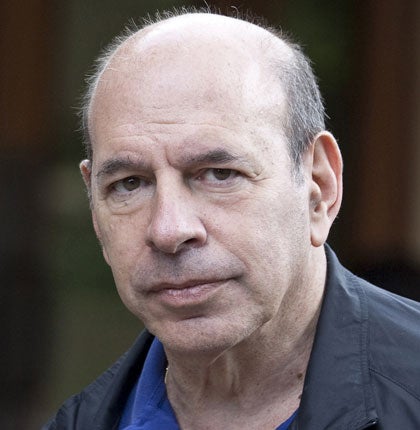

Kenneth Starr – whose clients include Uma Thurman and Martin Scorsese – has been arrested in New York. Guy Adams reports

He called himself the money manager to the stars, but he may turn out to be their Bernie Madoff.

A financial advisor who looks after the fortunes of a slew of Hollywood celebrities has been arrested and charged with stealing tens of millions of dollars from his clients in an elaborate Ponzi scheme.

Kenneth Starr, whose clients ranged from Al Pacino and Goldie Hawn to Ron Howard and Martin Scorsese, is accused of using his access to the rich and famous to "burnish an image of trustworthiness" as he secretly siphoned at least $30m [£20.6m] from their investment accounts.

He was detained at dawn on Thursday and denied bail. According to prosecutors, Starr used the stolen funds to buy a lavish New York apartment, enrich influential friends, and get a job with a record label for his wife Diane Passage, a former stripper and nightclub pole-dancer who aspired to a career in show business.

The criminal complaint alleges that Starr cultivated an image of exclusivity around his firm, and told his clients that its investments were a "sure deal". But he was actually using their cash to finance his lavish lifestyle, and sometimes transferred it directly to his own bank account.

If one investor started asking awkward questions, or wanted to withdraw funds, Starr allegedly used money from other client accounts to cover the shortfall. According to the Securities and Exchange Commission, he was looking after a total of $700m for 30 "high-net-worth" clients and 175 others.

One alleged victim, named in the document as "client number two," has been widely identified as the actress Uma Thurman. She marched into Starr's Manhattan offices on 26 April, demanding access to $1m which had disappeared from her account in murky circumstances. It was paid back within 24 hours.

Prosecutors claim, however, that Starr repaid Thurman with money belonging to a different client, "a former talent agent and his wife". That man has been identified by the US media as James Wiatt, the former head of William Morris.

As rumours of trouble at Starr's firm, Starr Investment Advisors, began to circulate in Hollywood earlier this year, several investors pulled out, including film director Mike Nichols and photographer Annie Leibovitz, who has been suffering widely reported financial problems. "News of Ken Starr's arrest does not come as a great surprise to me," she said yesterday. "I will follow this story with great interest."

The big question now concerns what has become of the money that Starr's other clients invested with him. Prosecutors say it is "very likely" that further victims of fraud will emerge. So far they know of at least three more: a former hedge-fund manager turned well-known philanthropist, an heiress and a prominent jeweller with a store in New York.

Other former investors in Starr's fund who have identified by the media (but who have not yet been named as actual victims) include Henry Kissinger, Caroline Kennedy and Candice Bergen. The actors Wesley Snipes and Sylvester Stallone have previously been linked to his firm, but do not seem to have had money in accounts at the time of his arrest.

Starr, 66, is not the same Kenneth Starr as the attorney who investigated Bill Clinton's marital infidelities, but he is a qualified lawyer. He will be charged with wire fraud, investment adviser fraud and money laundering, and (if found guilty) could face a maximum of 48 years in prison.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies