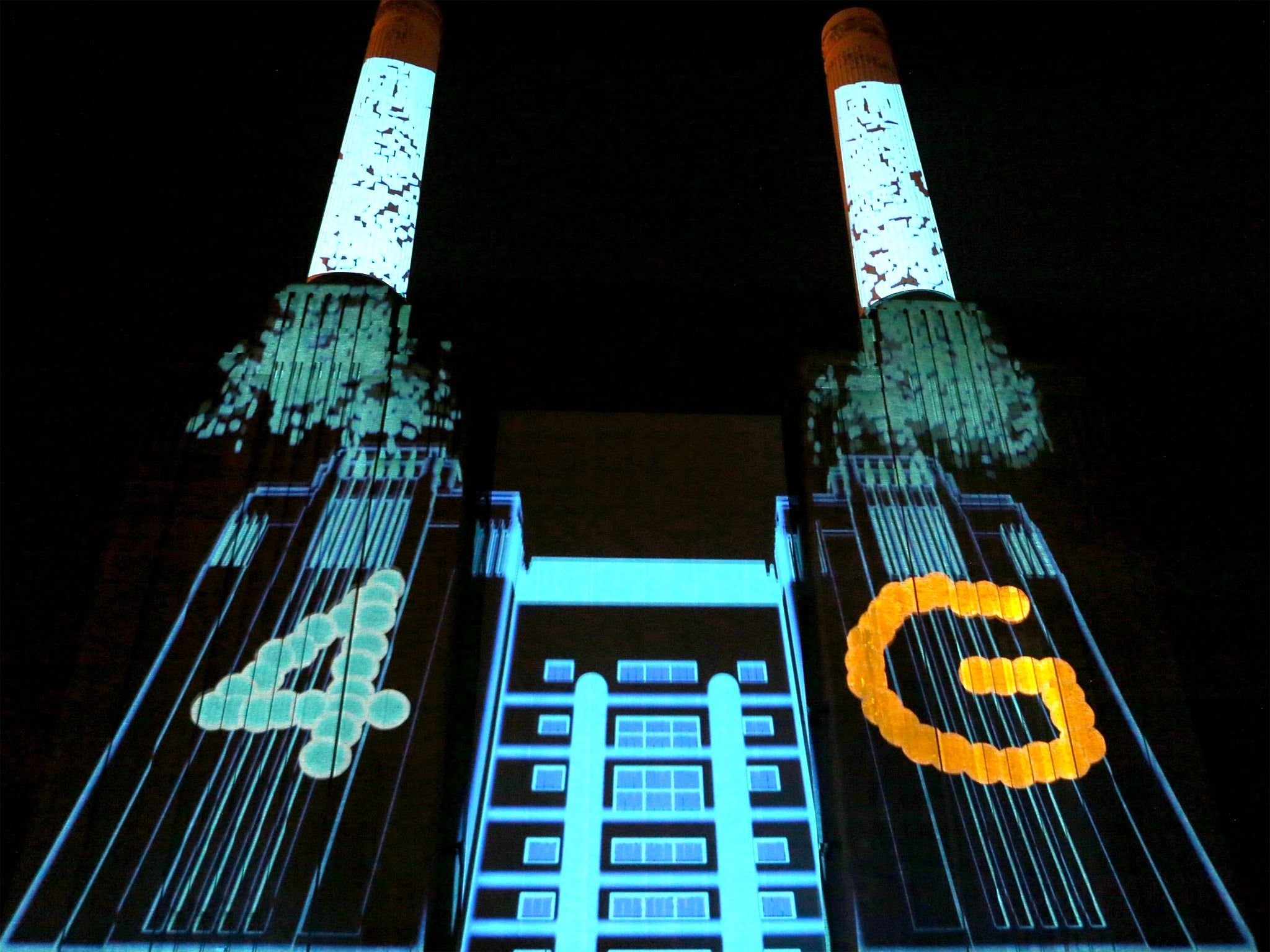

George Osborne's billion pound drop: 4G auction falls short of Treasury's budget

The Chancellor's plan to reduce the deficit relied on a hefty windfall from the sale of the 4G spectrum. But it hasn't worked out that way. So where does that leave the public finances?

The Chancellor stunned the House of Commons – and economists – in December when he stood at the Dispatch Box and boldly claimed that the Government’s fiscal deficit would fall this year. This was surprising because in every month since the beginning of the financial year in April 2012, official figures had shown public borrowing to be higher than in the corresponding month of the previous financial year, as the economy sank into a double-dip recession.

Wednesday did not bring good news for Mr Osborne: the Government, it was announced, had raised only £2.3bn from phone companies in the auction of 4G mobile phone licenses – casting fresh doubt on the Chancellor’s claim to be cutting the fiscal deficit in 2012/13.

When he made the claim, Mr Osborne had the support of the Treasury watchdog, the Office for Budget Responsibility. Total public borrowing, which came in at £121.4bn in 2011/12, was on course to register a modest fall to £119.9bn in 2012/13, the OBR said.

So how could this be possible given that the state’s borrowing bill had been growing month after month? An examination of the small print revealed that the watchdog had done two unusual things.

First, the OBR had assumed that government departments would spend £7.5bn less than their allotted budgets by the end of this year.

Second, it had assumed that the Treasury would raise £3.5bn from the 4G auction. (Some City analysts predicted it could hit £5bn.)

True, no one expected the mobile phone auction to raise anywhere near the staggering £22.5bn from the sale of 3G licences in 2000. In fact, the 4G sale had been carefully arranged to ensure that bidding would not spiral out of control again – which would ultimately hit consumers, through rising mobile phone bills. The 4G flop is good news in that regard, at least. But it leaves Mr Osborne desperately struggling to meet his commitment to cut the deficit.

Without the Chancellor’s neat trick – the two assumptions that hard-pressed Whitehall departments would spend even less than expected, and that the mobile phone auction would hit the £3.5bn target – this year’s deficit would instead have been projected to hit £131.9bn, up by almost £11bn.

Mr Osborne would have had to admit that public borrowing was actually increasing – a political embarrassment for the “austerity Chancellor”.

The announcement that the 4G auction has produced less than the Treasury and the OBR expected heightens the risk that the Chancellor will have to stand up in the Commons when he unveils his March Budget and announce that the deficit has instead grown in cash terms.

The OBR’s arguably generous assumptions last December left the Chancellor with only a tiny margin of £1.5bn with which to make good his claim of falling borrowing.

That has now been almost wiped out by the £1.2bn shortfall on the expected 4G revenues. And it would take only a further modest shortfall in tax revenues, or a slight increase in departmental spending relative to expectations, over the final four months of the financial year to wipe out this margin entirely.

The signs are not hopeful for the Chancellor. In December, government expenditure was slightly above the OBR’s forecasts for the remainder of the financial year and tax receipts were slightly below. We should get a clearer idea of the situation from the public finances figures for January, which will be released this morning. January is normally a bumper month for tax revenues because companies pay their corporation tax and individuals file their self-assessment income tax returns. Another severe disappointment here on revenues and the Chancellor’s deficit reduction hopes will be blown out of the water.

So why did the OBR get it wrong on the 4G auction, which was supposed to boost our public coffers? The watchdog points out that to make its estimate it used independent industry analyses, which were based on comparable 4G sales abroad. And it had always made clear that the projected revenues were “an area of particular uncertainty”.

But not everyone is convinced by that defence. John Redwood, the Conservative MP for Wokingham, said that the 4G error fits a pattern of the official forecaster being over-optimistic about Government revenues. “You can’t blame the Chancellor for it,” he told the BBC. “He deliberately made an independent budget office who are meant to know about these things and I’m afraid they’ve been consistently wrong.”

Whatever view one takes on the quality of the 4G auction forecasts, one thing is plain: the Chancellor’s chances of being able to stand up on Budget day next month and again stun the Commons by announcing that public borrowing is still falling have become much slimmer.

Ed Richards, Ofcom chief executive, said: “This is a positive outcome for competition in the UK, which will lead to faster and more widespread mobile broadband, and substantial benefits for consumers and businesses across the country. We are confident that the UK will be among the most competitive markets in the world for 4G services.

“4G coverage will extend far beyond that of existing 3G services, covering 98 per cent of the UK population indoors - and even more when outdoors - which is good news for parts of the country currently under-served by mobile broadband.”

Vodafone UK chief executive Guy Laurence said: “We’ve secured the low frequency mobile phone spectrum that will support the launch of our ultra-fast 4G service later this year. It will enable us to deliver services where people really want it, especially indoors. This is great news for our customers.”

Two forms lost their bids for licences: Hong Kong Telecom owner PCCW and private-equity backed Buckinghamshire-based firm MLL, which supports fixed and wireless services in the UK.

Telefónica’s deal requires it to provide coverage to 98 per cent of the UK population and at least 95 per cent of the population in each of the UK nations - England, Northern Ireland, Scotland and Wales - by the end of 2017 at the latest. BT said it did not intend to build a national mobile network.

BT chief executive Ian Livingston said: “Instead, this spectrum will complement our existing strategy of delivering a range of services using fixed and wireless broadband. We want our customers to enjoy the best possible connections wherever they are and this spectrum, together with our investment in fibre broadband, will help us achieve that.”

Olaf Swantee, chief executive of EE, said: “The acquisition of low and high frequency spectrum allows us to boost our superfast data services and coverage - indoors and outdoors, in cities and the countryside.

“This result means that we are perfectly placed to meet future data capacity demands - further enhancing the superfast 4G services we already offer the UK’s consumers and businesses.”

Ofcom predicted that demand for the mobile data could be 80 times higher than it is today by 2030 and it was planning for a further spectrum for possible future 5G mobile services. 4G services should make it much quicker to surf the web on mobiles, giving speeds close to home broadband services and allowing consumers to stream high-quality video, watch live TV and download large files.

Q&A: Long-term evolution - opening up the airwaves

Q. What is 4G?

A. It is short for fourth-generation mobile networks. 4G uses sophisticated technology known as LTE, or Long Term Evolution, which means much greater volumes of data can travel on existing frequencies.

Q. Why does it matter?

A. 4G allows super-fast mobile broadband, at speeds of up to 10 times the present 3G networks. It means watching video, surfing the web and making mobile payments will be smoother.

Q. Why was there an auction?

A. Spectrum has become available, thanks in part to the switching off of analogue TV. Ofcom manages the airwaves and wanted a wide range of 4G operators, allowing plenty of choice for consumers.

Q. Who won what and how much did they spend?

A. Five players spent £2.34bn. The existing pecking order with the “Big Three” remains largely intact as they spent the most. Vodafone paid £791m, EE (which includes T-Mobile and Orange) £589m, and O2 £550m. Three, the UK’s fourth and smallest mobile player, stumped up £225m. BT also emerged as a niche player, grabbing a slice for £186m.

Q. Why is BT getting into 4G when it doesn’t have a mobile network?

A. Britain’s biggest telecom company doesn’t offer mobile to consumers — it spun off Cellnet, which became O2, more than a decade ago — but it wants 4G for its corporate mobile customers. Some consumers should also get a better broadband signal as 4G can boost a wireless fixed-line service such as Wi-Fi.

Q. Why didn’t the auction raise more money?

A. Everyone knows the mobile companies overpaid when the 3G auction in 2000 brought in £22.5bn. Ofcom arranged this auction so bids did not rocket out of control — partly so that consumers would not be landed with much higher bills.

Q. Was George Osborne over-optimistic when he pencilled in a £3.5bn windfall?

A. Perhaps. But the mobile market is complicated and a similar auction in the Netherlands, a much smaller country, smashed forecasts and brought in £3bn last December. Ofcom ensured the UK auction was calm and steady.

Q. Is it bad news if the Treasury only got £2.34bn?

A. Not for consumers. Mobile operators will not have to pass on big costs, so all of us face less of a rise in phone bills. This should be good for Britain’s economic prospects as mobile and broadband play an increasingly important part in our lives.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies