Interest rises in battle of current accounts

The Nationwide building society has sent a fresh challenge to banks in the war to win your custom.

Would you switch current accounts for the promise of 5 per cent interest? Nationwide hopes you will, as it yesterday began offering that rate on its FlexDirect account.

The move sends a challenge to current account providers to match or better the offer. Banking analyst Andrew Hagger of Moneycomms said: "Because savings rates are so poor, I think we may see many more examples where credit interest is used as the carrot to tempt people to switch bank accounts."

Yesterday's revamp of the account by Nationwide makes it a far more attractive proposition than when it first launched last November.

"With savings rates in free fall, the 5 per cent credit rate for year one is a clever and well-timed move and will undoubtedly appeal to those with a bank account paying nothing," said Mr Hagger.

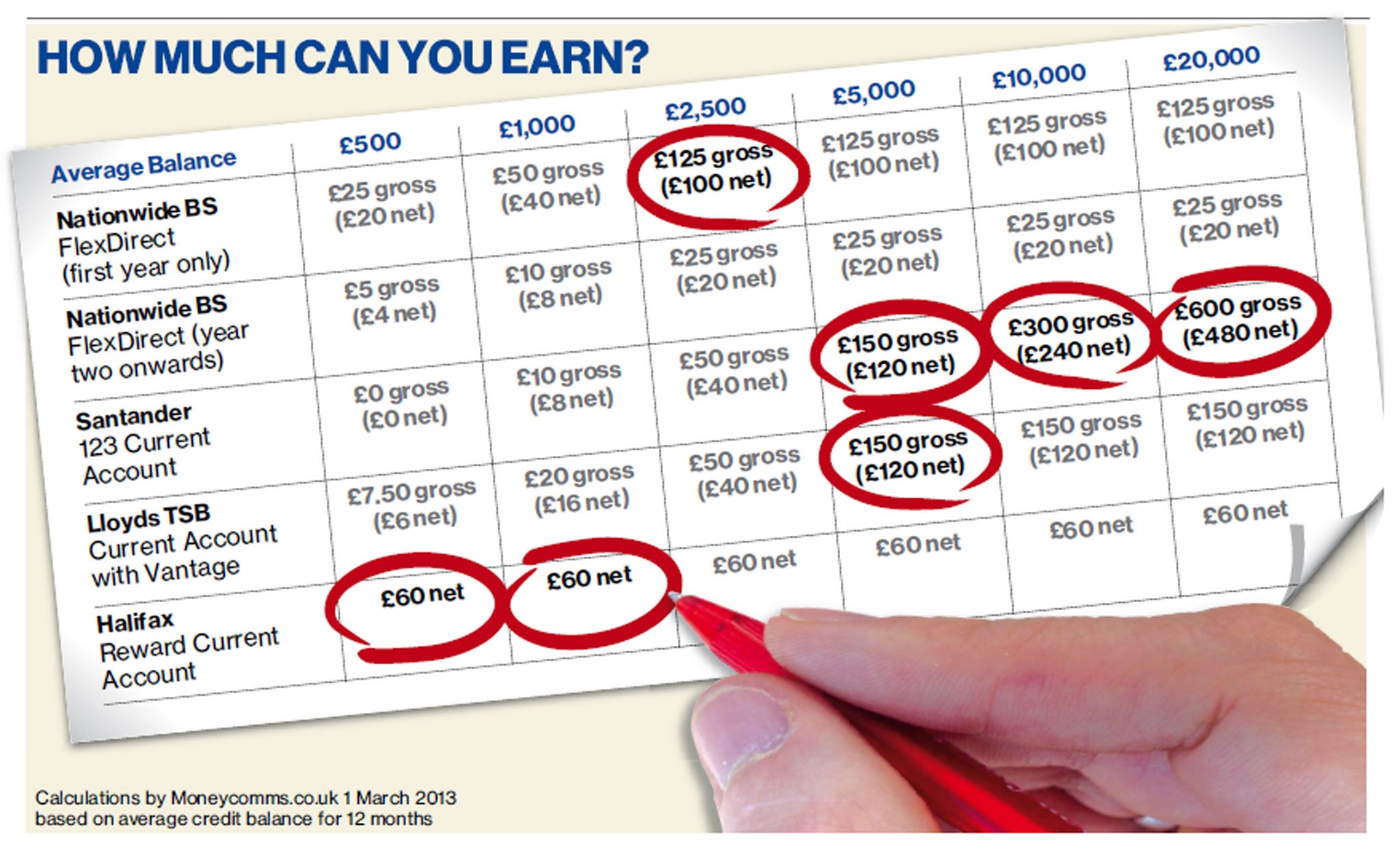

But, as you can see from our graphic, you can already get better deals elsewhere. Halifax's Reward account, for instance, pays more interest than Nationwide on balances of £1,000 or below.

Even more crucially for those tempted by Nationwide's new offering is the fact that it ends after just a year. Then the rate slips back to just 1 per cent, which means returns then become somewhat paltry and hardly worth bothering with.

Savings expert Anna Bowes of SavingsChampion.co.uk says the move is good in the short term for savers, but that the account in itself is gimmicky and doesn't offer enough.

"At a time when the rates on savings accounts are tumbling, the headline rate on this account certainly draws attention," she said. "But it's a bit of a gimmick really as you'll only be able to earn the fantastic 5 per cent rate on £2,500."

One good point is that the same high rate is paid on balances from £1 but the maximum interest you can earn in a year is £125 before tax, and that's only if you maintain a £2,500 balance for the whole year.

"And as there's no interest to be earned on balances higher than £2,500, it's a bit fiddly to make the account work to its optimum as a savings account," Ms Bowes said.

If you're in the unlikely position of regularly keeping more than £2,500 in your current account then you'll get better returns with Santander's 1 2 3 account.

While it pays no interest on balances less than £1,000, it adds 3 per cent to balances of £3,000 and above. However it does have an annual fee of £24, which is a major drawback.

It's also crucial when considering different current accounts to look at charges. Nationwide has improved the terms on its FlexDirect by cutting the daily overdraft fees from £1 to 50p per day. But daily fees can work out more expensive than monthly charges, points out Andrew Hagger.

"Although the daily fee tariff is becoming more common and is easier to understand, it does work out expensive for small overdrafts," he said.

For example a 50p charge for a £500 overdraft for one day works out at more than 36 per cent as an interest rate. But for larger overdrafts the tariff is better value with 50p for a £2,000 overdraft working out at less than 10 per cent in interest terms.

If you're really keen to get credit interest on your current account then Santander's 1 2 3 account still looks the best prospect. The £2 monthly fee can quickly be offset by the cashbacks paid on direct debit payments.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies