Mark Dampier: Europe prospects up despite pressure

The Analyst

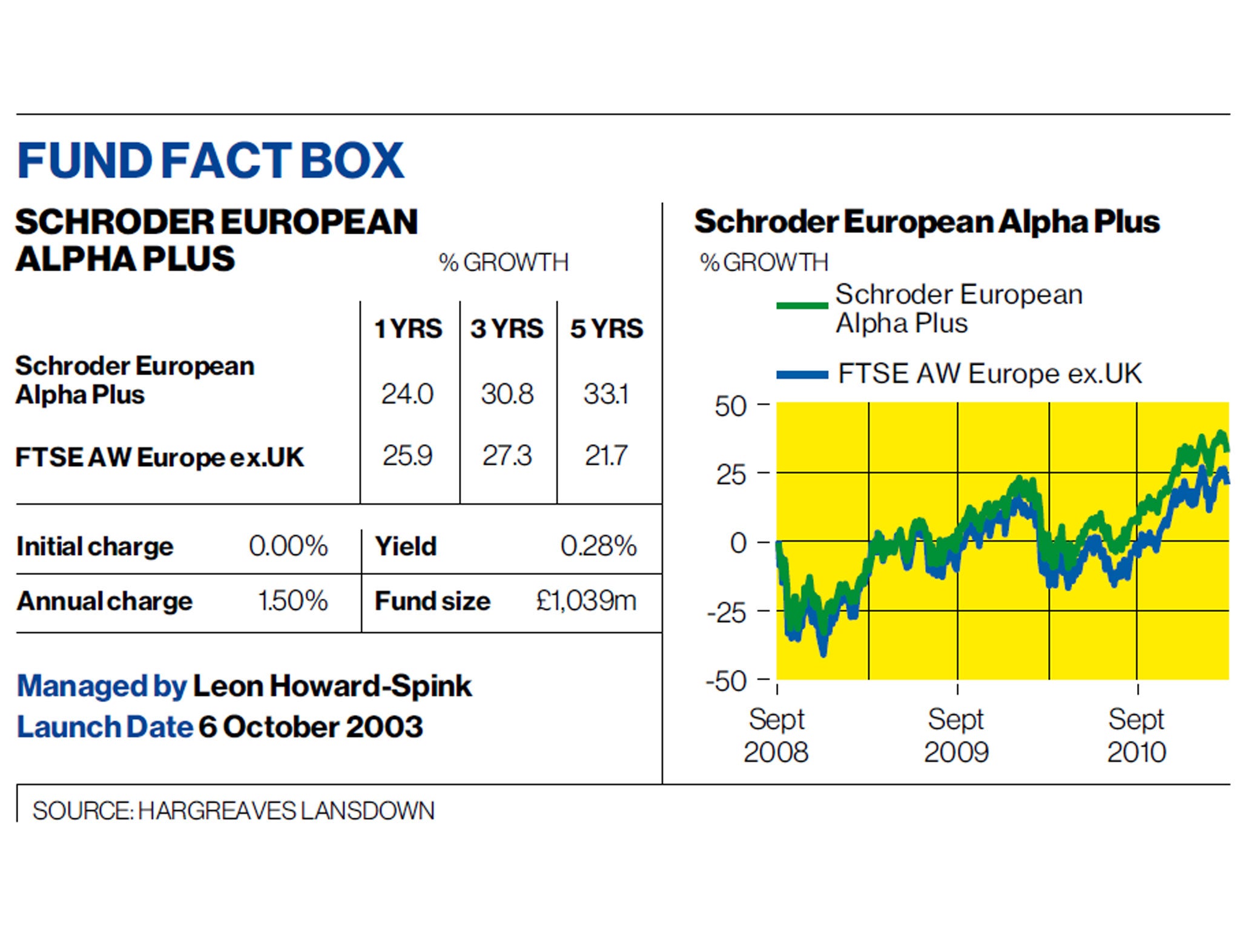

Over the past year, and particularly last summer, I mentioned on a number of occasions that European stock markets looked good value on many measures. Our own analysis suggested stock markets looked significantly cheaper than their long-term average. While this alone can't be considered a definite buy signal, it can suggest much of the downside is already priced in. A year later and the European stock market, as measured by the FTSE AW Europe ex.UK Index, has risen 26 per cent with dividends reinvested.

Despite this, some funds have not performed as well as I would have expected. One is Schroder European Alpha Plus, which has returned a decent 24 per cent but still lagged the wider stock market. The fund is managed with a focus on quality businesses with strong growth potential. Around a core of businesses that fit the bill from this perspective, however, are a number of companies more sensitive to economic growth; those that have underperformed or become unloved, and those restructuring.

Leon Howard-Spink, the fund's manager, confessed his performance had not been good enough. The top four companies that contributed negatively to performance cost him 3.5 per cent over the period. They have all now been sold. Three of the stocks – Saipem, Fugro and Vopal – suffered from profit warnings related to the energy market, and the latter two had been successful long-term holdings so all was not lost. The fund now has no exposure to the major oil or oil-service companies.

Mr Howard-Spink says his style of focusing on quality companies with growth potential has been out of favour. Unloved value companies with recovery potential have tended to perform better, and he tends to hold less in these stocks. Instead, he has focused on companies with high cash flow and return on equity, and lower debt, but which still look good value. Surprisingly, companies with these characteristic have not performed as well over the short term.

Quality companies with global growth potential have become more expensive, and Mr Howard-Spink has made adjustments to reflect this. He has added names he held in the past such as Syngenta. He is also keen to get new ideas into the fund, and wants the top three contributors over time to be an eclectic mix of companies, not just household names. He has also increased exposure to higher-risk smaller and medium-sized companies. GEA Group, for example, is a German food-processing equipment maker. It sells a lot to the emerging markets, and Mr Howard-Spink believes earnings should continue to rise and the valuation is reasonable.

The top three contributors to performance over the past year have been banks – BNP, DNB and UBS. He has tended to be underweight banks for his whole career, but as a stock-picker is willing to use his flexibility to seek opportunities in a variety of sectors. He wants to maintain a diversified portfolio which might provide some relative shelter from a tough economic environment, but equally could perform well in a recovery. That said, he is keen not to over-diversify the portfolio, so has reduced the total number of companies held to 38.

Mr Howard-Spink still believes European stock markets are cheap, and describes himself as cautiously optimistic. We could see more market volatility in the coming weeks. However, Mr Howard-Spink has a long and successful track record, and his recent underperformance can be partly explained by his style being out of favour.

I would be tempted to use any further weakness as a chance to top up, as I would expect long-term investors to be rewarded.

Mark Dampier is head of research at Hargreaves Lansdown, the asset manager, financial advisor and stockbroker. For more details about the funds included in this column, visit hl.co.uk/independent

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies