Age at which struggling first-time buyers can finally trade up rises to 40

The average age at which first-time home buyers trade up to a new property has risen to 40 – with younger owners trapped in homes they purchased before the recession of 2007.

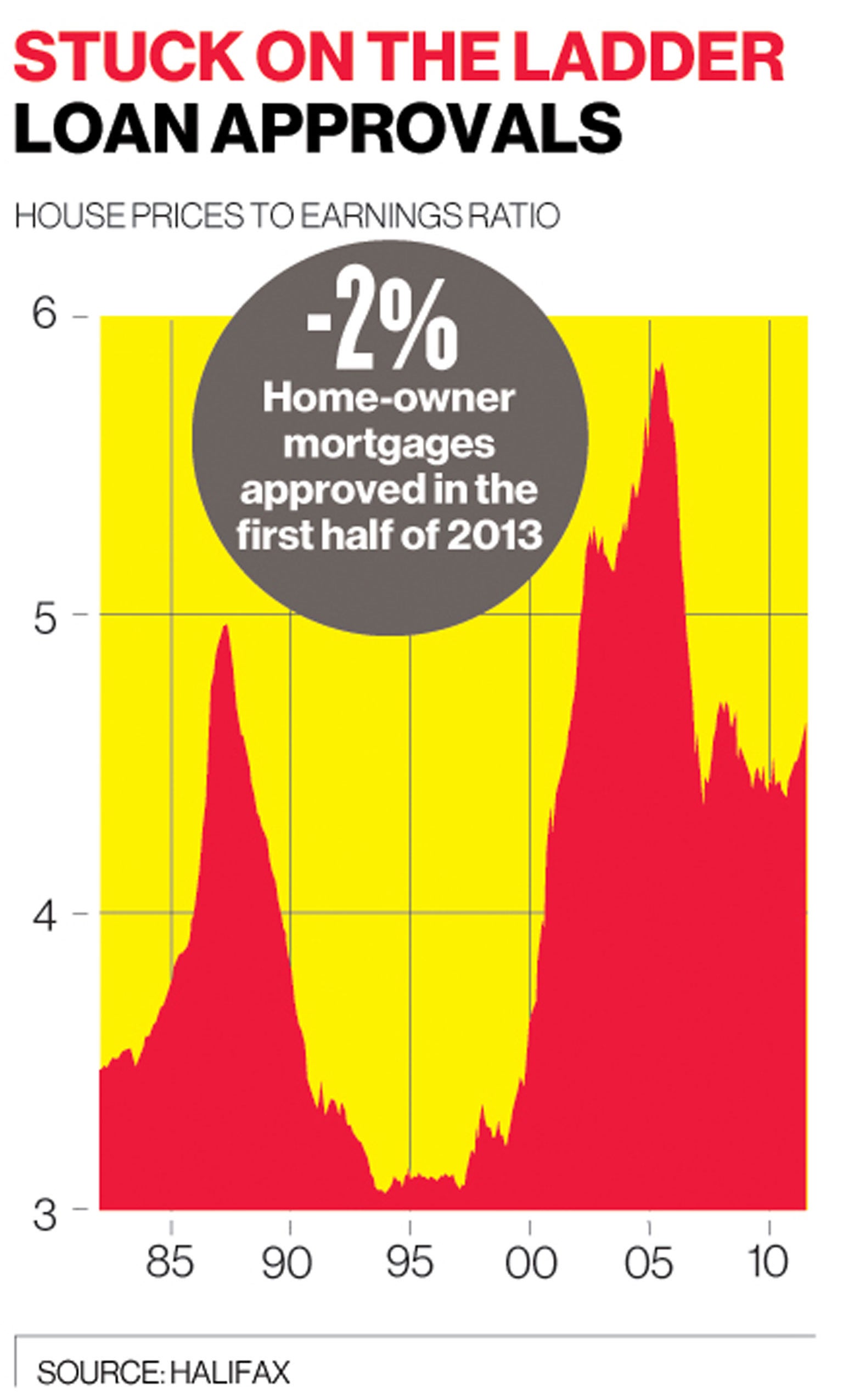

Figures also show that the number of approved home-owner mortgages dropped by 2 per cent in the first half of this year, despite those joining the housing ladder rising by a fifth – suggesting that government initiatives such as Help to Buy have increased the number of first-time buyers but young families are still struggling to move into bigger properties.

The data follows comments from Mark Carney, the Bank of England Governor, that he could use the new powers of the Bank’s Financial Policy Committee to curb surging house prices and uncontrollable mortgage lending in an attempt to stave off a housing bubble.

Mr Carney said he witnessed the “boom-bust cycle” first-hand while living in Britain during the 1990s and was “very alert to the damage it could do”. In an interview with the Daily Mail, he said the Bank would assess “emerging vulnerabilities” and could ask lenders to restrict borrowing terms or even force banks to hold more cash on their balance sheets to dampen down an overheated market.

Meanwhile, the Nationwide Building Society said house prices have risen 3.5 per cent in 2013, and climbed 1.4 per cent in the three months to August – the fastest increase in three years.

But figures from Lloyds TSB, released today, suggest the housing bubble is forcing young families to stay in first-time homes, years after acquiring them. The lender’s Home Movers’ Review showed the average age of a mover had risen from 37 in 2002 to 40 today, with most of the increase since 2007.

It said that while affordability had improved slightly for so-called “second steppers” – those looking to trade up from their first property – many of those who bought before the market crashed were still stuck in their homes.

Nitesh Patel, a housing economist at Lloyds TSB, said: “There are many potential second-steppers still in their first home, which they bought in the run-up to, and at the peak in house prices in 2007.

“Many may still be unable to move due to having very low, or negative, equity in their homes.”

The report said that many younger families had relied on having built up equity to be able to trade up.

The greater the difference between this “equity position” and the typical cost of a second home, the more difficult it is for potential buyers to get a mortgage to cover the cost of a move.

In June 2013 this difference was 4.4 times average annual earnings. London was the least affordable with a ratio of 5.7, with the East Midlands and West Midlands, both at 3.1, on the opposite end of the scale.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies