Property news roundup: Poor legal work causing problems for homeowners

Plus mortgage arrears, search by Travel Time, buying alone, and a guide to building regulations in brief

One in five legal complaints now made to the Ombudsman is about residential conveyancing which makes it the most complained about area of law, a new report reveals.

Chief Legal Ombudsman Adam Sampson says he is worried that a possible housing bubble may be at least partly responsible, putting pressure on lawyers to rush through house purchases to keep up with demand and consequently sacrificing quality of service.

Around 22 per cent of the residential conveyancing complaints received in the last year came from London and 17 per cent from the South East alone.

The report singles out problems with unpaid stamp duty as a particular issue with people receiving demands for thousands of pounds in unpaid fees plus interest because their lawyer had not made the necessary payments.

"It is concerning to see complaints from house buyers on the rise again," said Mr Sampson. "An improved housing market will inevitably be partly responsible, creating pressure through higher volumes of work, but I suspect there are a number of causes including procedural issues within firms and in some cases even fraudulent activity. Unfortunately, it is consumers who are paying the price.

"People deserve better and I want lawyers to ensure they aren’t leaving clients in the lurch. In the meantime anyone buying a house should seek confirmation of any payments entrusted to their lawyer before considering it a done deal."

Mortgage arrears

Mortgages in arrears fell during the first three months of 2014, according to new figures from the Council of Mortgage Lenders.

At 138,200 and 1.24 per cent, both the number and proportion of mortgages with arrears of more than 2.5 per cent of the mortgage balance were at their lowest level since 2008. At the end of March one in 400 mortgages had arrears equivalent to 10 per cent or more of the mortgage balance.

Search by travel time

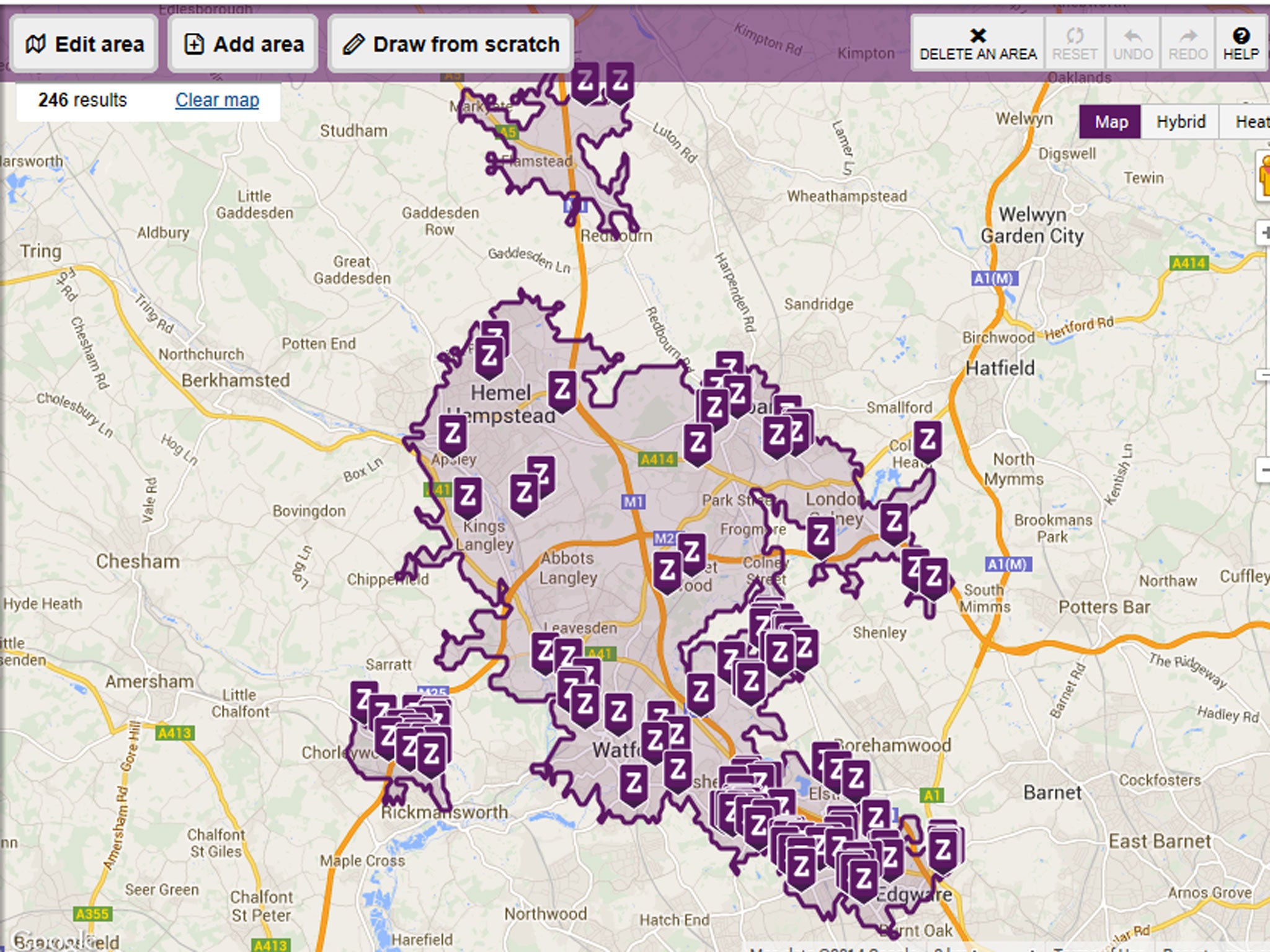

Zoopla has added a new way of searching its website called Travel Time, allowing homehunter to look for properties based on the travel time from a chosen property to work, school, or any other location by train, bus, driving, cycling and walking.

Buying alone

Single homebuyers have to find an extra £24,000 to afford their first property, according to figures from Move with Us, the UK’s largest network of independent estate agents has revealed.

Figures from its survey of 175 estate agents across Britain show that couples aged between 21 and 40 are the most popular type of buyer, accounting for 45 per cent of the buying market. Single people, in any age group, make up a total of just under three per cent of buyers.

Using Office for National Statistics statistics for average wages, Move with Use estimates that the most a typical single homebuyer can borrow is £119,250. With the average national price of a flat currently at £158,872 and with a 10 per cent deposit, this leaves a shortfall of just under £24,000.

Robin King, Director at Move with Us said: "Many potential homeowners are reliant on the bank of mum and dad to make up the deficit. More of an effort should be placed on creating affordable housing. Shared ownership is a feasible government incentive that people who are struggling to afford a home should give serious consideration."

Properties down, sales up

There was a drop in new property coming onto the market in April for the fourth consecutive month according the the RICS, although 26 per cent more chartered surveyors reported increased agreed sales. The average number of homes sold per surveyor was 23, the highest since February 2008.

'Building Regulations in Brief' now in eighth edition

Written by Ray Tricker and Samantha Alford, this book has undergone a comprehensive revision to include all the latest amendments to Building Regulations and Planning Permission, an updated list of fees for planning consents, and provides guidance on the changes to permitted development rights in agricultural, business and residential buildings. It's published by Routledge.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies