Bad Apple? The tech giant has become a victim of its own success

Competition from rivals puts the brakes on its previous levels of growth

When a company's share price slumps more than 11 per cent, something must be very, very wrong. Profits and sales must have cratered. Its finances must be a mess.

And yet, on the face of it, Apple, whose shares suffered such a fate following the release of its quarterly earnings, seems to be doing just fine.

The Californian tech giant posted $13.1bn (£8.3bn) in net profits for the final three months of last year late on Wednesday, a result which most companies, as well as those who invest in them, would be rather glad about. Moreover, it said it had shifted a record number of iPhones during the period – 47.8 million, to be exact, nearly 11 million more than in 2011. iPads, too, did well, with the business selling nearly 23 million, against 15.4 million previously. The shares, however, crashed like a badly damaged smartphone. Why? In a word, growth.

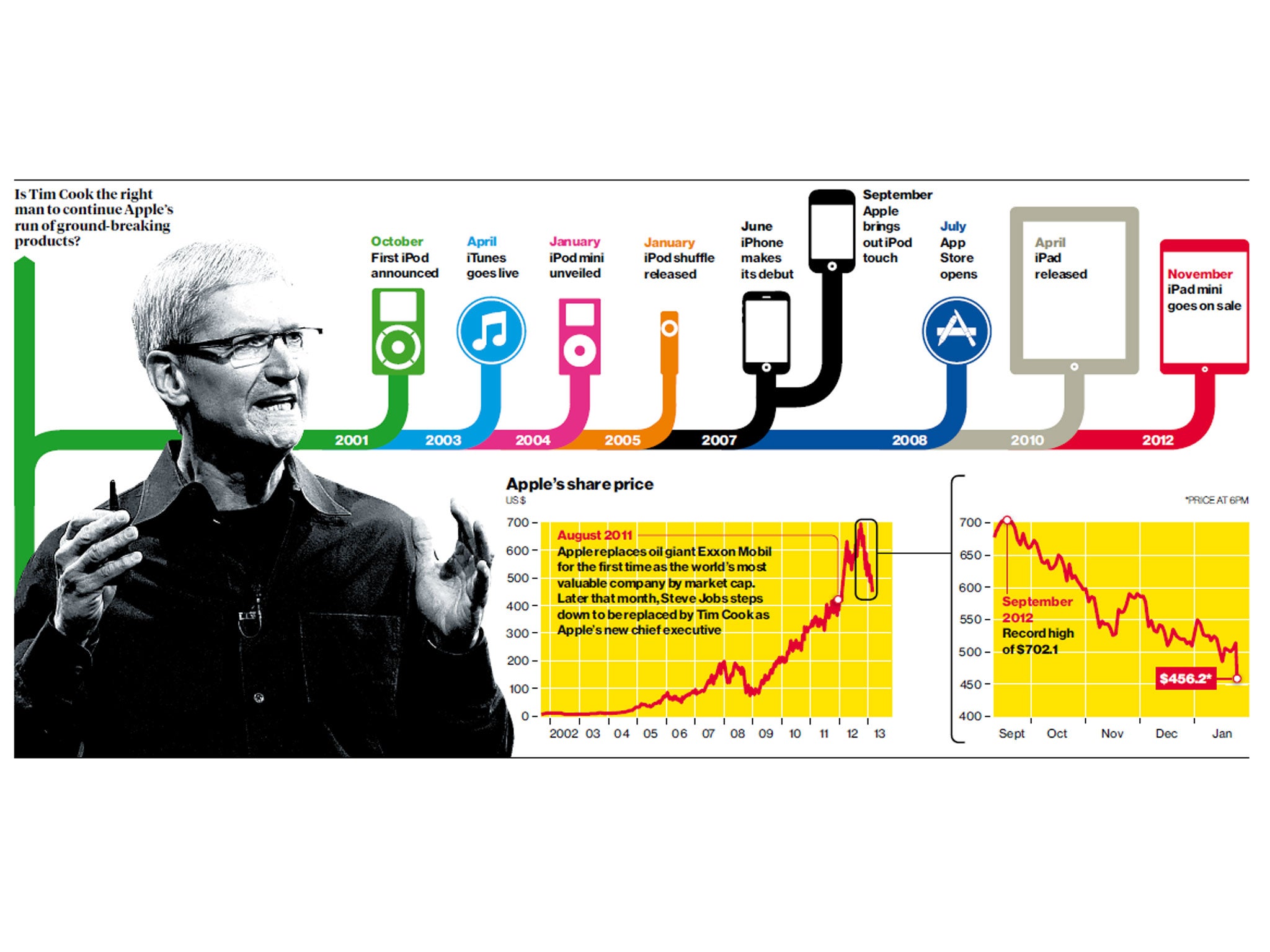

In this, Apple has become a victim of its own success. Over the last decade, helmed for most of it by the late Steve Jobs, who had perhaps the most finely honed sense of marketing in American business, the company produced an array of best-selling products. Flashy Macs that forever changed the dull grey-box aesthetic that until then had defined the personal computer; the iPod and the accompanying iTunes software, which set the tone of the digital-music market; and then the iPhone and the iPad, which did the same in the fast-growing area of smartphones and tablets. Though it's become a cliché, they were ground-breaking.

The market couldn't get enough. Beginning in April 2003, Apple beat analyst estimates for earnings for 34 consecutive quarters, according to figures complied by Bloomberg. Its stock, worth around $6.50 at the time, had, by last September, reached a stunning peak of more than $700 apiece as it grew to become the world's most valuable company with a cash pile of some $137bn, more than the GDP of a few governments.

The market got used to Apple's success. And unfortunately for Tim Cook, who took over from Mr Jobs in 2011, he came into the job just as the company was beginning to face some real competition from rivals such as Samsung, which has been garnering kudos for its Galaxy range of smartphones and tablets, available at a wide variety of prices. Taken together, Apple and Samsung account for around half the global market for smartphones.

Powered by Google's Android operating system, the Galaxy range has been instrumental in driving up the South Korean firm's smartphone market share in recent quarters, leaving Apple behind. Figures published earlier this month by the New York-based market-research firm ABI predicted that, while Samsung had boosted its market share from 8 per cent to more than 30 per cent since 2010, Apple's would likely peak at 22 per cent this year, and remain flat though 2018.

"Barring an unlikely collapse in Samsung's business, even Apple will be chasing Samsung's technology, software, and device leadership in 2013 through the foreseeable future," the ABI analyst Michael Morgan said.

As if to underline concerns, reports earlier this month suggested that Apple was cutting orders for iPhone 5 components in the face of what was said to be weaker than expected demand.

A gambit last year to reclaim momentum with the new iPad mini, as consumers shift to mobile devices with screens bigger than the iPhone but smaller than the original iPad, has failed to quell concerns, as questions are asked of the impact on sales of its big brother.

The biggest question, though, is whether Apple can continue to come up with new products of the kind that have underpinned its growth over the last decade or so.

Trip Chowdhry, a managing director at Global Equities Research, summed up the challenge shortly after the latest earnings were released, telling Reuters: "Apple will need to innovate. It has two or three product lines that are doing OK. But they need to come up with new phones and get the innovation going. The iPhone is coming toward the end of its life and they need a completely new device soon – in months, not years."

Mr Cook did his best to allay these concerns this week, saying: "We are working on some incredible stuff. The pipeline is chock-full. I don't want to comment about a specific product, but we feel great about what we have got in store."

The market's response has been uncompromising. "It better be great," investors seemed to be saying as Apple's stock fell 11 per cent in early afternoon trading.

Some have even questioned Mr Cook's leadership. Peter Cohan, who runs a venture capital firm, this week mooted Jonathan Ive, Apple's long-standing design guru, as a replacement for Mr Cook, who is known for building Apple's supply chain in the years that Mr Jobs was in charge.

In fact, the pressure on Mr Cook had been rising long before this week's figures. The peak of $700-plus looks like ancient history now, with the stock now well below $500, and closer to $450 midway through the session. Earlier in the day, no less than 14 brokerages – everyone from Barclays Capital, Mizuho Securities USA, Credit Suisse and Deutsche Bank to Raymond James, Robert W Baird & Co and Canaccord Genuity – scaled back their price targets for Apple stock.

Speaking on a conference call after this week's results, Mr Cook pointed out that 24 January marked a milestone for Apple. It was on this day in 1984 that "Steve introduced the first Macintosh right here at a shareholder meeting in Cupertino", he said, adding: "On the evening news that night, they said it was supposed to be one of the easiest computers to use, and thanks to the new mouse, you hardly have to touch the keyboard."

The headlines were very, very different.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies