The UK economy is slowing - and whether that's because of Brexit or not, it makes Osborne look very bad indeed

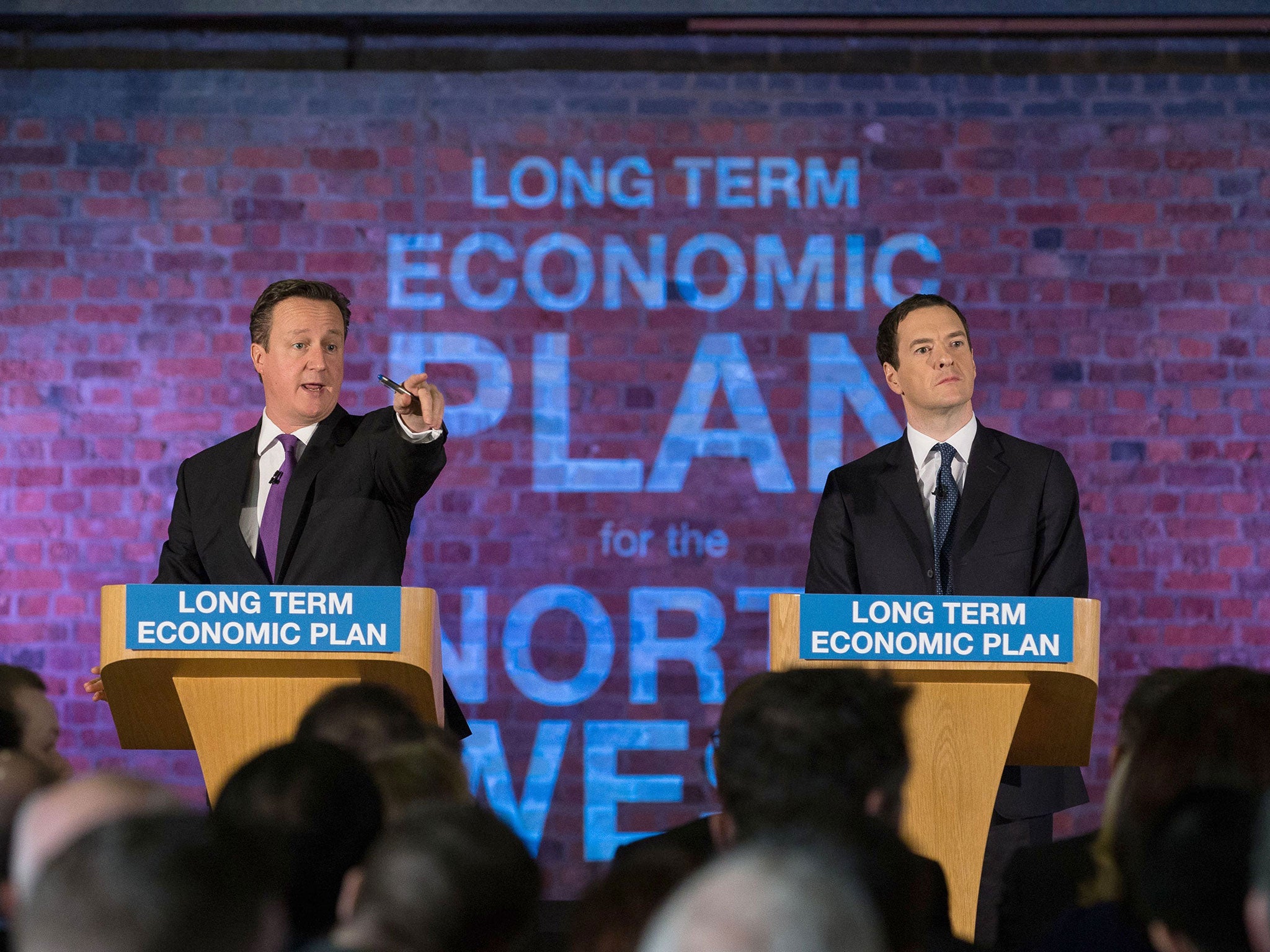

Slower growth, whatever the cause, is bad news for George Osborne. It puts in question his boast that Britain is the fastest-growing large economy. It isn’t anymore

Is the UK economy slowing because of fears of Brexit? That will be the key issue this week, with the judgement on Thursday by the Bank of England on what is happening to the economy likely to hit the headlines. That the economy is slowing is pretty much beyond doubt. Quite why is another matter.

Every three months the Bank produces its Inflation Report, a report not so much about inflation or indeed the lack of it, but rather about growth. It used to be eagerly awaited, as it would signal what might happen to interest rates – it coincides with a meeting of the monetary policy committee. Nowadays it is usually a dull affair, for there has been no change in rates for years and won’t one for a while yet. But this Thursday it will be given extra spice by two things: the slowdown in the economy and the possibility of Brexit.

The slowdown is real. Indeed some economists, for example the team at Barclays Bank, think there will be no growth in the UK economy this quarter. Hiring is slackening, decisions are being postponed. But there are, as so often in economics, two explanations. One is fear of Brexit and there will be a lot of speculation as to what the Bank might do in the event of a Leave vote next month. Cut rates, which are already at rock bottom, and which would hit savers even more? Is the Bank, which is supposed to be independent, quietly trying to massage opinion in favour of Remain?

Or is the main reason for the slowdown quite different? Is it instead fears by business of the additional costs of hiring people being lumped onto it, not just from the living wage, but from pension legislation, the apprenticeship levy, the additional charge on non-EU people who come in on working visas and so on? If so, this is bad news not just for job-seekers but for the Chancellor. Actually slower growth, whatever the cause, is bad news for George Osborne. It puts in question his boast that Britain is the fastest-growing large economy. It isn’t anymore.

That leads to the second story of the week. We will learn on Friday the growth rate for the Eurozone in the second quarter. Remember that our growth was estimated at 0.4 per cent. Well, we already have some Eurozone members growing faster than that - and it looks as though it will be 0.6 per cent.

So the sluggish Eurozone, despite all the things going wrong there, seems to have performed better than the vibrant UK. True, these are preliminary numbers and it is only one quarter. But you can see the story that Europe is growing faster than Britain, and how the Remain camp is sure to spin it.

The week will not entirely move in the direction of Europe, however - and that's story three. On Monday the so-called "eurogroup", the people who scrutinise what is happening in Greece, is having a special meeting in Brussels. The sole item on the agenda is how the country is performing relative to the targets imposed on it. It is unlikely to be a happy tale, and while things will be patched up until after the UK referendum, it will be reminder that Greece’s fate within the Eurozone is far from secure.

Story four will concern the US. Last Friday there were disappointing figures on job creation, and the dreaded R-word, recession, has started to appear again in the media. This week will be spent digesting that, with optimists looking for comfort from retail sales figures. Maybe the weaker dollar will put more demand into the economy. Maybe.

Finally, do you want to be a multi-millionaire? Go to Zimbabwe. It is introducing new dollar notes, as part of the move to getting rid of US dollars and South African rand, which have been the main currency for the past seven years. These new Zimbabwe dollars will supposedly be convertible into US ones. Let’s see what happens, but people will remember the beautiful five dollar notes of yesteryear - which sadly were worthless. Maybe Zimbabwe will have to learn again that you can’t print yourself rich.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies